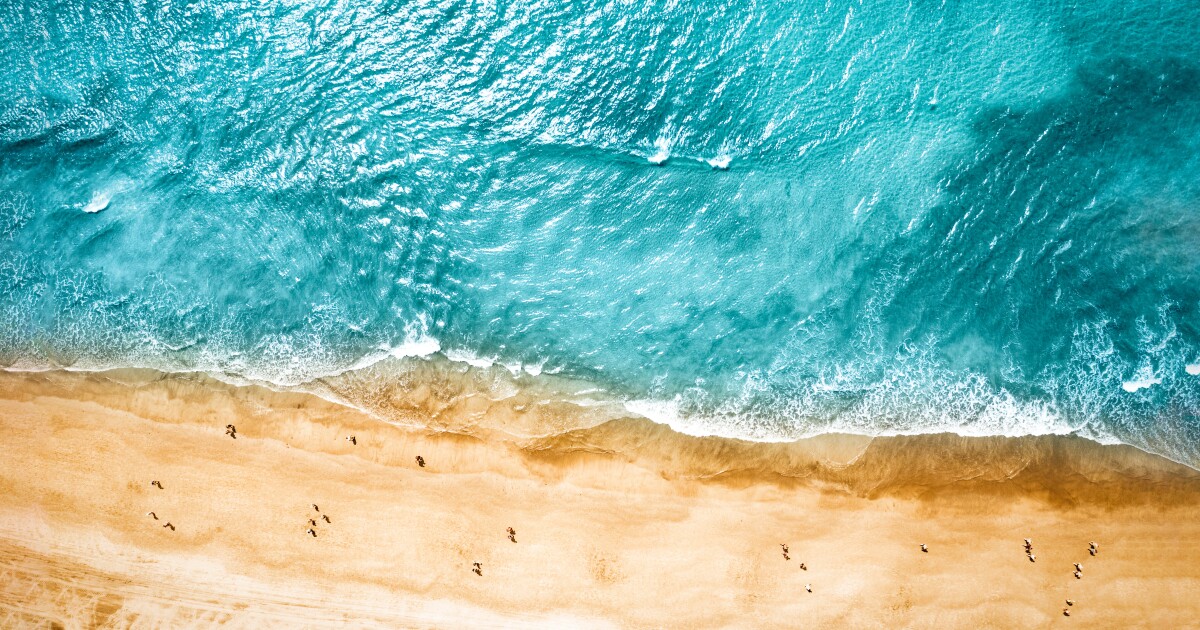

Summer always comes to an end, but financial advisors, tax professionals and their clients can fondly recall their fun in the sun with big savings on the next Tax Day.

Day camp for children under 13 years old, a summer job for clients’ kids at the family business and vacation rental properties can rack up credits, deductions and exemptions — which means that advisors and their customers could find reason for a brief meeting between beach days and soaking up rays. Besides the more traditional summer activities, the season marks a good time “to figure out any tax strategies that you can put in place proactively,” said Jerel Butler, a financial planner with Philadelphia-based Zenith Wealth Partners.

“We like to have biannual touch-ups with our clients,” Butler said in an interview. “That gives us time to formulate a strategy to mitigate any tax hurdles. You don’t have to wait until it’s time to file taxes. You can do it the year before.”

READ MORE: 30 tax questions to answer by the end of the year

A break on summer daycare

The child and dependent care tax credit carries some highly specific requirements and a maximum of $3,000 for an individual or $6,000 for a couple. In addition to the restriction related to the age of the child, the rules prohibit the cost of overnight camps from receiving the credit and limit the break to between 20% and 35% of qualifying child care expenses. Babysitting or daycare expenses do qualify, but parents must be working or looking for a job during the hours they leave kids under others’ supervision.

They also cannot be paying any members of their family for the camp or babysitting, noted Les Williams, a wealth strategist with RBC Wealth Management. The breaks are “a great valuable tax credit that they can claim,” but clients will need to work with their advisor or tax professional on complicating factors such as the particular guidelines and how they relate to employee benefits such as flexible spending accounts, Williams said in an interview.

“That’s something where you really have to work with your tax advisor to make sure that you’re not violating any of the limitations,” he said. “It can work. You just have to be very cautious about it.”

As another example, Butler pointed out that the credit isn’t available to couples who file separately. If one of the parents has a dependent care FSA through their work, they could be eligible for further savings through reimbursements of up to $5,000, he said.

“It’s a huge benefit because it comes back to you pretty much tax-free,” Butler said. “Typically that $5,000 is spread out over your paycheck for 12 months, but you don’t have to wait 12 months to use that $5,000.”

READ MORE: HSAs come with pitfalls — here’s how to avoid them

Tax breaks for employing your kid

Clients can save in multiple ways by hiring their kids to a family business, with the caveat that they must keep accurate records and put them in an actual job with the company.

Then the savings can begin. If the business owner’s child is under 18 and they pay the child up to $14,600 for the year, the entrepreneur won’t have to pay Federal Insurance Contributions Act (FICA) taxes, the child won’t owe Uncle Sam any income duties and their parent can deduct the wages from their profit as a business expense.

That adds up to “a really innovative strategy” for self-employed clients or other business owners, Butler said.

“As long as the child doesn’t have any other income, they don’t have to file any taxes,” he said. “You don’t have to withhold the FICA taxes on the employer’s end, and the child doesn’t have to file a tax return.”

The wages could go into savings accounts such as a 529 plan or a Roth individual retirement account, Butler and Williams noted. That Roth IRA could lead to “years or decades of tax-free growth” building in the child’s account, Williams said.

“No. 1, your child’s getting some work experience, which is great,” he said. “It’s a fantastic opportunity for kids to start learning responsible financial management.”

READ MORE: 24 tax tips for self-employed clients

Renting out your property and taking home savings

Vacation rentals through Airbnb, Vrbo or independent from the popular services may open more tax doors for clients.

Homeowners — especially those living near the location of the Masters golf tournament — know that the high cost of buying a property comes with some tax strategy tools. For example, the “Masters” or “Augusta” rule enables the property owner to collect rent tax-free from any home that isn’t used as their primary place of business for up to 14 days.

With properties that draw visitors for more than two weeks in a given year, the owners can deduct many kinds of expenses, Williams noted. He always advises clients to make sure they purchase liability insurance coverage and set up a limited liability company to receive the rental income, which effectively “insulates your assets from any lawsuit” filed by renters, he said.

Owners using Airbnb or Vrbo for short-term rentals can deduct the cost of cleaning, mortgage interest payments, insurance premiums and depreciation, according to Butler. The client may be earning money in practice, but not when it comes to their filings with Uncle Sam.

“A lot of times it results in having a business loss,” Butler said. “You may end up paying less or nothing in taxes related to your Airbnb business.”

On top of exploring these three areas of potential savings, Butler views the summer as a good time to begin thinking through employee benefits enrollment season and tax withholdings for the next year.

And Williams mentioned that teachers who are oftentimes doing some gig work or other summer jobs to supplement their incomes while paying out of their pockets as they prepare for the next school year should remember that they must report the additional pay to the government and consider the $300 deduction for educator expenses.

“I always encourage the teachers to keep their receipts so they can take advantage of that deduction,” Williams said.

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics4 days ago

Economics4 days ago

Finance4 days ago

Finance4 days ago

Economics4 days ago

Economics4 days ago

Economics4 days ago

Economics4 days ago

Finance3 days ago

Finance3 days ago