Accounting

Moss Adams launches AI consulting service for ML and gen AI

Published

9 months agoon

Top 25 firm Moss Adams announced the launch of a new AI consulting service that aims to help clients identify realistic AI implementations that deliver value for organizations through tailored solutions set up to meet their unique objectives.

“Few technologies in the last couple decades have the potential to expand a business’ capabilities, increase efficiency and grow revenue like AI,” said Michael Parker, consulting partner at Moss Adams. “The AI landscape is crowded and overhyped, leaving businesses overwhelmed with where to begin and how to leverage this technology within their business, potentially leading to AI investments that go under-utilized or poorly implemented. Our team combines former executives familiar with the rigors of growing a business and professionals with deep, practical experience in AI, allowing us to meet organizations’ unique needs in harnessing the value of this technology.”

The practice will be split into two teams. One is focused specifically on generative AI. Through this service, Moss Adams will help businesses create a central knowledge center that empowers employees to search, access and leverage organizational data, as well as gain augmented workflows aligned with their IT stack and structure. From there, professionals will work directly with the organization to identify use scenarios for generative AI, navigate change management, deliver end-user training and provide additional guidance that may be needed.

The other is focused on machine learning. This service is meant for organizations seeking to effectively tap into large volumes of data quickly, accurately and at scale, in alignment with broader business needs and goals. Professionals will work with clients to develop customized AI solutions that drive data-based insights and aid in decision making. Working closely with clients, the firm will guide businesses to increase their data’s return on investment, boost workforce productivity, accelerate legacy processes and more.

Loren Den Herder, managing director of enterprise systems consulting for Moss Adams, said in an email that the teams work together, as there can be a great deal of crossover between the two. He added that their services further integrate with the firm’s broader consulting offerings, meaning the AI consultancy is part of a larger holistic approach that covers both the technology and the organizational aspects, such as change management or security. The groups are composed partially of experts hired specifically for this purpose and partially those drawn from other parts of the firm, with Herder noting that both technology and business skillsets are required for the solutions to be effective.

He said that while there are clients new to AI and are looking for a place to start, what they’ve mostly been seeing so far has been businesses who are interested in AI but need deeper insights — they’re interested in the technology, have the resources to invest in it and are looking to get the most out of them. Still, he stressed that the service is for businesses of all sizes at all levels of AI sophisticated: “This is not limited to large complex organizations.”

There are many areas where this new service can be applied, with Den Herder pointing to regulatory compliance as one particular area where AI has been especially useful.

“Generative AI can augment the assessment of a large set of operating policies with regulatory requirements. This removes the drudgery of this language-intensive process and quickly identifies recommendations. It also provides a method to more effectively deliver operating policy guidelines directly to the frontlines of operations in real-time. Generative AI offers a whole new way of thinking about how to solve business problems,” he said.

He acknowledged that the AI landscape has a lot of hype, and it can sometimes be confusing to determine what is and is not worth it. What helps for Moss Adams is an incremental approach that controls implementation costs. They drive for “effectiveness each step of the way,” which makes it relatively straightforward to determine real return on investment. This allows people to understand the tangible impact of this new technology, which serves to cut through at least some of the hype.

“As an accounting firm, Moss Adams comes to the table with a breadth of business insight and familiarity with business finances and operations,” said Den Heder. “We understand how businesses operate. We also understand the external factors facing businesses. It’s a unique position we, as an accounting firm, have. We’re already adept at working with clients to address their unique needs. The service offers an integrated consulting approach that delivers on all aspects of an effective business implementation. We are differentiated from pure technology plays. Overall, we are taming the hype and bringing reality to the value proposition.”

You may like

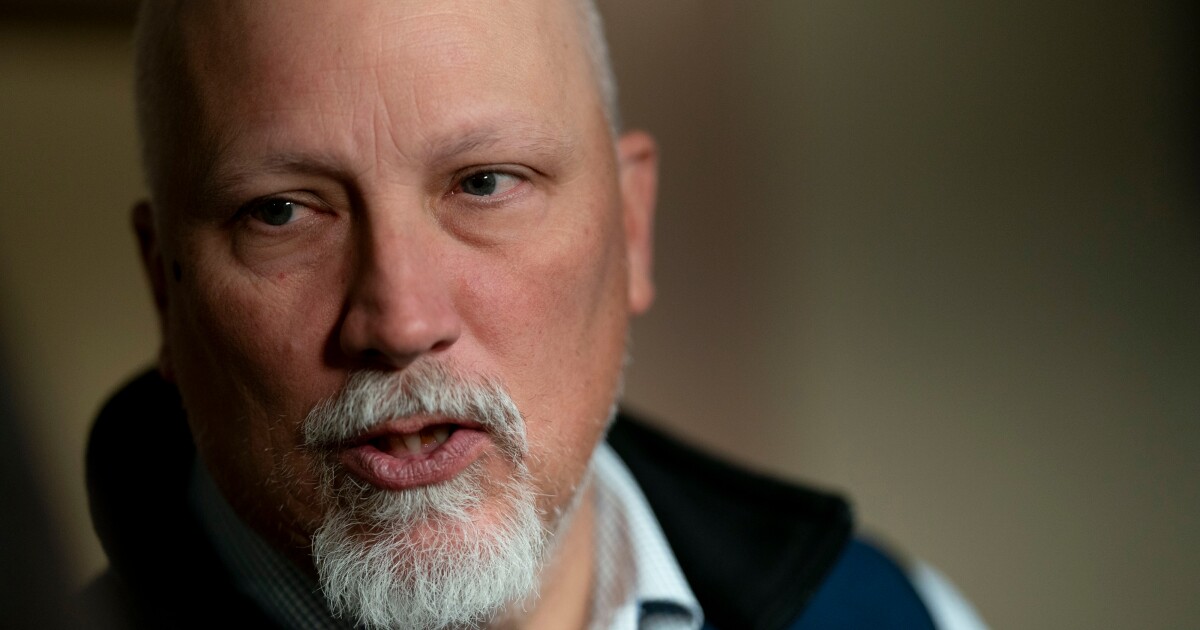

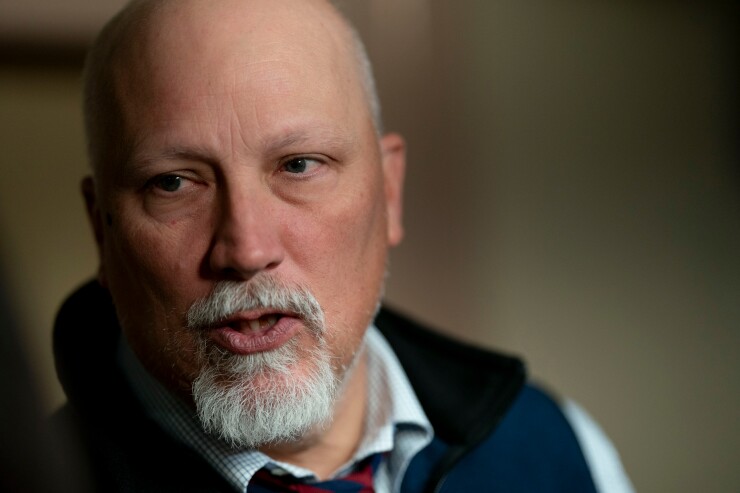

A key House committee on Friday failed to advance House Republicans’ massive tax-and-spending bill after hard-line conservatives bucked President Donald Trump and blocked the bill over cost concerns.

The House Budget Committee rejected

It’s incredibly rare for bills to fail at this step in the process, with the committee vote typically serving as a rubber-stamp to the bill before it moves to the House floor.

Stefani Reynolds/Photographer: Stefani Reynolds/B

The setback could be temporary and the panel can still approve the bill once the GOP differences are resolved.

Republican Lloyd Smucker, who switched his vote to “no” to allow the committee to bring it up again, told reporters the committee will hold another vote on Monday.

Trump, whose social media muscle and calls to lawmakers have previously been crucial to advancing his priorities, inserted himself in the debate less than two hours before the vote, berating dissidents and urging them to fall into line.

“We don’t need ‘GRANDSTANDERS’ in the Republican Party,” Trump said in a social media post on Friday. “STOP TALKING, AND GET IT DONE! It is time to fix the MESS that Biden and the Democrats gave us. Thank you for your attention to this matter!”

The bill’s failure exposes the power a small group of lawmakers can wield as Republicans seek to push Trump’s “one big, beautiful bill” through the House with very narrow margins. GOP infighting threatens to kill the bill, or at least significantly delay Republicans’ plans to pass the bill next week.

(Read more: “

Republican holdouts spelled out their demands during Friday’s committee meeting, including accelerating new work requirements for able-bodied adults on Medicaid to take effect immediately rather the 2029 deadline set in the legislation. The ultraconservatives also want a faster phase-out of clean energy tax credits.

It wasn’t immediately clear how House Republicans will re-group to address the divisions and advance the bill.

“I’ll let you know this weekend if we’re going to return first thing Monday. That’s the goal at this point,” Budget Chairman Jodey Arrington said after the vote.

House Majority Leader Steve Scalise, who is helping to broker a deal among Republicans, said party leaders are in touch with the Trump administration to address some of the changes demanded by hardliners.

“We are all in agreement on the reforms we want to make,” Scalise said. “We want to have work requirements. We want to phase out a lot of these green subsidies. How quickly can you get it done?”

House Speaker Mike Johnson on Thursday pledged he would work through the weekend to broker a compromise between moderates, who are seeking an increase in state and local tax deductions, and ultra-conservatives, who say they won’t support it without more spending cuts.

(Read more: “

Members from both factions — the SALT Republicans representing high-tax districts and the fiscal hawks who want steeper budget reductions — have threatened to block the bill if House leaders don’t acquiesce to their demands.

“No one group gets to decide all this stuff in either direction,” Roy, an ultraconservative Texas Republican advocating for bigger spending cuts, said in a brief interview on Friday. “There are key issues that we think have this budget falling short.”

Both Roy and Norman urged continued negotiations and significant changes to the bill that could in turn jeopardize support among moderates.

“I’m a hard no until we get this ironed out,” Norman said. “I think we can. We’ve made progress but it just takes time.”

If the legislation passes the House, it would then head to the Senate where it would likely undergo significant changes. Several members, including Senator Josh Hawley of Missouri, have stated opposition to the Medicaid cuts in the House bill.

Accounting

Practice Profile: From country club member to club advisor at PP&Co,

Published

1 hour agoon

May 16, 2025

Relationships fuel so many businesses — including accounting — but for the clients of San Jose, California-based PP&Co.’s fastest growing industry specialization, they are the “lifeblood,” according to assurance partner Richard O’Leary.

More specifically, for the Regional Leader’s burgeoning private and public club industry clients, members are their foundation.

“Membership is the lifeblood and lifeline of the industry — keeping members, and especially always getting new members, is paramount to the industry,” explained O’Leary of the firm’s club clients, part of its wider hospitality group that includes private clubs as well as public golf clubs, city clubs, yacht clubs, equestrian/athletic clubs, hotels, amusement parks and conference centers.

O’Leary has worked with this type of client since the mid-1980s — first as part of a New York firm that specialized in hospitality and transferred him to the Bay Area, and later at their largest competitor in that niche in 2018, as PP&Co. was, according to him, “dominating the Bay Area in this particular industry.”

And PP&Co.’s success has only grown in recent years, he reports. “We did have a very good 2024 in terms of new client opportunities,” O’Leary said. “That comes from brand recognition, name recognition, all of these clubs and hospitality clients all talk amongst one another — ‘Who are your auditors, your tax providers? Do you work well with them? Do you get along with them?’ Opportunities come by word of mouth and reputation. And other firms — there isn’t another firm in the state of California that does as many clubs as we do. We are dedicated to the industry. There are other firms that just dabble in the industry and don’t provide [full] service and the clients can tell. It’s only a matter of time before they want to change service providers.”

Long before his decades serving these clients, he had an understanding of their business as a “country club kid” growing up in New York. It even led to his first accounting firm job.

“My parents belonged to a local club and I was kind of raised in the country club environment,” he shared. “My pop referred me to the partner that did that particular country club’s audits — my pop was treasurer at the time. I connected with the partner at the firm, and that’s how I got the interview.”

As a direct beneficiary of the powerful connections that can be formed at clubs, O’Leary can personally relate to the needs of his clients — the overriding one, again, being to maintain and grow membership. This has led to changing priorities as these organizations aim to bring in younger members.

“New members, the younger generation of their parents, belong to these clubs,” O’Leary said. “Keeping membership strong is one of the challenges the industry faces. In order to attract younger members, the industry has to react to the changing trends of younger generations. We are seeing that happen within clubs providing things like casual dining versus formal dining, fitness facilities — things the younger generation is more interested in versus the older generations. There are a lot of changes in the industry.”

Keeping pace with a changing industry

Recent changes to regulations, especially in the wake of COVID, mean O’Leary and his practice are kept busy as they keep clients up to date and informed. The firm provides traditional assurance and tax services to these clients, though that work has expanded to include more consulting work.

“There’s always opportunity in the industry to educate your client base,” he explained of his club clients, which he estimates to currently include about 45 organizations in the Bay Area. “Because a lot of clubs are tax-exempt, the industry comes with lots of rules and regulations that need to be understood to preserve tax exemption and to understand what aspects of the business are taxable, where to pay tax. With that, there is a world of opportunity to consistently and constantly advise clients on these rules and regulations.”

