Tech titan Elon Musk ratcheted up his offensive against Donald Trump’s signature tax bill on Wednesday, urging that Americans contact their lawmakers to “KILL” the legislation....

Three private equity-backed firms have made deals: Carr, Riggs & Ingram has expanded into East Texas by merging in Axley & Rode; UHY is continuing its...

The accounting talent shortage has reached a near-crisis level, with all indications that the trend will continue for some time. As turnover increases and the pipeline...

Big Four firm PwC announced it can now provide independent assurance of AI systems so clients can be confident they’ve been designed, deployed and operated responsibly,...

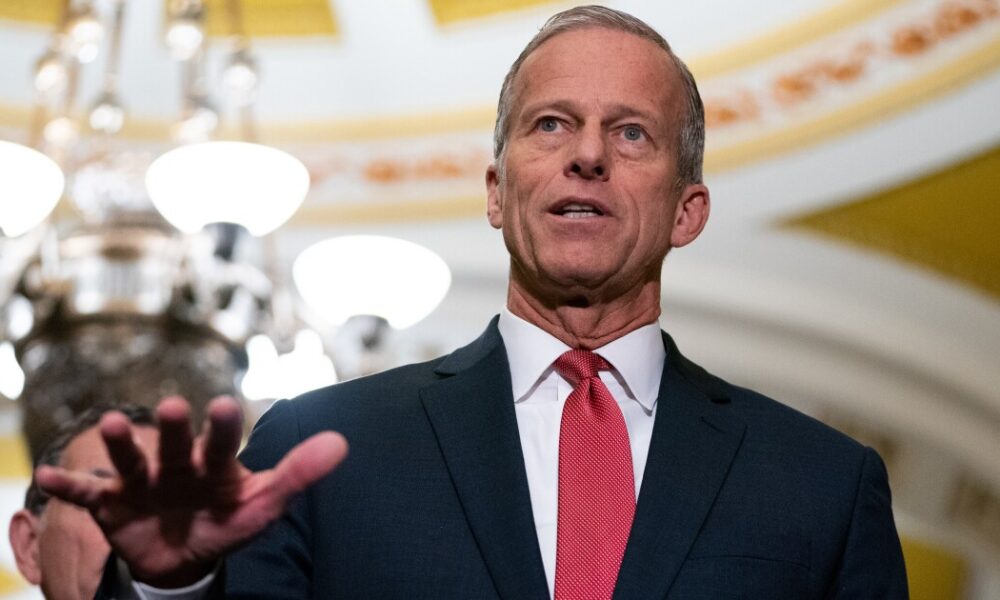

Senate Majority Leader John Thune believes the deal that led the House to increase the maximum deduction for state and local taxes to $40,000 will have...

The House-passed version of President Donald Trump’s tax and spending bill would add $2.42 trillion to U.S. budget deficits over the next decade, according to a...

Private sector employment increased by only 37,000 jobs in May, payroll giant ADP reported Wednesday, down from a revised figure of 60,000 in April, while annual...

Advisory and audit solutions provider Fieldguide released Field Agents for Financial Audits, which comes with an agentic AI “Audit Testing Agent” to automatically execute the testing...

Senate Republican Leader John Thune said President Donald Trump’s giant fiscal bill is unlikely to repeal the estate tax. “I’d love to get rid of it,”...

Service over the phone and at Taxpayer Assistance Centers and safety at TACs are among the issues still in need of improvement by the Internal Revenue...