Goran Babic | E+ | Getty Images

Building a $1 million nest egg may seem an impossible feat.

However, amassing such retirement wealth is within reach for almost anyone — provided they take certain steps, financial advisors say.

“You might think that, ‘Well, I have to become a Silicon Valley entrepreneur to become rich,'” said Brad Klontz, a financial psychologist and certified financial planner.

In fact, you can be a fast-food worker your whole life and amass wealth, said Klontz, a member of the CNBC Financial Advisor Council and the CNBC Global Financial Wellness Advisory Board.

The calculus is simple, he said.

Every time you’re paid a dollar, save and invest a percentage toward your “financial freedom,” Klontz said.

With this mindset, “you can work almost any job and retire a millionaire,” he said.

It’s not necessarily a ‘Herculean task’

Saving $1 million may sound like a “Herculean task” but it “might not be as hard as you think,” Karen Wallace, a CFP and former director of investor education at Morningstar, wrote in 2021.

The key is to start saving early, perhaps in a 401(k) plan, individual retirement account or taxable brokerage account, experts said. This allows investors to harness the magic of compound interest over decades. In other words, you “let your investments do as much heavy lifting as possible,” Wallace wrote.

About 79% of American millionaires say their net worth was “self-made,” according to a Northwestern Mutual poll published in September. Just 11% said they inherited their wealth, while 6% got it from a windfall event like winning the lottery, according to the survey of 4,588 U.S. adults, fielded from Jan. 3 to Jan. 17, 2024.

More from Personal Finance:

IRS: There’s a key deadline approaching for RMDs

Egg prices may soon ‘flirt with record highs’

Federal Reserve is likely to cut interest rates next week

There were 544,000 Americans with 401(k) balances of more than $1 million as of Sept. 30, according to Fidelity Investments, which is the largest administrator of workplace retirement plans. There were also more than 418,000 IRA millionaires.

In fact, the number of 401(k) millionaires grew by 9.5%, or 47,000 people, between the second and third quarter of 2024, largely due to stock-market gains.

How to get to $1 million

Wera Rodsawang | Moment | Getty Images

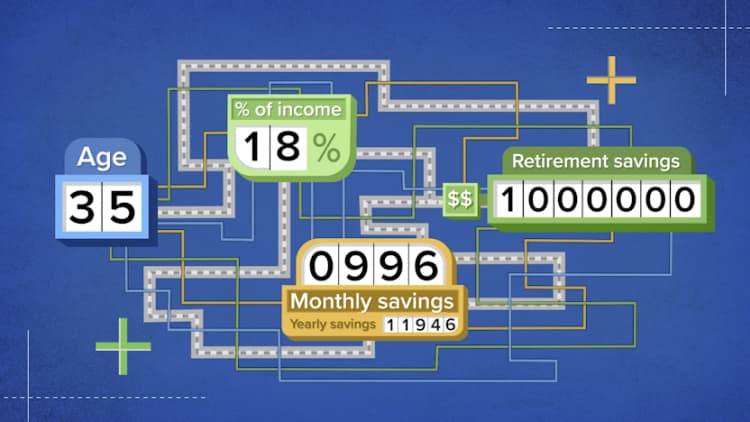

Winnie Sun, a financial advisor, provides an example of the math that links $1 million of wealth with consistent saving.

Let’s say a 30-year-old makes $60,000 a year after tax. If they were to save $500 a month — or, 10% of their annual income — they’d have $1 million by age 70, assuming average market returns of 7%, she said.

This doesn’t account for financial factors that might boost savings over that period, like a company 401(k) match, bonuses or raises.

You can work almost any job and retire a millionaire.

Brad Klontz

financial psychologist and certified financial planner

“In 40 years, you’ll have over $1 million, and that’s doing nothing else but $500 a month,” said Sun, co-founder of Sun Group Wealth Partners, based in Irvine, California, and a member of CNBC’s Financial Advisor Council.

It’s also important to avoid debt, which is probably the “biggest cavity” for building savings, and try not to increase expenses too much, Sun explained.

Timing is more important than being perfect, Sun said.

She recommends starting with a low-cost index fund — like one tracking the S&P 500, which diversifies savings across the largest publicly traded U.S. companies — and building from there.

“Even waiting a year can make a dramatic difference in reaching that $1 million point,” Sun said. “Stop and take action.”

What is the right amount of savings?

Damircudic | E+ | Getty Images

Of course, $1 million in retirement may not be the right amount for everyone.

An oft-cited rule of thumb — known as the 4% rule — indicates a typical retiree can draw about $40,000 a year from a $1 million nest egg in order to safely assume they won’t run out of money in retirement. (That annual withdrawal is adjusted annually for inflation.)

For many, this sum would be supplemented by Social Security.

Fidelity suggests a savings goal based on income. For example, by age 67 a worker should aim to have saved 10 times their annual salary to ensure for a comfortable retirement.

Ideally, households would aim to save 15% to 20% of their income, Sun said. This is a rule of thumb often cited by financial planners.

How much wealth you want — and how quickly you want to be rich — will determine the percentage, Klontz said.

He’s personally aimed for a 30% savings rate, but knows people who’ve shot for close to 90%. Saving such large chunks of one’s income is a common thread of the so-called FIRE movement, which stands for Financial Independence, Retire Early.

How do they do it?

“They didn’t move out of their parents’ house, they minimized everything, they don’t buy new clothes, they take the bus, they shave their head instead of paying for haircuts,” Klontz said. “There’s all sorts of hacks you can do if you want to get there faster.”

How to enjoy today and save for tomorrow

Of course, there’s a tension here for people who want to enjoy life today and save for tomorrow.

“We weren’t meant to only survive and save money,” Sun said. “There has to be that good quality of life and that happy medium.”

One strategy is to allocate 20% of household expenses toward the thing or things that are most important to you — perhaps big vacations, fancy cars, or the newest technology, Sun said.

Make some concessions — i.e., “scrimp and save” — on the other 80% of household costs, she said. This helps savers feel like they’re not reducing their quality of life, she said.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Personal Finance1 week ago

Personal Finance1 week ago