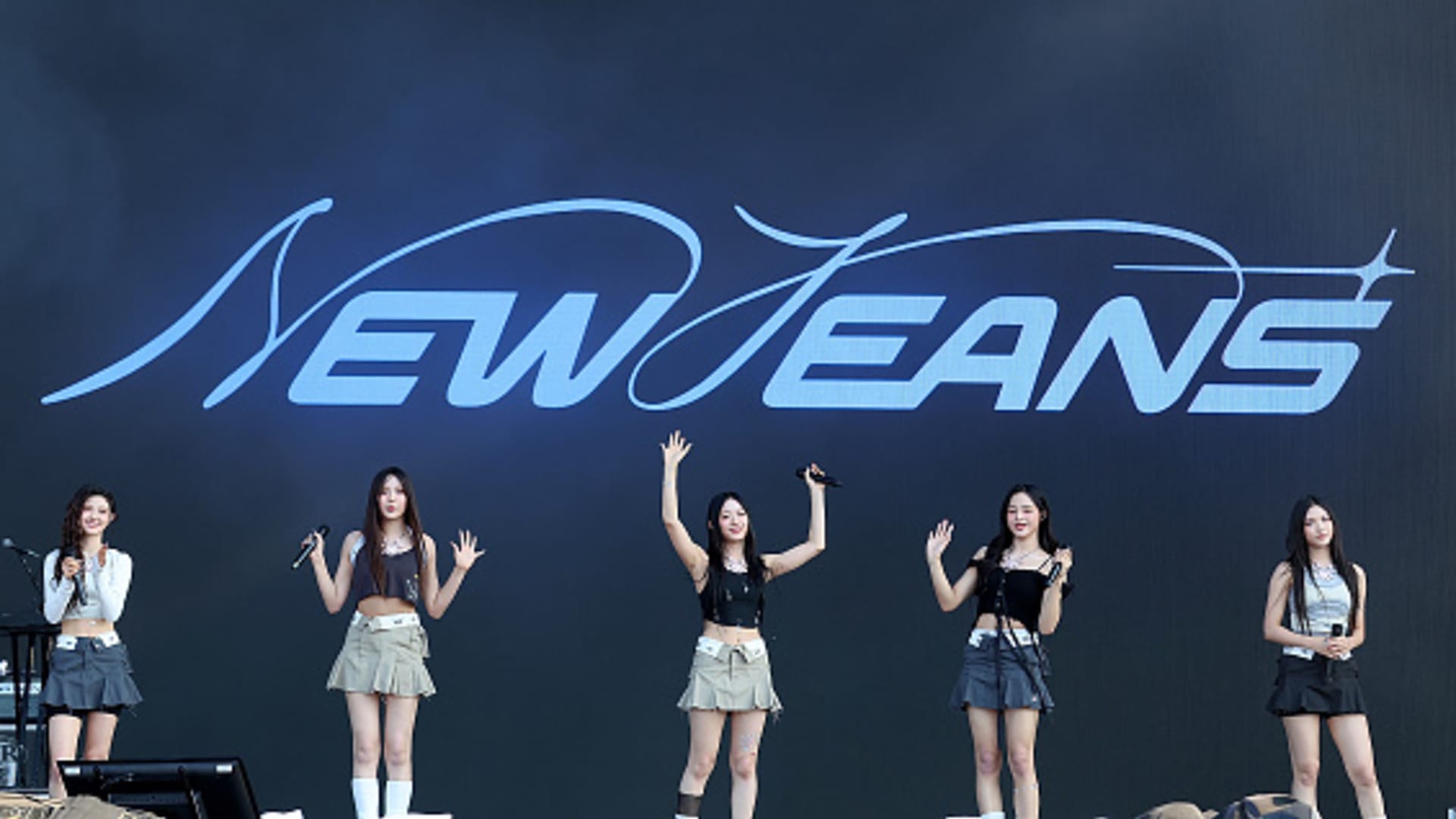

CHICAGO, ILLINOIS – AUGUST 03: (L – R) Danielle, Hyein, Hanni, Minji and Haerin of NewJeans perform in concert during Lollapalooza at Grant Park on August 03, 2023 in Chicago, Illinois.

