The Good Brigade | Digitalvision | Getty Images Mortgage rates have risen in recent months, even as the Federal Reserve has cut interest rates. While those...

US President Donald Trump holds up outgoing President Joe Biden’s letter as he signs executive orders in the Oval Office of the WHite House in Washington,...

Rockaa | E+ | Getty Images How to qualify for IRS Free File For the 2025 season, you can use IRS Free File if your adjusted...

Cofotoisme | E+ | Getty Images How long it takes you to save for a 20% down payment on a home depends in part on where...

Sweeping changes may be in store once President-elect Donald Trump takes office. Among them could be the closure of numerous federal agencies and regulators. Trump will be sworn...

Osaka, Japan. Jiale Tan | Moment | Getty Images The new year has many travelers thinking ahead to 2025 vacation plans — and how much those...

Elijah Nouvelage/Bloomberg via Getty Images The Consumer Financial Protection Bureau fined Equifax $15 million over errors tied to consumer credit reports, alleging the company failed to...

Hirurg | E+ | Getty Images With the start of tax season approaching, Democratic and Republican lawmakers are split on the future of Direct File, the...

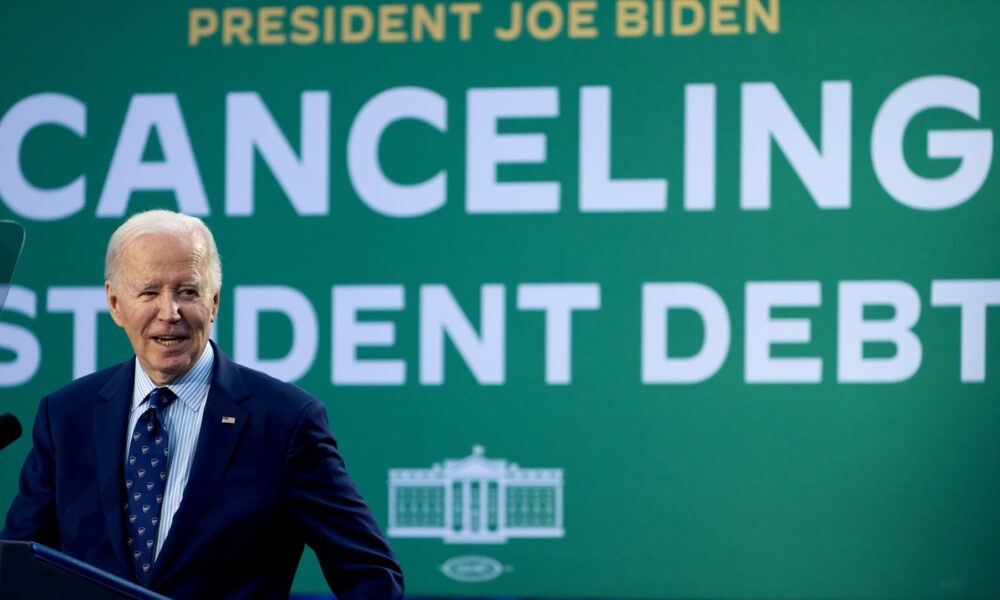

US President Joe Biden speaks during an event in Madison, Wisconsin, US, on Monday, April 8, 2024. Daniel Steinle | Bloomberg | Getty Images In 2023, the...

Burned cars and homes destroyed by the Eaton Fire are pictured in Altadena, California, on Jan. 9, 2025. Zoe Meyers | AFP | Getty Images How...