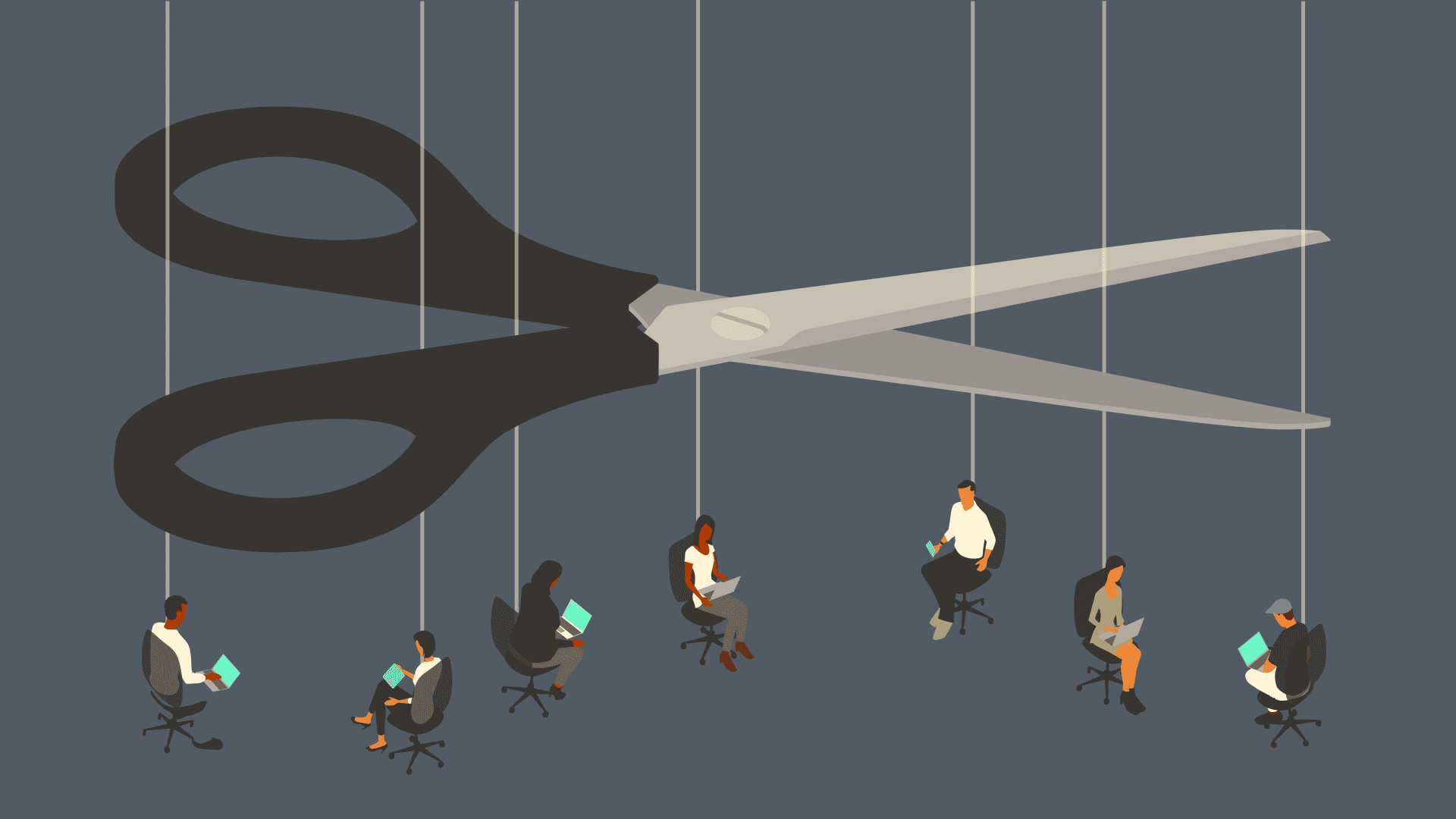

There seems little doubt now that hiring slowed considerably in May as companies and consumers braced for higher tariffs and elevated economic uncertainty. The main question is by how much.

A small dip from the recent trend likely wouldn’t be viewed as worrisome. But anything beyond that could set off a fresh round of fears about the labor market and broader economy, possibly pushing the Federal Reserve into a quicker-than-expected interest rate action.

Economists expect that when the Bureau of Labor Statistics reports the May nonfarm payroll numbers (NFP) Friday at 8:30 a.m. ET, they will show a gain of just 125,000, down from an initial tally of 177,000 in April and the year-to-date monthly average of 144,000. That represents a slide but not a collapse, and markets will hinge on the degree of decline.

“Going into the NFP print, expectations have been reset lower and a reading of around 100,000 (vs. the 125,000 expected by the consensus) could fall in the ‘not-as-bad-as-feared'” camp, wrote Julien Lefargue, chief market strategist at Barclays Private Bank. “Anything below the 100,000 mark could reignite recession fears, while a stronger-than-expected print could perversely be negative for risk assets as it would likely put upward pressure on [Treasury] yields.”

Consequently, the report will be a balancing act between competing concerns of a slowing labor market and rising inflation.

Data tell different stories

A broad range of sentiment indicators, including manufacturing and services surveys as well as gauges of small business sentiment, indicate flagging optimism toward the economy, led by worries over tariffs and the inflation they could ignite.

Moreover, hard data this week from ADP showed that private payrolls essentially were flat last month, growing by just 37,000 in May, a two-year low. Jobless claims also have also recently been edging higher, with last week hitting the highest since October.

Friday’s payroll report, then, could be a key arbiter in determining just how much worry there is in the economy where it counts, namely the labor market, which in turn provides clues about the strength of consumers who drive nearly 70% of all U.S. economic activity.

“We do think it’s going to slow down. We do think that tariffs are going to start biting a little bit,” said Dan North, senior economist at Allianz Trade North America. “Everybody hates the economy, but if you look at the hard data, it’s not so bad.”

North expects it will still take several months before the sentiment surveys — “soft” data — take their toll on other economic readings, such as payrolls.

Tariff impacts are key

In the interim, markets will be watching further developments on the trade front as President Donald Trump continues in a 90-day negotiating window that investors hope will ease some of the “Liberation Day” tariffs that are on pause.

“We don’t expect to see a crash this month, probably not the month after this, but certainly a weight on the economy, not just from the tariffs but also from uncertainty. It’s as if tariff policy is a specter in the mist,” North said.

There are a variety of views on Wall Street, from Goldman Sachs, which expects a below-consensus 110,000 growth in payrolls, to Bank of America, which is looking more for a number around 150,000.

From there, investors will try to figure out whether the latest numbers move the needle on Fed policy, with markets currently not expecting further interest rate cuts until September. Most policymakers of late have been focusing on tariff-induced inflation impacts, with the caveat that they are watching the jobs numbers as well.

“One encouraging sign about economic activity is the resilience of the labor market,” Fed Governor Adriana Kugler said Thursday in New York. “We will get the May employment report tomorrow, but the data in hand indicate that employment has continued to grow and that labor supply and demand remain in relative balance.”

The consensus estimate also sees the unemployment rate holding at 4.2%, while average hourly earnings are projected to show a 0.3% monthly gain and 3.7% annual increase.

Blog Post5 days ago

Blog Post5 days ago

Economics1 week ago

Economics1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics7 days ago

Economics7 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago