Finance

Today’s 15- and 30-year mortgage rates hold steady | April 19, 2024

Published

1 year agoon

Our goal here at Credible Operations, Inc., NMLS Number 1681276, referred to as “Credible” below, is to give you the tools and confidence you need to improve your finances. Although we do promote products from our partner lenders who compensate us for our services, all opinions are our own.

Mortgage rates fluctuate almost daily based on economic conditions. Here are today’s mortgage rates and what you need to know about getting the best rate. (iStock)

The interest rate on a 30-year fixed-rate mortgage is 7.500% as of April 19, which is unchanged from yesterday. Additionally, the interest rate on a 15-year fixed-rate mortgage is 6.625%, which is also unchanged from yesterday.

With mortgage rates changing daily, it’s a good idea to check today’s rate before applying for a loan. It’s also important to compare different lenders’ current interest rates, terms, and fees to ensure you get the best deal.

Rates last updated on April 19, 2024. Rates are based on the assumptions shown here. Actual rates may vary. Credible, a personal finance marketplace, has 5,000 Trustpilot reviews with an average star rating of 4.7 (out of a possible 5.0).

How do mortgage rates work?

When you take out a mortgage loan to purchase a home, you’re borrowing money from a lender. In order for that lender to make a profit and reduce risk to itself, it will charge interest on the principal — that is, the amount you borrowed.

Expressed as a percentage, a mortgage interest rate is essentially the cost of borrowing money. It can vary based on several factors, such as your credit score, debt-to-income ratio (DTI), down payment, loan amount, and repayment term.

After getting a mortgage, you’ll typically receive an amortization schedule, which shows your payment schedule over the life of the loan. It also indicates how much of each payment goes toward the principal balance versus the interest.

Near the beginning of the loan term, you’ll spend more money on interest and less on the principal balance. As you approach the end of the repayment term, you’ll pay more toward the principal and less toward interest.

Your mortgage interest rate can be either fixed or adjustable. With a fixed-rate mortgage, the rate will be consistent for the duration of the loan. With an adjustable-rate mortgage (ARM), the interest rate can fluctuate with the market.

Keep in mind that a mortgage’s interest rate is not the same as its annual percentage rate (APR). This is because an APR includes both the interest rate and any other lender fees or charges.

Mortgage rates change frequently — sometimes on a daily basis. Inflation plays a significant role in these fluctuations. Interest rates tend to rise in periods of high inflation, whereas they tend to drop or remain roughly the same in times of low inflation. Other factors, like the economic climate, demand, and inventory can also impact the current average mortgage rates.

To find great mortgage rates, start by using Credible’s secured website, which can show you current mortgage rates from multiple lenders without affecting your credit score. You can also use Credible’s mortgage calculator to estimate your monthly mortgage payments.

What determines the mortgage rate?

Mortgage lenders typically determine the interest rate on a case-by-case basis. Generally, they reserve the lowest rates for low-risk borrowers — that is, those with a higher credit score, income, and down payment amount. Here are some other personal factors that may determine your mortgage rate:

- Location of the home

- Price of the home

- Your credit score and credit history

- Loan term

- Loan type (e.g., conventional or FHA)

- Interest rate type (fixed or adjustable)

- Down payment amount

- Loan-to-value (LTV) ratio

- DTI

Other indirect factors that may determine the mortgage rate include:

- Current economic conditions

- Rate of inflation

- Market conditions

- Housing construction supply, demand, and costs

- Consumer spending

- Stock market

- 10-year Treasury yields

- Federal Reserve policies

- Current employment rate

How to compare mortgage rates

Along with certain economic and personal factors, the lender you choose can also affect your mortgage rate. Some lenders have higher average mortgage rates than others, regardless of your credit or financial situation. That’s why it’s important to compare lenders and loan offers.

Here are some of the best ways to compare mortgage rates and ensure you get the best one:

- Shop around for lenders: Compare several lenders to find the best rates and lowest fees. Even if the rate is only lower by a few basis points, it could still save you thousands of dollars over the life of the loan.

- Get several loan estimates: A loan estimate comes with a more personalized rate and fees based on factors like income, employment, and the property’s location. Review and compare loan estimates from several lenders.

- Get pre-approved for a mortgage: Pre-approval doesn’t guarantee you’ll get a loan, but it can give you a better idea of what you qualify for and at what interest rate. You’ll need to complete an application and undergo a hard credit check.

- Consider a mortgage rate lock: A mortgage rate lock lets you lock in the current mortgage rate for a certain amount of time — often between 30 and 90 days. During this time, you can continue shopping around for a home without worrying about the rate changing.

- Choose between an adjustable- and fixed-rate mortgage: The interest rate type can affect how much you pay over time, so consider your options carefully.

One other way to compare mortgage rates is with a mortgage calculator. Use a calculator to determine your monthly payment amount and the total cost of the loan. Just remember, certain fees like homeowners insurance or taxes might not be included in the calculations.

Here’s a simple example of what a 15-year fixed-rate mortgage might look like versus a 30-year fixed-rate mortgage:

15-year fixed-rate

- Loan amount: $300,000

- Interest rate: 6.29%

- Monthly payment: $2,579

- Total interest charges: $164,186

- Total loan amount: $464,186

30-year fixed-rate

- Loan amount: $300,000

- Interest rate: 6.89%

- Monthly payment: $1,974

- Total interest charges: $410,566

- Total loan amount: $710,565

Pros and cons of mortgages

If you’re thinking about taking out a mortgage, here are some benefits to consider:

- Predictable monthly payments: Fixed-rate mortgage loans come with a set interest rate that doesn’t change over the life of the loan. This means more consistent monthly payments.

- Potentially low interest rates: With good credit and a high down payment, you could get a competitive interest rate. Adjustable-rate mortgages may also come with a lower initial interest rate than fixed-rate loans.

- Tax benefits: Having a mortgage could make you eligible for certain tax benefits, such as a mortgage interest deduction.

- Potential asset: Real estate is often considered an asset. As you pay down your loan, you can also build home equity, which you can use for other things like debt consolidation or home improvement projects.

- Credit score boost: With on-time payments, you can build your credit score.

And here are some of the biggest downsides of getting a mortgage:

- Expensive fees and interest: You could end up paying thousands of dollars in interest and other fees over the life of the loan. You will also be responsible for maintenance, property taxes, and homeowners insurance.

- Long-term debt: Taking out a mortgage is a major financial commitment. Typical loan terms are 10, 15, 20, and 30 years.

- Potential rate changes: If you get an adjustable rate, the interest rate could increase.

How to qualify for a mortgage

Requirements vary by lender, but here are the typical steps to qualify for a mortgage:

- Have steady employment and income: You’ll need to provide proof of income when applying for a home loan. This may include money from your regular job, alimony, military benefits, commissions, or Social Security payments. You may also need to provide proof of at least two years’ worth of employment at your current company.

- Review any assets: Lenders consider your assets when deciding whether to lend you money. Common assets include money in your bank account or investment accounts.

- Know your DTI: Your DTI is the percentage of your gross monthly income that goes toward your monthly debts — like installment loans, lines of credit, or rent. The lower your DTI, the better your approval odds.

- Check your credit score: To get the best mortgage rate possible, you’ll need to have good credit. However, each loan type has a different credit score requirement. For example, you’ll need a credit score of 580 or higher to qualify for an FHA loan with a 3.5% down payment.

- Know the property type: During the loan application process, you may need to specify whether the home you want to buy is your primary residence. Lenders often view a primary residence as less risky, so they may have more lenient requirements than if you were to get a secondary or investment property.

- Choose the loan type: Many types of mortgage loans exist, including conventional loans, VA loans, USDA loans, FHA loans, and jumbo loans. Consider your options and pick the best one for your needs.

- Prepare for upfront and closing costs: Depending on the loan type, you may need to make a down payment. The exact amount depends on the loan type and lender. A USDA loan, for example, has no minimum down payment requirement for eligible buyers. With a conventional loan, you’ll need to put down 20% to avoid private mortgage insurance (PMI). You may also be responsible for paying any closing costs when signing for the loan.

How to apply for a mortgage

Here are the basic steps to apply for a mortgage, and what you can typically expect during the process:

- Choose a lender: Compare several lenders to see the types of loans they offer, their average mortgage rates, repayment terms, and fees. Also, check if they offer any down payment assistance programs or closing cost credits.

- Get pre-approved: Complete the pre-approval process to boost your chances of getting your dream home. You’ll need identifying documents, as well as documents verifying your employment, income, assets, and debts.

- Submit a formal application: Complete your chosen lender’s application process — either in person or online — and upload any required documents.

- Wait for the lender to process your loan: It can take some time for the lender to review your application and make a decision. In some cases, they may request additional information about your finances, assets, or liabilities. Provide this information as soon as possible to prevent delays.

- Complete the closing process: If approved for a loan, you’ll receive a closing disclosure with information about the loan and any closing costs. Review it, pay the down payment and closing costs, and sign the final loan documents. Some lenders have an online closing process, while others require you to go in person. If you are not approved, you can talk to your lender to get more information and determine how you can remedy any issues.

How to refinance a mortgage

Refinancing your mortgage lets you trade your current loan for a new one. It does not mean taking out a second loan. You will also still be responsible for making payments on the refinanced loan.

You might want to refinance your mortgage if you:

- Want a lower interest rate or different rate type

- Are looking for a shorter repayment term so you can pay off the loan sooner

- Need a smaller monthly payment

- Want to remove the PMI from your loan

- Need to use the equity for things like home improvement or debt consolidation (cash-out refinancing)

The refinancing process is similar to the process you follow for the original loan. Here are the basic steps:

- Choose the type of refinancing you want.

- Compare lenders for the best rates.

- Complete the application process.

- Wait for the lender to review your application.

- Provide supporting documentation (if requested).

- Complete the home appraisal.

- Proceed to closing, review the loan documents, and pay any closing costs.

How to access your home’s equity

If you need to tap into your home’s equity to pay off debt, fund a renovation, or cover an emergency expense, there are two popular options to choose from: a home equity loan and a home equity line of credit (HELOC). Both a home equity loan and a HELOC allow you to borrow against your home’s equity but a home equity loan comes in the form of a lump sum payment and a HELOC is a revolving line of credit.

These two loan types have some other key similarities and differences in how they work:

| Home equity loan | Home equity line of credit (HELOC) | |

| Interest rate | Fixed | Variable |

| Monthly payment amount | Fixed | Variable |

| Closing costs and fees | Yes | Yes, might be lower than other loan types |

| Repayment period | Typically 5-30 years | Typically 10-20 years |

FAQ

What is a rate lock?

Interest rates on mortgages fluctuate all the time, but a rate lock allows you to lock in your current rate for a set amount of time. This ensures you get the rate you want as you complete the homebuying process.

What are mortgage points?

Mortgage points are a type of prepaid interest that you can pay upfront — often as part of your closing costs — for a lower overall interest rate. This can lower your APR and monthly payments.

What are closing costs?

Closing costs are the fees you, as the buyer, need to pay before getting a loan. Common fees include attorney fees, home appraisal fees, origination fees, and application fees.

If you’re trying to find the right mortgage rate, consider using Credible. You can use Credible’s free online tool to easily compare multiple lenders and see prequalified rates in just a few minutes.

You may like

Finance

U.S.-China agree on framework to implement Geneva trade consensus

Published

54 minutes agoon

June 10, 2025

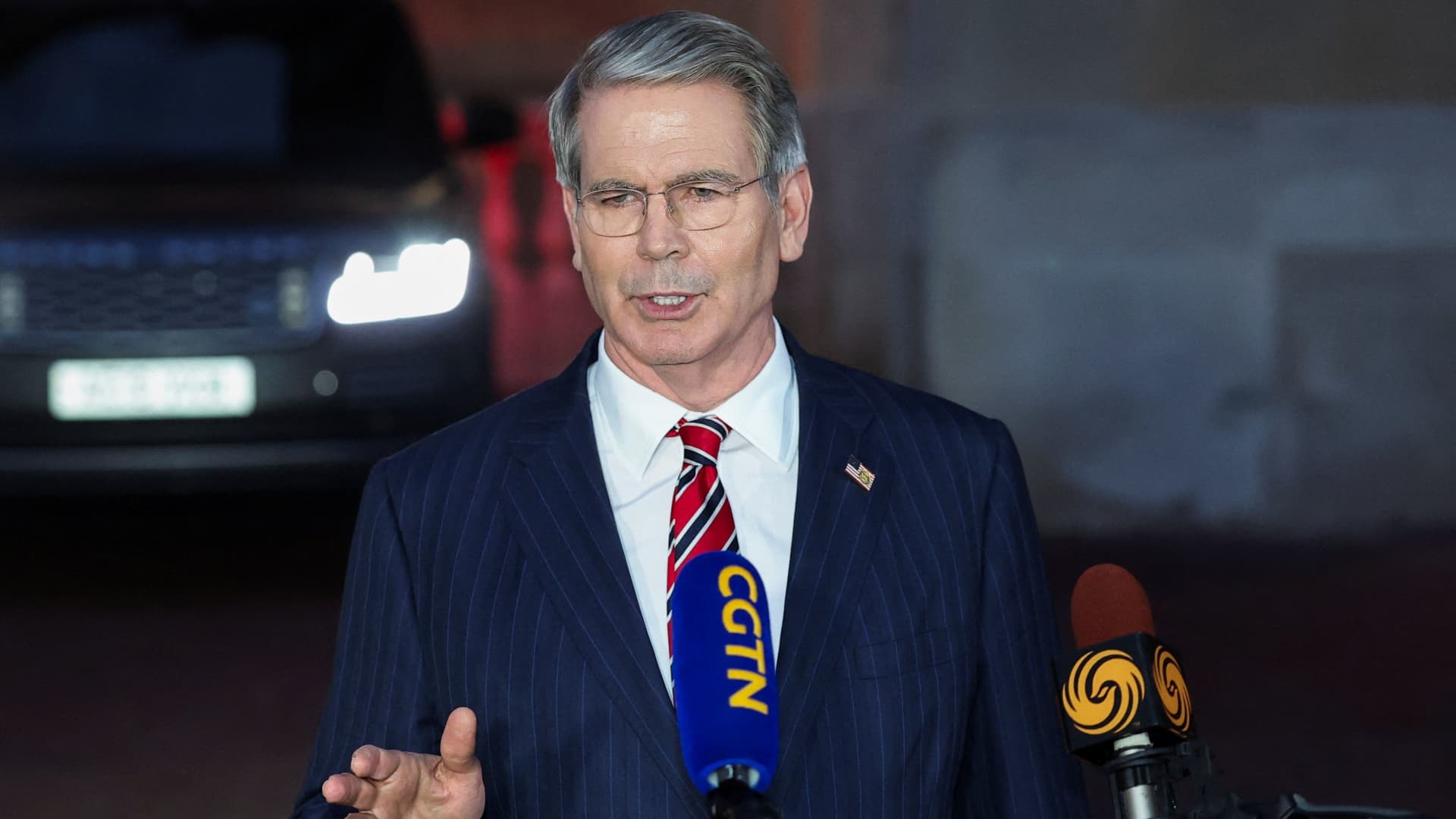

U.S. Treasury Secretary Scott Bessent speaks with the media as he departs to return to the U.S., while trade talks between the U.S. and China continue, in London, Britain, June 10, 2025.

Toby Melville | Reuters

The U.S. and China have reached consensus on trade, representatives from both sides said following a second day of high-level talks in London, according to an NBC transcript.

“We have reached a framework to implement the Geneva consensus and the call between the two presidents,” U.S. Commerce Secretary Howard Lutnick said.

That echoed comments from the Chinese side, shared via a translator.

Lutnick said he and U.S. Trade Representative Jamieson Greer will head back to Washington, D.C., to “make sure President Trump approves” the framework. If Xi also approves it, then “we will implement the framework,” Lutnick said.

Earlier, U.S. Treasury Secretary Scott Bessent told reporters he was headed back to the U.S. in order to testify before Congress on Wednesday.

This is breaking news. Please check back for updates.

Finance

Gundlach says to buy international stocks on dollar’s ‘secular decline’

Published

3 hours agoon

June 10, 2025

Jeffrey Gundlach speaking at the 2019 Sohn Conference in New York on May 6, 2019.

Adam Jeffery | CNBC

DoubleLine Capital CEO Jeffrey Gundlach said Tuesday that international stocks will continue to outshine U.S. equities on the back of what he believes to be the dollar’s secular downtrend.

“I think the trade is to not own U.S. stocks, but to own stocks in the rest of the world. It’s certainly working,” Gundlach said in an investor webcast. “The dollar is now in what I think is the beginning of [a] secular decline.”

Gundlach, whose firm managed about $95 billion at the end of 2024, said dollar-based investors who buy foreign stocks could enjoy “a double barreled wind” if the greenback declines against foreign currencies and international equities outperform.

The dollar has weakened in 2025 as Trump’s aggressive trade policies dented sentiment toward U.S. assets and triggered a reevaluation of the greenback’s dominant role in global commerce. The ICE U.S. Dollar Index is down about 8% this year.

“I think it’s perfectly sensible to invest in a few emerging market countries, and I would still rather choose India as the long term hold there,” Gundlach said. “But there’s nothing wrong with certain Southeast Asian countries, or perhaps even Mexico and Latin America.”

The widely-followed investor noted that foreigners invested in the United States could also be holding back committing additional capital due to heightened geopolitical tensions, and that could create another tailwind for international markets.

“If that’s reversing, then there’s a lot of selling that can happen. And this is one of the reasons that I advocate ex U.S. stocks versus U.S. stocks,” he said.

The investor has been negative on the U.S. markets and economy for some time, saying a number of recession indicators are starting to “blink red.”

Gundlach predicted that the Federal Reserve will stay put on interest rates at its policy meeting next week even as current inflation is “quite low.”

He estimated that inflation is likely to end 2025 at roughly 3%, although he acknowledged the difficulty in predicting future price pressures due to the lack of clarity in President Donald Trump’s tariff policy.

Finance

BlackRock’s smallest deal of 2024 may end up being its most consequential

Published

7 hours agoon

June 10, 2025

BlackRock CEO Larry Fink has sent a clear message to investors: The world’s largest asset manager’s smallest acquisition last year could end up its most consequential. During an industry conference in March, the long-time executive said BlackRock’s $3.2 billion purchase of alternatives asset data provider Preqin — its smallest of the four deals announced in 2024 — is “probably the most significant thing we have done in terms of expanding the profile of private markets.” It could be a big deal for investors, too. For starters, Preqin can bring what BlackRock currently does best — offer investors index products like exchange-traded funds (ETF) for public markets — to the opaque world of private markets. That would add revenue and earnings diversification that’s less tied to the daily fluctuations of the stock and bond markets, BlackRock CFO Martin Small said when announcing the deal in July 2024. “Through strong organic growth and scaling of our private markets and investment technology platforms, both of which fuel stable earnings growth,” Small added. “We believe we can drive multiple expansion for our shareholders.” BLK YTD mountain BlackRock (BLK) year-to-date performance The acquisition, which closed on March 3 , integrates Preqin’s private markets data into BlackRock platforms such as its portfolio management system Aladdin and investment software eFront. This gives BlackRock clients – mostly institutional investors who pay for access to these platforms – more visibility into non-public investment areas like infrastructure, private equity, private credit, and more. They will get valuation and performance data on more than 190,000 funds and 60,000 managers, according to BlackRock. “Preqin effectively does for private markets what Zillow did for housing,” CEO Fink said in his 2025 annual chairman letter . “If you’re buying a home, you want to know if you’re paying a fair price, and there are ways to do that. You can check neighborhood benchmarks, recent sales, or historical appreciation trends; companies like Zillow have made this simple. But today, investing in private markets feels a bit like buying a house in an unfamiliar neighborhood before Zillow existed, where finding accurate prices was difficult or impossible.” “This lack of transparency discourages investment,” he added. The new venture could take some of the pressure off BlackRock’s index business, which manages trillions of dollars and makes up a significant portion of its overall revenues. Although the firm has profited immensely as a traditional asset manager and has become an industry leader for ETFs, the division’s revenue streams are still at the mercy of the stock market’s volatility. BlackRock also has to pay fees to third-party providers like S & P Global and MSCI to use their underlying data in BlackRock funds. The longer-term goal is for BlackRock to create its own private-market benchmarks and sell more accessible private index products. Fink has also said private market investments could play a role within retirement accounts like IRAs, touting them as offering higher returns. “Not that we’re making a pivot, we just see the blending of public and private markets coming together and [it’s] probably happening faster than I ever envisioned,” Fink said at RBC Global Financial Institutions Conference in March. There are signs that the Preqin deal is already starting to pay off. Preqin added roughly $20 million to first-quarter revenue — even though it was owned for less than a third of the period — and contributed to the firm’s 30% year-over-year increase in annual contract values, or ACV, Small said during the company’s April earnings call. The CFO said this new “growth reflects sustained demand” from Preqin and that the trend shouldn’t die down anytime time. “We remain committed to low to mid-teens ACV growth over the long term,” he said. ACV is a financial metric that represents the average annual revenue from a customer contract. Offering retail investors access to private market investments doesn’t come without risk. Moody’s has warned that selling funds to retail investors could result in “reputation loss, heightened regulatory scrutiny and higher costs” for asset managers, the Wall Street Journal reported Tuesday. “If growth outpaces the industry’s ability to manage such complexities, such challenges could have systemic consequences,” Moody’s analysts wrote. However, in his annual chairman letter, Fink wrote that “private markets don’t have to be as risky. Or opaque. Or out of reach.” He added: “Not if the investment industry is willing to innovate—and that’s exactly what we’ve spent the past year doing at BlackRock.” There’s more to like about the Preqin acquisition. The deal should attract more clients and deepen its existing relationships. The competition for private markets data providers is limited, and Preqin has one of the most comprehensive data sets available. That could result in more valuable contracts with its existing clients and an increase in sales. We see this in the impact of similar acquisitions on BlackRock’s financials. Since BlackRock’s eFront acquisition in 2019, for example, BlackRock has doubled the annual contract value of the business. As these BlackRock platforms get bigger and integrate more data, they should retain customers and lure new ones in from rival asset managers. “In our thesis about demand for a whole portfolio view combining Aladdin and eFront capabilities, it’s driven new sales for both Aladdin and eFront,” Small said last July. “We’ll look to repeat this success with Preqin and have a business plan that we believe can generate significant synergies resulting in an 18% [internal rate of return].” Better client relationships also means Preqin can create a flywheel effect within BlackRock. Clients who use Preqin could be more inclined to tap BlackRock for its other services as well. “Preqin just makes [these platforms] better and crowds out competition and drives growth in all [BlackRock’s] businesses,” Evercore analyst Glenn Schorr told CNBC recently. “What’s probably even more appealing to this amazing asset manager is the insights [Preqin] can bring on where and how it can grow in the future as an asset manager, and then the value that [the deal] can bring to their large LPs that they manage money for,” Schorr said. “I think that’s the mindset that Larry probably had when he was talking about how important of a business this could be for them.” And lastly, BlackRock’s Preqin buy further expands the firm into the fast-growing world of private markets, which have grown enormously over the past several years as investors look for alternatives. It follows the firm’s other recent moves in the space. BlackRock closed a $12.5 billion deal for infrastructure investment firm Global Infrastructure Partners in October. The firm is also expected to complete its purchase of private credit manager HPS Investment Partners for $12 billion as well in 2025. “There are few people that would disagree that private markets are a continued very large growth opportunity for any good asset manager, any good wealth management firm [or] any good bank as well,” Schorr said. (Jim Cramer’s Charitable Trust is long BLK. See here for a full list of the stocks.) As a subscriber to the CNBC Investing Club with Jim Cramer, you will receive a trade alert before Jim makes a trade. Jim waits 45 minutes after sending a trade alert before buying or selling a stock in his charitable trust’s portfolio. If Jim has talked about a stock on CNBC TV, he waits 72 hours after issuing the trade alert before executing the trade. THE ABOVE INVESTING CLUB INFORMATION IS SUBJECT TO OUR TERMS AND CONDITIONS AND PRIVACY POLICY , TOGETHER WITH OUR DISCLAIMER . NO FIDUCIARY OBLIGATION OR DUTY EXISTS, OR IS CREATED, BY VIRTUE OF YOUR RECEIPT OF ANY INFORMATION PROVIDED IN CONNECTION WITH THE INVESTING CLUB. NO SPECIFIC OUTCOME OR PROFIT IS GUARANTEED.

U.S.-China agree on framework to implement Geneva trade consensus

IRS updates procedures list for accounting method changes

Gundlach says to buy international stocks on dollar’s ‘secular decline’

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoWhat the national debt, deficit mean for your money

-

Economics1 week ago

Economics1 week agoPeople cooking at home at highest level since Covid, Campbell’s says

-

Economics1 week ago

Economics1 week agoElon Musk’s failure in government

-

Economics4 days ago

Economics4 days agoJobs report May 2025:

-

Finance4 days ago

Finance4 days agoStocks making the biggest moves midday: WOOF, TSLA, CRCL, LULU

-

Economics4 days ago

Economics4 days agoDonald Trump has many ways to hurt Elon Musk

-

Economics4 days ago

Economics4 days agoDonald Trump has many ways to hurt Elon Musk

-

Finance3 days ago

Finance3 days agoChina’s EV race to the bottom leaves a few possible winners