While this year-round advisory work, including recently updated Internal Revenue Service regulations, keeps PP&Co. in ongoing conversations with clients, O’Leary aims to also strike up new ones with his involvement and board memberships in several local industry and networking groups.

In addition, he shared, “There are a myriad of opportunities for the firm and for myself to provide articles, webinars, to stay face-front to our clients and the industry itself.”

Fluctuating regulations and membership numbers are not the only things keeping these clients up at night. “On a ratio basis, it is one of the most capital-intensive industries that exists,” O’Leary shared. “[Clients] need to have a clubhouse where members can come and use the facilities, mingle with fellow members. They need to have a golf course, tennis facilities, swimming facilities … it’s very capital-intensive.”

Nationwide, the industry encompasses 5,000 to 6,000 clubs, O’Leary cited from a recent study, generating $32 billion of direct revenue to the economy.

“It’s a very labor-intensive industry,” he explained. “To where payroll expenses have been tabulated to be $17 to $18 billion, with the number of employees at almost 600,000.”

With this kind of reach, certain misconceptions about the niche abound, according to O’Leary.

“It’s a very large industry,” he explained. “The industry sometimes gets a little of a bad rap, from the public, from the media, because members are in the top 1% of the country and get an unfair advantage, or tax breaks. That’s not really true. The industry is an incredibly large employer to the economy in the U.S. It often gets misunderstood. The needs of these organizations are solely that they get together and provide social and recreational activities to their membership group. It’s why the organizations exist. Some are formed as tax-exempt organizations, some are taxable organizations. It’s just specific to the voice of each individual club, and the path they want to go when the club is formed.”

As for O’Leary’s personal career path, his success can be attributed to “basic familiarity with the industry, being connected at a young age,” he said.

“It’s just kind of cool, as a young kid, a junior playing golf and using the club my parents belong to, it’s just kind of cool to have turned that into your career,” he shared. “There’s just a lot of passion associated with working within the industry you grew up in. From the kid-of-a-member perspective, now providing those services and expertise, it’s kind of cool.”

Accounting

Firms to disable Windows Recall, but third parties remain a risk

Published

3 hours agoon

May 16, 2025

Despite security enhancements from Microsoft, CPA firms are likely to disable the controversial Recall feature in Windows 11, which

Last September,

valerybrozhinsky – stock.adobe.c

Cory Wolf, director of offensive security with cybersecurity consulting firm risk3sixty, said these new changes have allayed many concerns about the Recall feature between when it was first launched and now. He noted that the initial release was indeed a major security challenge, adding that Microsoft rushed it without going through the typical insider preview process and so did not account for the security issues, but has improved the solution since then.

“That was why everyone was freaking out, it was clear they did not do any security around it, did not go through previews and at the time it was a real security risk. Now it is going through the proper channels of Windows preview, they added content filtering, they added the virtual machine component … at least from a cybersecurity perspective, it’s really worked out and they’ve improved it quite a bit,” he said.

Despite these changes, however, some firms are still opting to disable recall on their devices, such as California-based Navolio & Tallman LLP. Though they intend to soon get laptops specifically optimized for AI solutions, IT partner Stephanie Ringrose said that, for now at least, they’re going to disable the feature.

“We started with the hardware that has the new processor, so that as technology comes out that has more AI in it, we’re set up for success. … So we’re open to new technology. Another part is we like to be on the leading edge, but we’re not necessarily on the bleeding edge, so initially [Recall] does not seem like something we need right away, so our plan currently is to disable it,” she said in an interview.

Top 50 firm LBMC will also be disabling Recall, according to chief digital and technology officer David Maynard. He raised concerns about the security implications, such as the inadvertent storing of sensitive data via screenshot captures, the use of LLM-powered indexing opening up the possibility for prompt injection attacks, insider threat risks of administrative access being misused, as well as compliance and legal exposure under data protection laws.

“With specific regard to Microsoft’s Windows 11 Recall feature, we are closely monitoring its development and capabilities as we do all other tools. Microsoft is a trusted partner and delivers some of the most powerful enterprise tools. That said, all evolving technology tools present unique challenges that merit thorough scrutiny, especially for professional services firms handling high volumes of confidential and regulated data. … We are currently disabling Recall by policy across all internal devices, even though it remains in preview. Our experts are also considering the broader implications of using LLMs in enterprise settings and continuing to test the Recall functionality in non-production environments to inform both internal and client-facing recommendations,” he said in an email.

