Tesla Inc.’s shares sank as Elon Musk and President Donald Trump’s simmering feud devolved into a public war of words between two of the world’s most...

DMJPS PLLC, a Regional Leader based in Greensboro, North Carolina, is adding Potter & Company P.A., a firm based in the Charlotte metropolitan region, effective July...

Audit partners’ pessimism about the U.S. economy surged from 10% in the fall to 44% today, according to a report. The Center for Audit Quality’s latest...

The IRS has released to the public the vast majority of the code used to develop its Direct File program, theoretically allowing anyone to build their...

Over the last several months, I’ve been partnering with Intuit QuickBooks, Brittany Brown with Ledger Gurus and Utah Valley University professor David Waite to deliver a...

From the moment Donald Trump and Elon Musk joined forces, betting in Washington held that the president’s bond with the First Buddy who bankrolled his comeback...

A plan to sell thousands of acres of federal land to help pay for President Donald Trump’s massive package of tax cuts will be returning in...

A Republican attempt to block states from enforcing new artificial intelligence rules over the next decade has drawn growing bipartisan objections, exposing tension in Washington over...

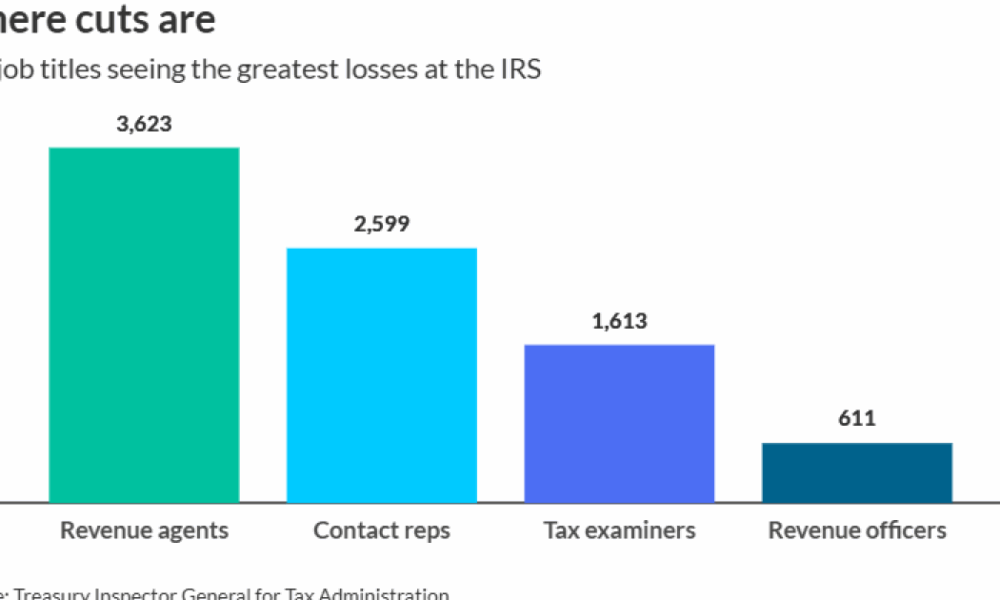

Enjoy complimentary access to top ideas and insights — selected by our editors. This week’s stats focus in part on the job titles seeing the greatest...

CrowdStrike Holdings Inc. said U.S. officials have asked for information related to the accounting of deals it’s made with some customers and said the cybersecurity firm...