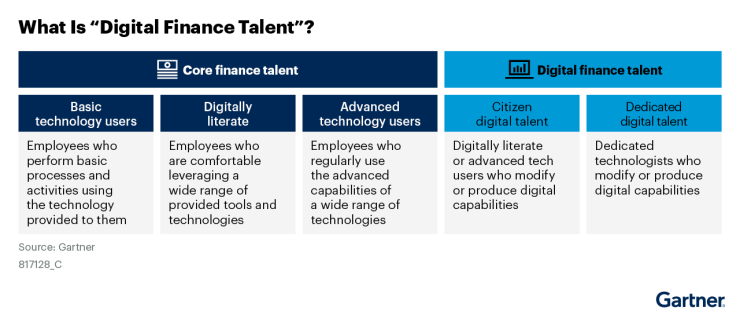

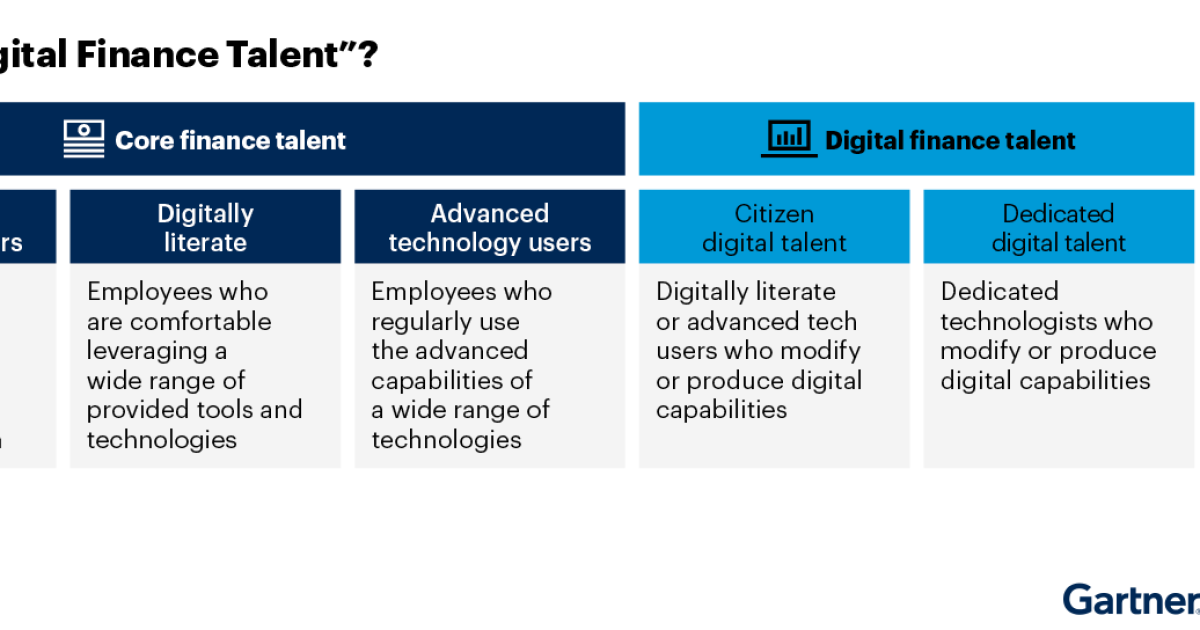

Finance functions struggle to obtain enough digital talent to achieve their finance transformation goals. They won’t get there through hiring alone. To meet transformation objectives, nearly half of traditional finance roles must become digital finance roles: employees who can produce new finance technology capabilities by modifying, customizing and creating technology solutions.

Finance functions are hoping digital transformation will help them to navigate heightened operating complexities, unfavorable labor market dynamics and the increasing embeddedness of technology. Yet to gain a full return on digital investments, finance must gain more productivity from its existing talent, with finance roles broadening to include more technology-related tasks alongside core finance responsibilities.

However, most organizations have overfocused on developing employees’ ability to use existing technologies, while simultaneously underestimating the amount of new digital finance talent needed to reach transformation goals.

Finance must secure “digital finance talent” rather than “core finance talent.”

To achieve this, finance leaders should consider the following strategy:

Make finance employees producers of technology capabilities

To get finance employees to do more valuable technology work, finance leaders should focus on redesigning their core finance roles to incorporate technology capability production. By doing this, finance transformation leaders can intentionally embed technology work into employees’ roles and encourage them to shape technology processes to achieve specific outcomes relevant to their roles.

A broad range of finance roles should undergo some form of role evolution in the coming years. In the meantime, however, most role evolutions will fall under two key areas within finance — accounting and analytics — as these are the most immediate applications for modern finance technology. Still, this overall shift applies to a much broader range of finance roles as organizations continue their transformation efforts and adopt advanced technologies.

Evolve process-heavy roles into technology producers to drive deeper automation

Finance work necessitates a substantial portion of process-heavy and routine-based work that is time-intensive, prone to human error and repetitive in nature. Automating these process-heavy tasks will alleviate some of the embedded inefficiencies associated with core finance tasks.

The ability to produce automation capabilities will free up capacity for more thought-based and analytical work, creating an advantage that can compound as employees make real-time adjustments to automated processes and tasks, and spot additional opportunities to automate. Accountants, with their manual, task-based and process-oriented work, are perfect candidates to automate and streamline their day-to-day processes.

To begin evolving accountant roles into digital finance talent through automating tasks, finance leaders must look at changes to role responsibilities, day-to-day activities, performance measurement, experience and educational qualifications, and career pathing, such as supporting lateral moves into technology roles. These changes will help shape a culture where accountants feel emboldened to experiment with modern finance technology to drive better outcomes for the function.

Some companies use a more structured, leadership-driven approach to turn accountants into technology producers, with formally defined test cases and guidance on available technology, dedicated training time, and peer learning groups. For example, a finance leader at a global insurance company helped launch a learning program for automating existing manual processes for a select few finance employees with digital interest. The mandate for this group was to learn about the new technologies and then develop and implement shorter-term, real-time solutions that would create efficiencies across existing accounting processes.

Others develop accountants by using a combination of leadership- and employee-driven methods.

For example, a financial and accounting analyst at a different insurance company built developer skills by participating in her organization’s enterprise citizen developer program. She leveraged a structured training course that allowed her to easily follow along and implement her learning alongside her daily work. But her success can primarily be attributed to her ability to identify her own digital opportunities, such as turning roadblocks in her daily responsibilities into impactful use cases for digital tools. This approach promotes autonomy and freedom to explore and increases capacity for quick wins to drive continued effort and motivation.

Evolve analytical-heavy roles into technology producers to accelerate technology-enabled decision support

Finance transformation leaders are increasingly recognizing the potential of financial analysts to better drive business decisions through enhanced digital capabilities. By producing technology capabilities instead of just using them, financial analysts can fully explore their analytical curiosities while creating more differentiated, high-value analyses.

The responsibility of the analyst role should evolve from having a finance-level lens, offering operational support for enterprise decision-making into having an enterprise-level lens offering strategic support for enterprise decision-making. Day-to-day this means moving away from relying solely on tools such as Excel, Power BI and Tableau to execute long range and scenario planning toward more data scientist-style work such as writing low-code to automate financial analysis and budget reports and creating artificial intelligence and machine learning models to transform planning and forecasting throughout the organization.

To incentivize this, performance measurement for financial analysts should be focused toward improving the actionality, reliability and accuracy of insights given to the enterprise from finance and increasing the business’ reliance on analyst’s input.

As finance functions become more complex, they must balance traditional responsibilities with the integration of new technologies. Repurposing core finance roles into digital finance talent who can actively contribute to technology development and implementation is a necessary step in getting the most of any finance transformation initiative while navigating such a challenging labor market for these digital skills.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago