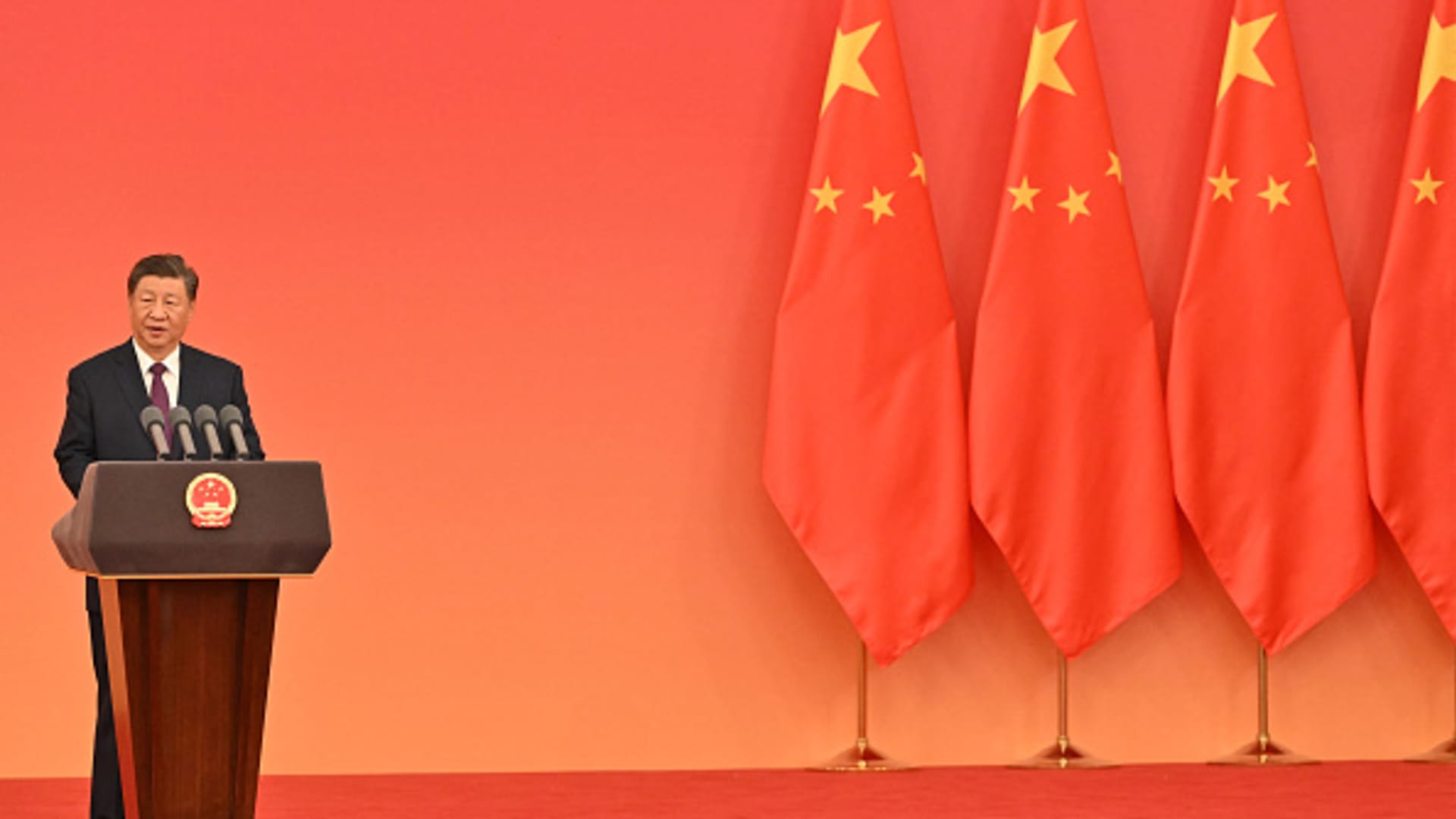

China’s President Xi Jinping speaks during an awards ceremony at the Great Hall of the People in Beijing on Sept. 29, 2024, ahead of China’s National Day.

Adek Berry | Afp | Getty Images

BEIJING — Chinese President Xi Jinping said Monday that no challenges can stop the country from moving forward and reiterated Beijing’s reunification aims with Taiwan.

He was speaking at a reception commemorating the 75th anniversary of the People’s Republic of China, which was founded on Oct.1, 1949.

“The path ahead will definitely see challenges,” Xi said, before calling on the country to overcome uncertainties and risks. “No challenges can stop China’s progress.”

The comments were translated by CNBC from a Chinese state media broadcast.

The brief speech, aired during the state broadcaster’s daily evening news program, noted that Xi and other top Chinese leaders entered the reception shortly after 5 p.m. local time on Monday.

About 3,000 people, including foreigners, attended the event in Beijing, according to state media.

During his speech, Xi emphasized the need to unify under the Chinese Communist Party’s leadership and reiterated Beijing’s “firm opposition” to Taiwan “separatist” activities, while calling for both sides to increase economic and cultural cooperation.

He cast reunification with Taiwan as an inevitable development of history — something he has said previously.

Beijing considers the democratically self-ruled island as a part of its territory.

No mention of trade tensions

Tensions between China and the U.S. and Europe have increased over the last several years, with Western nations increasing tariffs and restrictions on Beijing’s access to advanced technology.

Xi did not mention specific countries or trade conflicts in his Monday speech, instead portraying China as upholding globalization. He broadly thanked “friendly” countries and supporters of China’s development.

He also emphasized Beijing’s claim to Greater China by saying “national rejuvenation” was the hope of Hong Kong, Macao, Taiwan and all Chinese peoples.

The Beijing leader added that China would “spur” the development of Hong Kong and Macao — both self-governed regions which are ruled by Beijing under the “one country, two systems” principle.

In a 2019 speech commemorating the PRC’s 70th anniversary, Xi had said that no force could sway China’s development, amid festivities involving a military parade and large-scale celebrations. Events for the 65th anniversary were more subdued.

Xi’s speech comes at a time of uptick in Chinese markets in recent weeks, with major mainland Chinese and Hong Kong stock indexes recently surging to their highest in more than a year after authorities announced plans to support economic growth. On Thursday, a high-level meeting led by Xi called for halting the real estate decline, and for strengthening fiscal and monetary policy.

While the People’s Bank of China has cut rates in the last week, the Ministry of Finance has yet to announce additional fiscal support.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago