The American Institute of CPAs published information on reporting on stablecoins, a type of cryptocurrency, providing a framework to stablecoin issuers for presenting and disclosing information...

CPA business executives’ outlook on the U.S. economy appears to be dimming, thanks to persistent inflation and growing worry over tariffs, according to a new survey...

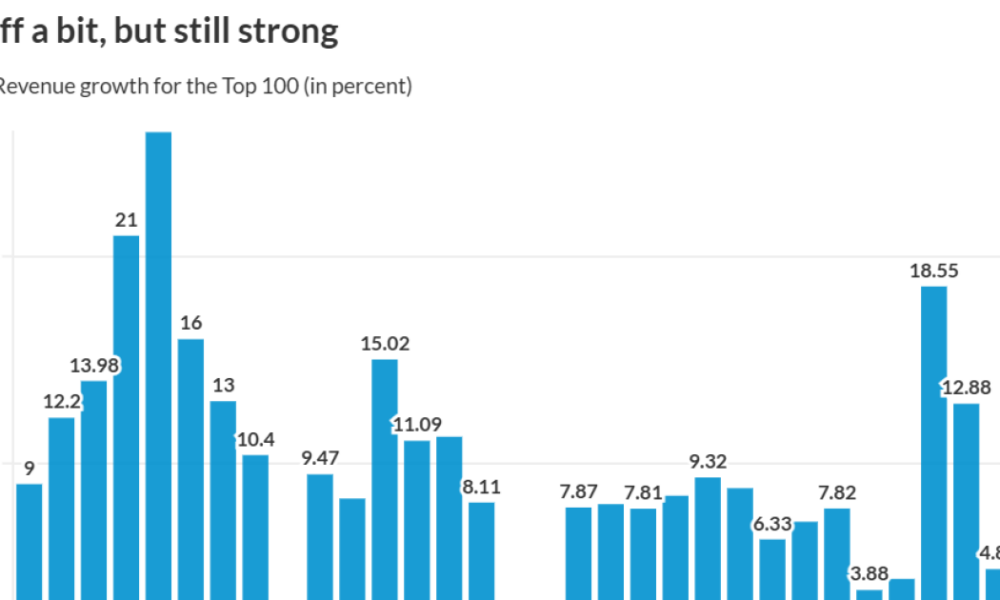

After a couple of very strong years, the biggest firms in the accounting profession as a group were a little slower in 2024 — though they...

The field of environmental, social and governance reporting and assurance is a natural opportunity for accountants, and one that’s ripe for the taking. But they risk...

The Public Company Accounting Oversight Board and the Securities and Exchange Commission ramped up enforcement against auditors in the first half of 2024, but activity was...

Ukraine, Iraq, Haiti and Bangladesh have been added to countries for tax year 2024 for which some requirements have been waived concerning foreign earned income exclusions....

The Institute of Internal Auditors has released a draft version of proposed requirements on third-party governance, risk management and control processes to include in audit plans....

Cohen & Co, a Top 50 Firm based in Cleveland, is acquiring Tassi and Company, based in the northwest suburbs of Chicago. Tassi and Company provides...

As Mahatma Gandhi famously said, “If you don’t ask, you don’t get it.” I bring this up because young accountants (and soon-to-be accounting graduates) are increasingly telling...

Cutting IRS staffing in half over the next 10 months would mean less help and longer waits for many U.S. taxpayers and increase the risk that...