Madison Ventures Plus managing director Mitch Roschelle argues anything that promotes demand for housing is ill-advised when you have a supply-side problem on ‘Varney & Co.’

Nearly 1 in 10 American homeowners say they pulled money from their retirement savings to cover the down payment and closing costs associated with buying their house.

A recent survey by Bankrate found that 9% of homeowners withdrew from their 401(k) or other retirement account to make the purchase, and younger generations were most likely to do so.

The Washington Post published a new report detailing how the nation’s top home builders are opting to build smaller homes than previously to account for the current housing crisis. (Reuters Photos)

Sixteen percent of Gen Z respondents (ages 18-27) and 12% of millennials (ages 28-43) reported taking money out of retirement savings to fund their down payment, compared to 7% of Gen Xers (ages 44-59) and 8% of baby boomers (ages 60-78).

FED LEAVES RATES UNCHANGED, SAYS THREE CUTS STILL PLANNED

But is it a smart financial move?

David Ragland, CEO of IRC Wealth and a certified financial planner, says “the 401(k) — or any retirement program — is the most powerful wealth building tool out there,” and he does not recommend withdrawing from those funds to buy a home.

He points to two major reasons for not pulling money from retirement funds.

The first is that the saver will lose out on the growth they would have had if they kept the money in the fund over the long term, which would hurt young people much more than older generations.

A “For Rent” sign outside an apartment building in the East Village neighborhood of New York City on July 12, 2022. (Gabby Jones/Bloomberg via Getty Images / Getty Images)

The second-biggest downside is that the government takes a big chunk of the funds withdrawn from a retirement account.

Between federal and state taxes and a 10% penalty for a withdrawal, a person is looking at paying 40% on every dollar they take out, Ragland explained.

TO RENT OR TO BUY? WHAT TO CONSIDER WHEN DECIDING BETWEEN A HOUSE OR APARTMENT

To spell out the impact, he provided a hypothetical scenario of a 30-year-old who needs a $20,000 down payment and wants to take it from their retirement fund. Because of the penalties, an individual in that scenario would actually need to withdraw $33,000 from their retirement funds in order to cover the hit from the government.

However, if that 30-year-old left the $33,000 in their 401(k) rather than pulling it out, by the time that person is 85 years old, that amount of money would grow to $1.2 million, assuming the typical 7% rate of return.

“You’re not making a $30,000 decision, you’re making a $1.2 million decision,” Ragland said. “That’s why you don’t do it.”

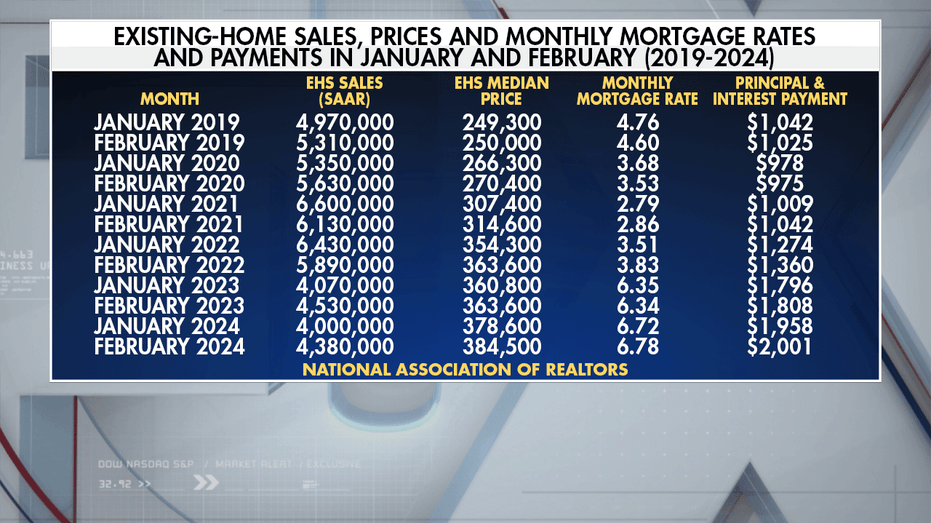

A data table showing existing home sales, prices, mortgage rates and mortgage payments in January and February for the years 2019-2024. (Fox News / Fox News)

However, for those who have a retirement fund and do not have other means to come up with a down payment, Ragland offered an alternative option.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

He noted that those with a 401(k) are able to take a loan against those funds up to $50,000. That allows people to keep their funds in their retirement account while getting the down payment money they need, and avoiding any taxes or penalties.

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Economics5 days ago

Economics5 days ago

Economics1 week ago

Economics1 week ago

Accounting6 days ago

Accounting6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics6 days ago

Economics6 days ago

Personal Finance5 days ago

Personal Finance5 days ago