Still, while firms can take action for themselves, the indirect third party risk remains. While one user might disable Recall, anything shared with someone who has enabled it will be saved to their device, which could still result in data leakage and cyber incidents. Imagine someone from a firm with Recall disabled talking about sensitive matters with a vendor who does have it enabled; now imagine that vendor getting hacked and the attackers getting that sensitive data despite the firm itself protecting on their end.

Ringrose said that while there are measures a firm can take, there are limits to how much they can control third parties. The firm can have open communications and be vigilant about their data but there is only so much one can do.

“This [applies to] almost all technology when communicating with outside parties, that you cannot really control what every third party uses on their side. I think there’s a couple different things we can do on the client side, [like] more education as you communicate with them… you have open discussions with them on how they intend to use it and help be an advisor if [the risks] come up,” she said.

LBMC took a similar position, saying that it can’t really control what other parties do, so they need to be careful about what they, themselves, disclose to outside parties.

“LBMC can control only its devices, not third-party assets. Management and understanding of Recall’s implications are necessary before sharing information,” said Maynard.

But at the same time, the two said it’s not that much different than any other communications technology. Yes, third parties might capture sensitive data through Recall, but the same thing could happen with irresponsible emails or file shares too. In this respect, while the firms intend to have controls over the use of the feature, they would be no different than the controls they would require for any other new technology.

“It’s like email, you know? It’s like any form of communication—you’re putting something out there. And so it’s a little bit open to what that third party is using,” said Ringrose.

Maynard raised a similar point: while LBMC will be thoroughly evaluating Recall for safety, it does so for every new piece of technology it potentially could adopt. At a high level, every new tool under consideration—whether developed internally, by a third party, or as part of a widely used platform—is assessed using a phased model. The evaluation model encompasses infrastructure and compatibility review, security review, privacy and data governance review, legal and regulatory risk assessment, ethical and professional standards alignment, cybersecurity and AI committee input, governance and approvals process, a test phase with controlled rollouts, then training, usage, policies and compliance integration.

“Window 11 Recall is just one of many emerging technologies that highlights the need for organizations, especially those in regulated industries like accounting to have a structured enterprise-wide process for evaluating new tools. At LBMC we view every innovation through a multidimensional lens balancing potential benefits with security, privacy, regulatory and ethical considerations. Our approach is part of a broader, proactive framework that involves cross functional expertise from cybersecurity, AI, legal, compliance and operational leadership. This is how we ensure new technology aligns not only with our internal standards, but with the expectations of the clients and industries we serve,” he said.

Wolf, from risk3sixty, said that while the risks from improper use are real, at this point they are not dramatically greater than other solutions. He noted that many CPA firms already have third party risk management programs and it wouldn’t be difficult to work Recall into these already existing controls. However, he said it might be more of a lift for those who do not already have these programs in place.

“So when doing vendor questionnaires and audits they should bake in Recall, things like doing security awareness training around Recall, that should be baked into that, but it definitely needs adjustment … for smaller firms that do not have one. Contractual obligation is their best recourse. It’s no different than sending something to a noncompany email for example, the risks are still the same,” he said.

There was similar thinking regarding remote work and bring-you-own-device policies. Many firms already have specific security policies in these areas, and while Recall is a factor in both cases, there appears to be little need to carve out an entire new set of policies specifically for this feature. Firms should be diligent with their cybersecurity overall, said Maynard, which includes accounting for Recall but no more than other tools.

“For accounting and advisory firms, any tool that touches client data must be evaluated not just on features—but on trust, integrity, and compliance. We believe that by embedding subject matter expertise into every phase of the evaluation process, firms can strike the right balance between innovation and responsibility,” he said.

Trump tax bill fails in House panel

Insiders at UnitedHealth are scooping up tarnished shares

Practice Profile: From country club member to club advisor at PP&Co,

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoI bonds investments and Trump’s tariff policy: What to know

-

Personal Finance1 week ago

Personal Finance1 week agoHow consumers prepare for an economic hit

-

Personal Finance1 week ago

Personal Finance1 week agoReal estate and gold vs. stocks: Best long-term investment

-

Economics1 week ago

Economics1 week agoAndrew Bailey on why UK-U.S. trade deal won’t end uncertainty

-

Economics1 week ago

Economics1 week agoThe president has deleted a key tenet of American civil-rights law

-

Economics1 week ago

Economics1 week agoTrump knocks down a controversial pillar of civil-rights law

-

Economics1 week ago

Economics1 week agoA social history of America in a warehouse

-

Economics1 week ago

Economics1 week agoOne of the most controversial executive orders will shortly land at SCOTUS