Gary Miller | Filmmagic | Getty Images

It hasn’t been an easy start to the year for investors in the K-pop sector as lower fourth-quarter sales and profits, as well as dating scandals, hit stock prices.

Goldman Sachs, however, expressed optimism for the industry in a March 14 report, saying the K-pop sector is “misunderstood.”

Shares of K-pop’s “big four” companies have all fallen since the start of the year. JYP Entertainment’s stock has plunged over 37% year to date, while YG Entertainment shed nearly 17%. Kospi-listed Hybe, home of superstars BTS, saw a smaller drop of about 4.5%.

Shares of SM Entertainment have plunged over 17%. The decline comes as one of the agency’s artists was embroiled in a dating scandal that drew widespread international and domestic coverage.

In February, the stock fell for five straight sessions to its lowest level since October 2022 following the drama surrounding Karina, the leader of girl group Aespa. The sell-off wiped $50 million off SM’s market value as Chinese fans threatened to boycott the group’s albums.

Nonetheless, Goldman Sachs said it sees a “high potential for valuation re-rating,” as companies still continue to deliver multi-year earnings growth. For 2023, all four companies posted higher full-year revenue and net profits.

A superior valuation metric

Goldman said the sell-off is tied to markets focusing on album sales, which has historically been considered a key proxy for the number of fans and, by extension, prospects for the companies.

“We challenge this mainstream mindset, arguing that offline concert audience… is the superior metric to measure the growing reach of K-pop,” the analysts wrote. They explained album sales can be tainted by wallet share, where one fan can buy multiple albums — a common occurrence among the K-pop fanbase.

The analysts also said album sales spiked during the pandemic due to the lack of offline interactions, which distorted the metric in relation to fans.

Japan to power short-term growth

When evaluating the industry by in-person concert attendance, Goldman said “growth has not stopped scaling at a rapid pace,” and “in the near term, we see audience growth in Japan as the key growth driver.”

The analysts see a substantial fanbase growth opportunity for K-pop companies in the near-term in Japan, “which we believe is being overlooked by the market.”

They note Japan has been one of the largest overseas fanbases for K-pop, with Hybe, SM and JYP taking a combined 7% of the live music market in Japan. Goldman pointed out that Japan’s top talent agency Johnny & Associates has been mired in a major scandal, leading to the industry turning more favorable to K-pop artists.

In 2023, Kouhaku Uta Gassen, the largest music show in Japan, invited five K-pop artists and two localized groups produced by K-pop companies. It was the first time the show has featured male K-pop artists since 2011 and the largest number of K-pop groups ever featured in its line up.

Goldman estimated Japan concert audiences will grow at a 24% compounded annual growth rate from 2023 to 2026, with the combined share for Hybe, JYP and SM doubling from 7% to 14%.

Catalysts for growth in Japan include SM’s newest Japanese boy group NCT Wish as well as JYP’s upcoming boy group NEXZ.

The global fanbase

Goldman is also bullish on K-pop’s global fanbase growth, especially in markets like the U.S.

The report pointed to the success of Hybe-managed girl group NewJeans on U.S. charts. In a March 27 report, analysts noted NewJeans’ most recent album hit No. 1 on the U.S. Billboard 200. The group’s lead single, “Super Shy,” charted at No. 2 on the Billboard Global 200.

The group also was the first South Korean girl group to perform at Lollapalooza. The Chicago Sun Times reported the group may have managed to draw the biggest audience ever for the festival’s 5 p.m. slot.

Le Sserafim, managed by Hybe subsidiary Source Music, also made their debut at the Coachella music festival on April 13, with another show scheduled for April 20.

Hybe also recently announced that it will expand its partnership with Universal Music Group, including exclusive distribution rights for Hybe’s artists and labels. UMG’s roster includes Taylor Swift, Ariana Grande and Justin Bieber.

Goldman said the announcement is a visible sign that K-pop is becoming mainstream globally, leading to a competitive position that allows stronger bargaining power in business relationships.

The analysts concluded there’s “a long runway of growth ahead” for the sector, adding that “further downside for wallet share, which has normalized close to pre-Covid levels, seems limited, in our view.”

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post4 days ago

Blog Post4 days ago

Economics5 days ago

Economics5 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago