Lordhenrivoton | E+ | Getty Images

Many American workers are optimistic about their retirement goals, but most believe it will be challenging for them to retire comfortably.

Almost half, 44%, of workers in a new CNBC poll are “cautiously optimistic” about their ability to meet their retirement goals, and 27% say they are “realistic” about that happening.

Even so, 82% of workers in that survey say achieving a comfortable retirement is “much harder or somewhat harder” to achieve than it was for their parents. A majority, 69%, are concerned about being able to afford to stop working or retire fully and 80% worry that Social Security will not be enough to live on in retirement.

The CNBC report, conducted by SurveyMonkey, polled 6,657 U.S. adults, including 2,603 who are retired and 4,054 who are working full time or part time, are self-employed or who own a business.

Here’s a look at more stories on how to manage, grow and protect your money for the years ahead.

The decline in traditional pensions, the rising cost of health care, and increasing life expectancy have contributed to workers’ need to rethink their retirement plans.

“Retirement itself is being retired,” said Joseph Coughlin, director of the Massachusetts Institute of Technology AgeLab. “Often, within a year, two years, they found out that, frankly, they’re either need more money or need something to do.”

Here are smart moves you can make at every age to make it easier to meet your retirement goals:

In your 20s & 30s: Maximize tax-advantaged savings

Many younger workers in the CNBC poll — including 43% of Gen Z and millennials, who are in their 20s to early 40s — are “cautiously optimistic” about their ability to meet their retirement goals.

For people in their 20s and 30s, “retirement” is far away and means having the financial freedom to be “working because we want to, not necessarily because we have to,” said certified financial planner Rianka Dorsainvil, founder of YGC Wealth in Lanham, Maryland, and a CNBC Financial Advisor Council member.

Starting to invest for retirement early, especially in tax-advantaged accounts, helps you make the most of your time investing in the market and leverage the power of compound interest.

Various work opportunities can offer flexibility in options to save for the future. Many people in their 20s may work a 9-to-5 job and have a “side gig” or part-time job in the evenings or weekends.

That means you could save in a 401(k) plan at work as well as a self-employed retirement plan, like a Simplified Employee Pension-Individual retirement account or Solo 401(k) on your own, said Nate Hoskin, a certified financial planner and founder of Hoskin Capital in Denver, Colorado.

While you may have opened a 401(k) plan in your first job, aim to increase the percentage you contribute each year. Put in at least enough money to get the company’s full matching contribution.

Traditional IRAs and 401(k) plans give you an upfront tax break. Making contributions with pre-tax money lowers your taxable income now, but you’ll have to pay taxes when you withdraw the money in retirement at your future tax rate.

Roth accounts, which let you contribute after-tax dollars that then grow and can be withdrawn in retirement tax free, can also be a smart bet for young workers who qualify.

In your 40s: Monitor rising expenses

While you’re in your peak earning years, expenses can also rise quickly. About half, 52%, of millennials and 47% of Gen Xers in the CNBC poll said “paying off debts or loans” is the main reason they feel behind in retirement planning or savings.

In that case, “it’s probably time to reassess financial goals,” said Dorsainvil. Focus on paying down credit card and high-interest debt and boosting your emergency savings so that you won’t be forced to dip into retirement savings for unexpected expenses.

Also, be careful of “lifestyle creep.” You don’t necessarily need to spend more just because you are making more. Don’t let the cost of your lifestyle increase faster than your income. See what expenses you can reduce or cut out.

In your 50s: Estimate your retirement income

The CNBC poll finds that 48% of GenXers hope to have saved $500,000 or more for retirement, yet the same share have currently saved $50,000 or less. Nearly 20% of this age group are “not sure” how much money they will need to spend each year on living expenses and other purchases in retirement.

In your 50s, it’s time to turbocharge your savings and start crunching the numbers to determine how much income you will have in retirement.

“Not enough people actually do financial planning, so they’re not aware of the numbers that they’re faced with early enough,” said Catherine Valega, a CFP and founder of Green Bee Advisory in Winchester, Massachusetts.

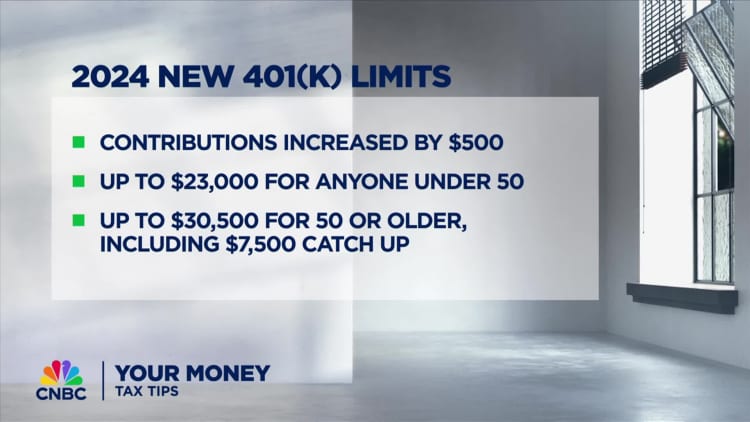

Starting at 50, you can boost your retirement savings with “catch-up” contributions. In 2024, the maximum you can contribute to a 401(k) is $23,000, but the IRS allows you to add an extra $7,500 if you’re 50 or older. For an individual retirement account (IRA), the maximum contribution for 2024 is $7,000, with an additional $1,000 if you’re 50 or older.

Online calculators can show you how much your retirement savings might grow between now and your anticipated retirement, and how much that balance it might provide in monthly income. Also, factor in how much money you may get from Social Security.

Even if you think you’re behind in saving, estimating your retirement income presents an opportunity to figure out how to make it work, said Valega.

“We’re not going to dwell on what you’ve done in the past. Let’s start today with what we have,” she said. “What are our assets? What are income-producing abilities, capabilities? And then we’re going to move forward.”

In your 60s: Test drive your retirement

Shapecharge | E+ | Getty Images

While 38% of baby boomers in their 60s and 70s say they are “on schedule” with retirement planning and savings, according to the CNBC poll, 41% say they are “behind schedule.”

As you enter your 60s, and are closer to retirement, take your retirement for a test drive. Think about what you will do, who you will do it with and where you will do it.

For example, Coughlin said to ask yourself: “What will you do on any given Tuesday? There will be many Tuesdays with expenses, challenges and opportunities.”

Many people today live well into their 90s and beyond. While travel, pursuing hobbies and interests and spending time with family are what most people of all ages say they will “ideally” do in retirement, the CNBC poll finds those who think they will “realistically” be able to do so are much lower.

Once you identify your aspirations, do a test run of the lifestyle and the location. Use your time off from work to engage in activities you think you’d like to do and vacation in the places where you think you’d like to live. Also, test drive your retirement budget by comparing housing, transportation, food, entertainment and health care costs in that area to what you’re paying now. See if you can stick to that new budget for a few months while still working.

No matter your age, Hoskin said, stick to some basic rules to achieve financial security: “You still need to spend less than you make, save a significant portion of your income, locate that money in the correct accounts, and invest it for the future,” he said. “That is the cycle that creates generational wealth.”

SIGN UP: Money 101 is an 8-week learning course on financial freedom, delivered weekly to your inbox. Sign up here. It is also available in Spanish.

REGISTER NOW! Join the free, virtual CNBC’s Women and Wealth event on Sept. 25 to hear from financial experts who will help fund your future — whether you are returning to the workforce, starting a new career or just looking to improve your relationship with money. Register here.

Blog Post7 days ago

Blog Post7 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago