New Hampshire is fighting back. The Granite State’s latest move to protect businesses from sales tax legislation, HB 135, was introduced on Jan. 8, 2025. It...

RSM International today announced its 2024 financial results, reporting $10 billion in global revenue, up 6% from $9.4 billion the prior year. Global fee income for...

Checking out a state’s tax competitiveness when looking to move can be beneficial, and Americans are moving to states with low taxes and lower costs. Of...

Financial advisors and tax professionals whose clients dispute an IRS calculation of their liability could get an outside ruling through the newly renamed Independent Office of...

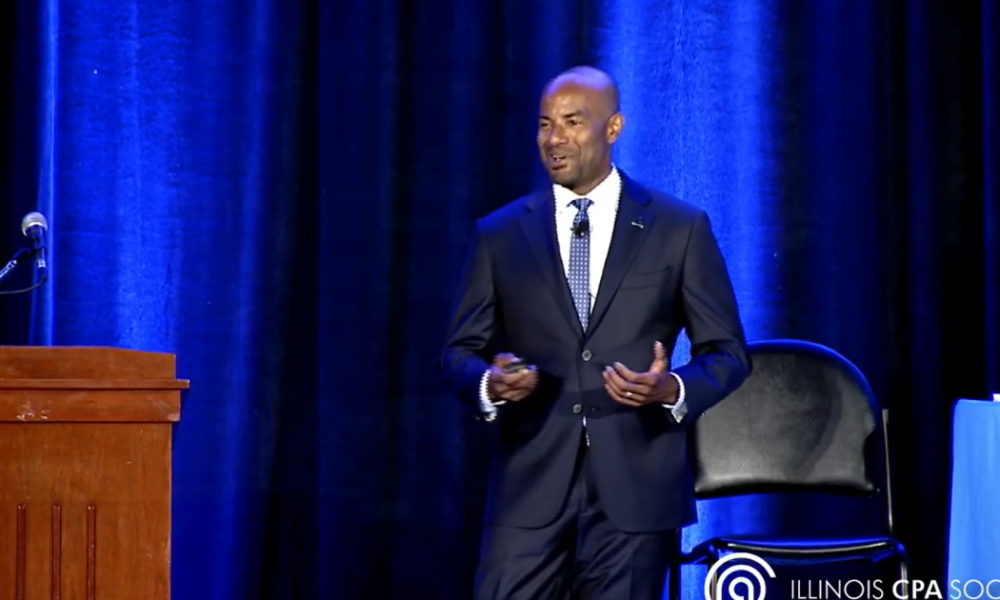

A pair of Illinois representatives have introduced legislation supported by the Illinois CPA Society to create two additional pathways to CPA licensure and practice mobility in...

President Donald Trump agreed to delay 25% tariffs against Mexico for one month after a conversation with his counterpart Claudia Sheinbaum on Monday, a dramatic turnabout...

BPM LLP, a Top 50 Firm based in San Francisco, has created an international network of independent firms that it’s calling BPM Global Ltd. The firm,...

Baker Tilly, a Top 10 Firm based in Chicago, plans to acquire Hancock Askew & Co. LLP, a Regional Leader based in Savannah, Georgia, expanding Baker...

Canada and Mexico vowed to hit back at the U.S. after President Donald Trump followed through on threats to impose 25% tariffs on imports of their...

Enjoy complimentary access to top ideas and insights — selected by our editors. My updated Word file of checklists is now available. There are 190 tax...