A small firm in Henderson, Nevada, Bush & Associates, topped the list of those with the most new Securities and Exchange Commission audit clients in 2024, followed by Big Four firm KPMG — but the audit firm that had what was likely the biggest impact on the market isn’t on the list at all.

Bush & Associates added 32 new SEC clients and netted 30 over the course of last year, while KPMG added 39 and netted 23. (See “Net engagement leaders.”)

Almost half of Bush’s new clients — 14 out of 32 — came from one-time star BF Borgers, which was permanently suspended from practice by the commission in May, and whose demise amid a welter of accusations of improper practice sent a huge number of clients out into the market seeking new auditors.

A significant number of firms picked up clients that had been with Borgers, including:

- Michael Gillespie & Associates, with 15 Borgers clients;

- Boladale Lawal & Co., with 12;

- Fruci & Associates, with 10;

- Olayinka Oyebola & Co., with 9;

- Astra Audit, BCRG Group, and M&K CPAs, with six each; and,

- BartonCPA and Beckles & Co., with five each.

BF Borgers wasn’t the only firm whose clients were looking for new homes: Astra Audit picked up 13 new engagements in 2024 from Accell Audit & Compliance, which closed down its SEC practice, and the exit of Morison Cogen from the SEC market helped Stephano Slack pick up 11.

Most of these firm departures didn’t have much of an impact on the largest auditors (see “2024 total gains & losses“), but the combination of Top 10 Firms Marcum and CBIZ did shake out a large number of clients who were picked up by a wide range of firms.

Clients by filing status, and more

In terms of clients by filing status, KPMG led among new large accelerated filers, while Bush & Associates took the lead among non-accelerated filers and small reporting companies. (See “Audit leaders.“) Deloitte took on the most accelerated filers in 2024.

As you might expect, KPMG topped the league tables for new market capitalization audited, with the biggest contribution coming from Grayscale Bitcoin Trust’s $25.5 billion, as well as for new assets audited, with insurance underwriter Everest Group accounting for $49.3 billion and Grayscale Bitcoin Trust for $26.4 billion. It came in second for new audit fees, energy distribution and services company UGI Corp. the biggest slice, at $9 million, and all the rest of its clients scattered below that. (See “New client leaders.“)

Deloitte was No. 1 for new audit fees, with dental instrument and supply provider Dentsply Sirona Inc. coming in at $11.8 million and 3D printing company 3D Systems Corp. at $10 million, and all its other clients below that. The firm came in second for new assets audited, with insurance holding company American National Group’s $79.9 billion and cruise line Carnival’s $49 billion standing out.

Finally, PwC took second in new market cap audited, with a big boost from semiconductor manufacturer Global Foundries Inc.’s $32.1 billion.

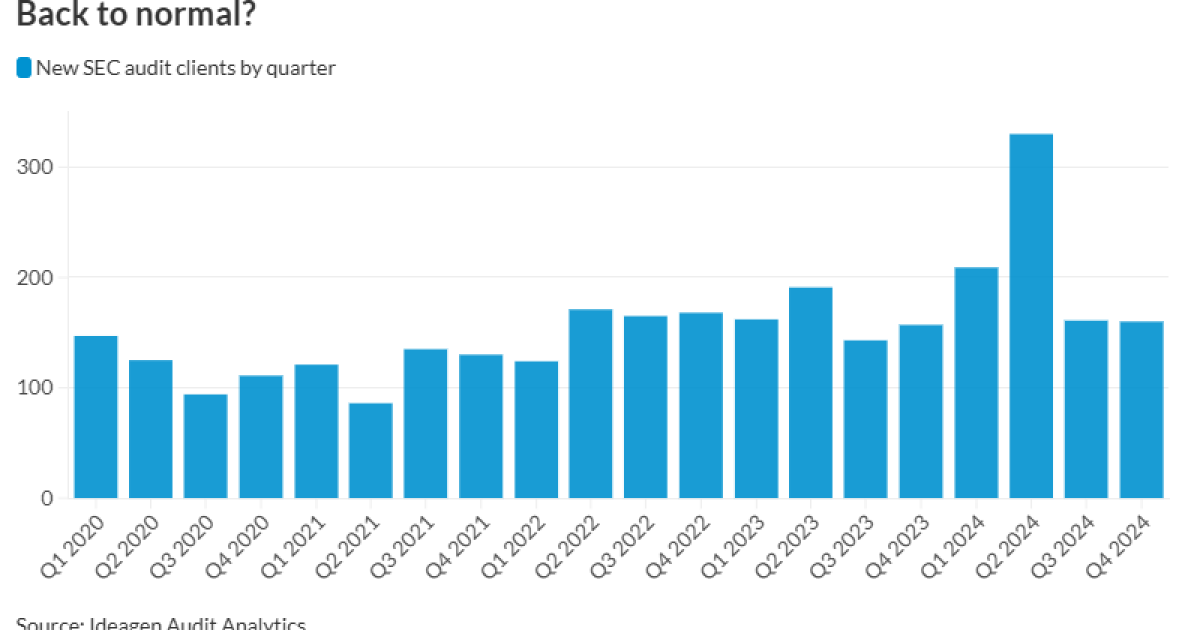

Data for the quarterly rankings are provided by Ideagen Audit Analytics, a premium online intelligence service delivering audit, regulatory and disclosure analysis. Reach them at (508) 476-7007, [email protected] or www.auditanalytics.com

Economics1 week ago

Economics1 week ago

Economics6 days ago

Economics6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Accounting6 days ago

Accounting6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Finance6 days ago

Finance6 days ago

Personal Finance6 days ago

Personal Finance6 days ago