Accountants need not necessarily abandon compliance work for advisory, as recent data shows that the most successful firms maintain a robust presence in both areas.

This is according to a report authored by professionals at the Center for Accounting Transformation, CPA Trendlines, Avalara and Brigham Young University, which is based on survey responses from 213 accountants at firms of varying size. What they found was that it is perfectly possible for a firm to be successful without necessarily specializing in advisory or, indeed, specializing at all.

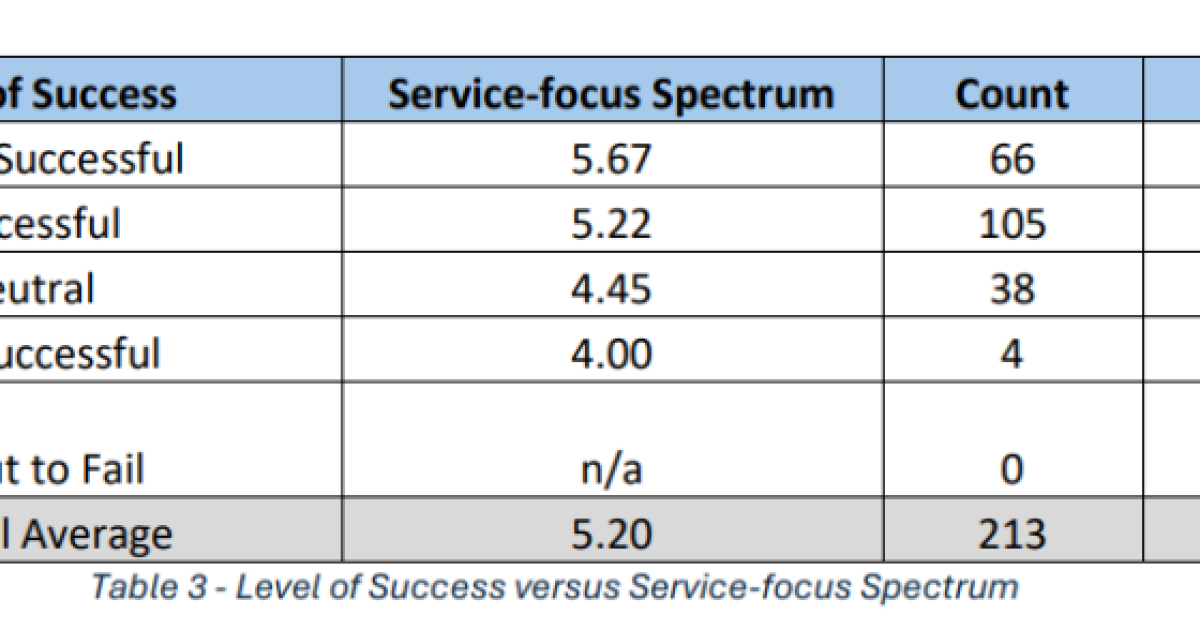

Practitioners were asked to rate, on a scale of 1-10, how successful they felt their firm was. They were also asked to rate their balance between compliance and advisory work, with 1 being “we do only compliance work” and 10 being “we do only advisory work.” They then looked at where the most successful firms stood on this compliance-advisory scale.

What they found was that the most successful firms, while leaning slightly more towards advisory over compliance, generally maintained a good balance between the two.

Those who were “highly successful” were rated 5.67 in terms of their balance between compliance and advisory. This number goes down the less successful one’s firm is, but not dramatically so, indicating that while a less advisory-focused firm might not be as successful, the gap is not as large as one might initially think.

Donny Shimamoto, the head of the Center for Accounting Transformation and one of the study’s authors, said what this shows is that firms can choose either advisory, compliance or some mix between the two. And, speaking from his own experience, the success of one can feed directly into the other.

“For example, my firm is pure advisory and we have been around for over 20 years already. What we’ve found though is that we need to ensure that our clients have someone performing the compliance work for them well. Without the strong base in compliance—which provides the reliability of the numbers for analysis—our advisory work may not provide the right recommendations because we are basing them on flawed base information,” he said.

A similar dynamic was observed when considering specialist versus generalist firms. Poll respondents were asked to rate, on a 1-10 scale, their degree of “vertical” specialization (the degree to which a firm focuses on a specific industry or sector, with 10 being they only work with clients in that area) and “horizontal” specialization (the degree to which a firm focuses on a specific service offering like R&D tax credits, with 10 being they only offer services in this particular area). What they found was that while both successful and highly successful firms, while possessing some degree of specialization, were not especially specialized in one area or another. However there does seem to be some benefit towards at least some specialization, as the unsuccessful firms were also the least specialized.

Still, this difference is not that great. Hyper-specialized firms on the vertical scale scored an average success rating of 8.11; firms that aren’t specialized at all, meanwhile, saw an average success rating of 7.5. There were similar results regarding horizontal specialization: the most specialized firms reported a success score of 8.45; the least specialized ones reported success scores of 7.61. While the differences are certainly relevant, the report noted they’re not especially dramatic.

There was one area where specialization made a big difference, though, and that was in employee satisfaction. The data found that those who were at firms that would be considered specialized, either in terms of service offerings or industrial sector, tended to have happier people who would be more likely to recommend the firm as a good place to work. However, the data also showed there can be too much of a good thing, as those who were at hyper-specialized firms were less happy.

“Hyper-specialized, I think, may be too narrowly focused and may not provide people with the variety of work that helps keep the work interesting. Many hyper-specialized also tend to be smaller firms, so there may also be challenges with the work environment and not as many people to spread the work among,” said Shimamoto.

Still, he also recognized that even if firms don’t necessarily have to jump into advisory, many have already done so and more will likely do so in the future. Even if a firm can find success focusing mainly on compliance-related work, he said they will still not be able to ignore advisory completely, especially as automation of routine tasks becomes more common.

“As compliance becomes more automated, I suspect we will see a trend toward about 20% compliance (that is highly automated) and then 80% advisory (that is automation-enabled). Firms that want to remain compliance-focused, will need to ensure that they are fully leveraging automation to keep that work sustainable. Or they will need to ensure they are partnering with an advisory-focused firm so that together they are coordinating the transformation for clients and its impacts on the compliance work,” he said.

While intuitively one might consider profit to be the primary metric of success, the study said that firm leaders have different goals and priorities when it comes to their businesses and so also have different measures of what makes them successful. Profit is certainly a factor, but it is not the only one. So, when considering how successful they are, accounting firm leaders also considered:

- Continuous learning and improvement of people;

- continuous improvement of processes;

- being ahead of other firms in technology usage;

- being team-oriented versus individually-focused;

- having a distinct culture and set of values that guides how a firm works and the decisions it makes;

- exceeding client expectations; having a positive impact on client success;

- growing faster than other similarly sized firms; and

- being able to operate successfully well into the future.

“We also knew that profit should not be the only measure of success, especially in the accounting profession where money is not necessarily a primary motivator. Thus we chose indicators that might show that one firm is more successful than other firms,” said Shimamoto.

Still, while profit is only one part of the equation, its impact can be quite material. But due to the hesitance of certain firms to share their specific profit figures, Shimamoto said it is difficult to pin down exactly what kinds of practices are more lucrative.

However, he said anecdotally he has heard advisory work and specialized work is generally more profitable because people can charge a premium for the knowledge. With his own firm, advisory work is much more profitable than the usual 30% rule of thumb that is used for professional services.

Accounting Today will be hosting a webcast on Oct. 31 to discuss the survey data in more detail. People can register here.

Blog Post6 days ago

Blog Post6 days ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago