Economics

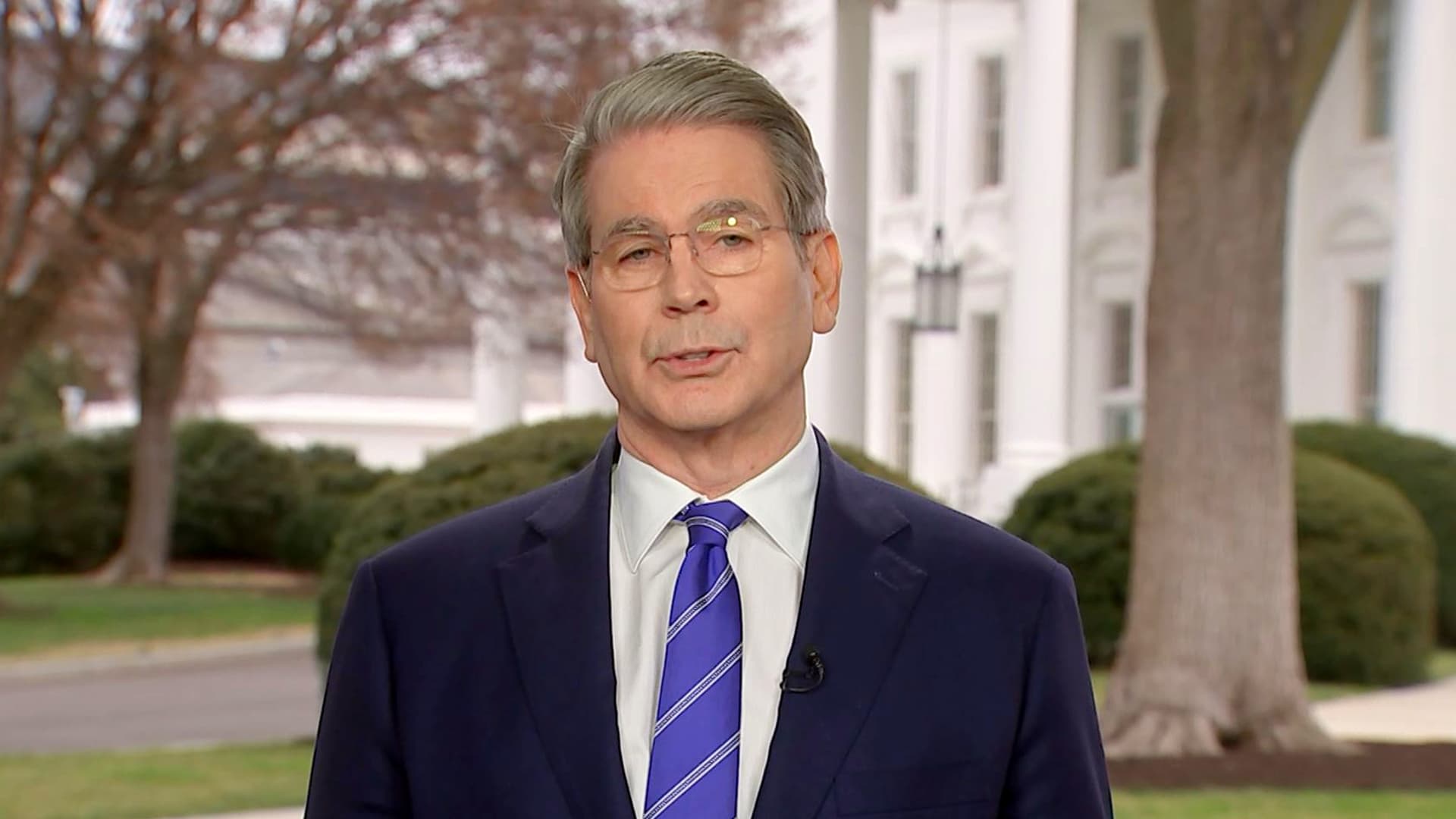

Treasury Secretary Bessent said the White House is focused on the ‘real economy’ and not concerned about ‘a little’ market volatility

-

Finance4 days ago

Finance4 days agoWarren Buffett to ask board to make Greg Abel CEO of Berkshire Hathaway at year-end

-

Economics1 week ago

Economics1 week agoWater sommeliers say the simplest drink is the future of luxury

-

Finance5 days ago

Finance5 days agoBerkshire meeting ‘bazaar’ features Buffett Squishmallows, 60th anniversary book and giant claw machine

-

Personal Finance6 days ago

Personal Finance6 days agoMillions of older workers lost jobs during Covid. Prospects have improved

-

Personal Finance1 week ago

Personal Finance1 week agoWhy Roth conversions are popular when the stock market dips

-

Economics6 days ago

Economics6 days agoHow Donald Trump could rescue John Roberts

-

Economics6 days ago

Economics6 days agoWhy does America have birthright citizenship?

-

Economics6 days ago

Economics6 days agoJobs report Friday to provide important clues on where the economy is heading