Some smaller accounting firms are in denial that they have a major role to play in advancing diversity, equity and inclusion in the accounting profession. One-third...

For many accounting and finance teams, the fiscal year-end brings a cycle of intense workloads that can extend into the new year, as accountants and auditors...

UBS Group AG stood trial in Paris accused of harassing a pair of whistleblowers who lifted the lid on the bank’s efforts to help wealthy French...

The long efforts to put in place the enforcement mechanisms to attack syndicated conservation easements appear to at last be finalized. In October 2024, the Internal...

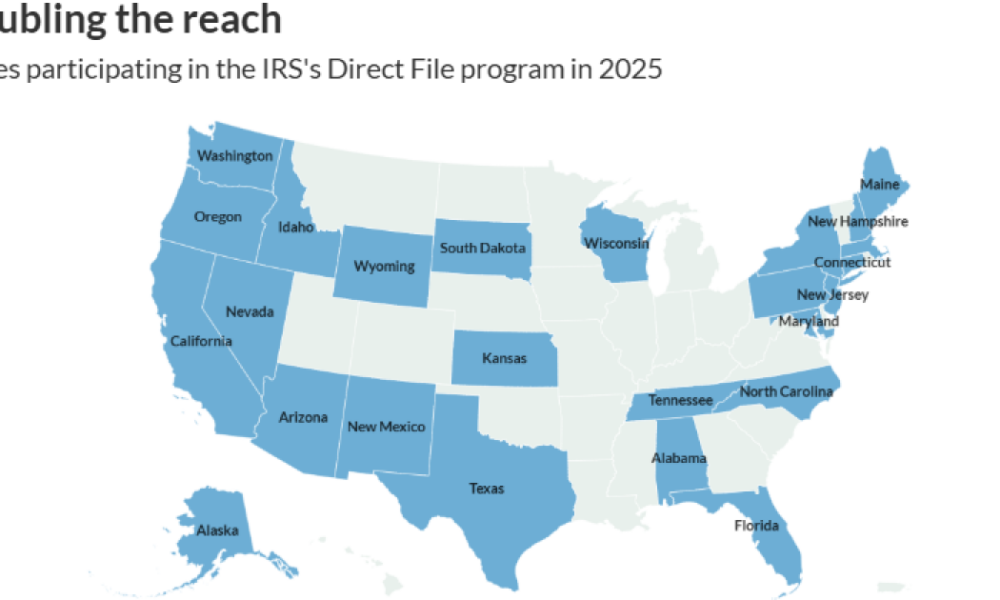

Enjoy complimentary access to top ideas and insights — selected by our editors. This week’s stats focus on the states that are participating in the IRS’s...

A rush to transfer assets into spousal lifetime access trusts in order to avoid estate taxes in the future may bring its own risks apart from...

The Financial Accounting Foundation today announced that John Auchincloss will retire from his post as executive director on September 30, 2025. The search for his successor...

Super Micro Computer Inc. said an independent review of its business found no evidence of misconduct but recommended that the server maker appoint new top financial...

Enjoy complimentary access to top ideas and insights — selected by our editors. Barry C. Melancon will be retiring as the CEO of the AICPA at...

Accounting firm ASE Group does not do taxes on April 15, and its employees don’t work Fridays. That’s the vision founder Al-Nesha Jones conjured up when...