Economics

El-Erian says the Fed has turned into a play-by-play commentator

-

Blog Post1 week ago

Blog Post1 week agoHow to Navigate 65A Compliance for NYC Nonprofits

-

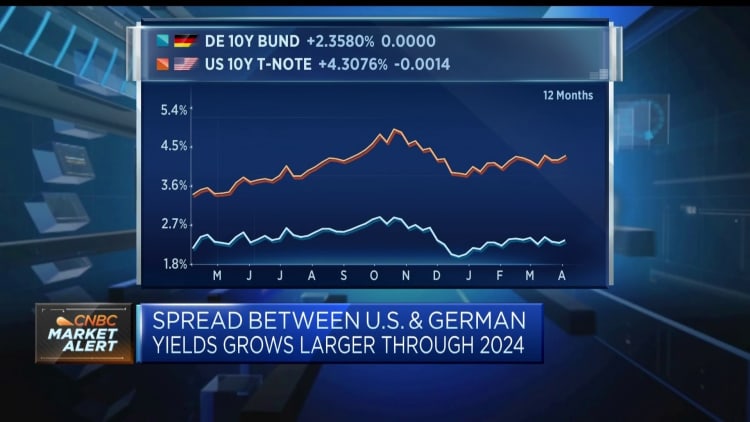

Finance1 week ago

Finance1 week agoBonds as protection play against stock market volatility

-

Personal Finance1 week ago

Personal Finance1 week agoAre designer handbags an actual investment? Here’s how returns stack up

-

Personal Finance6 days ago

Personal Finance6 days agoStudent loans could be managed by the Small Business Administration

-

Economics6 days ago

Economics6 days agoWhite House denials over the Signal snafu ring hollow

-

Personal Finance6 days ago

Personal Finance6 days agoMillions of student loan borrowers past-due after bills restarted: Fed

-

Economics5 days ago

Economics5 days agoYoung Americans are losing confidence in economy, and it shows online

-

Economics4 days ago

Economics4 days agoConsumer sentiment worsens as inflation fears grow, University of Michigan survey shows