The Internal Revenue Service is adding more features to the Tax Pro Account, Business Tax Account and Individual Online Account, while announcing a new enforcement campaign, even as it faces the threat of major cutbacks under the incoming Trump administration.

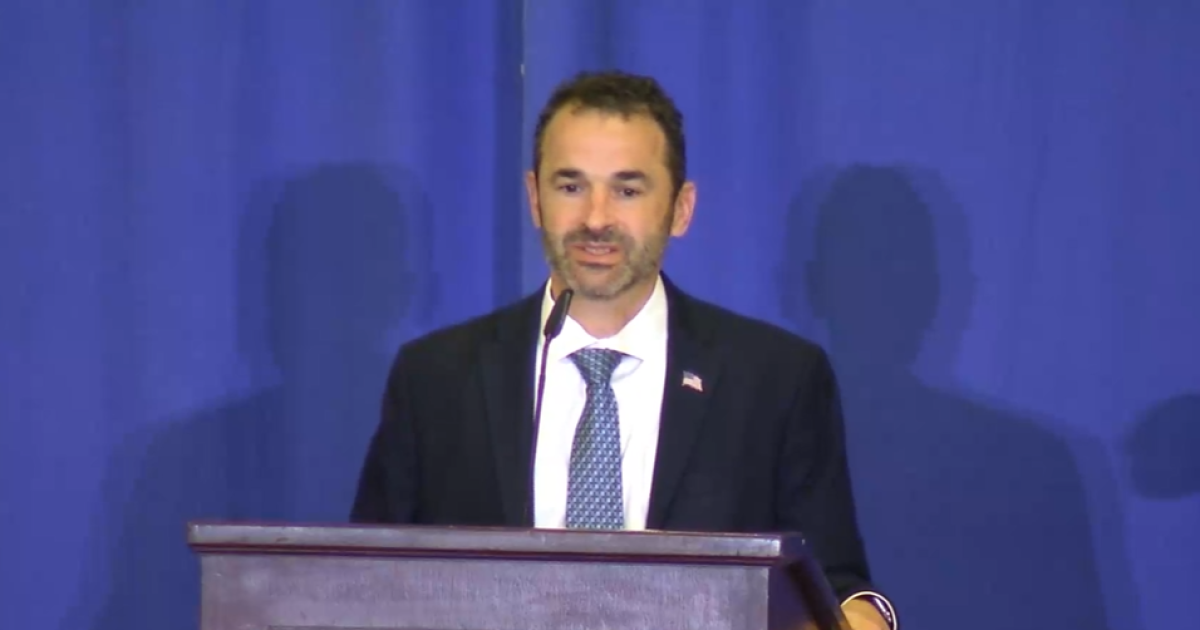

IRS Commissioner Danny Werfel discussed the new enforcement effort and technology improvements during a quarterly update Thursday on the IRS’s strategic operating plan, as he fended off questions from reporters about the future of the agency as it faces the prospect of $20 billion in budget cuts and a new IRS commissioner, Billy Long, who was named by Trump to replace him three years before his term expires.

The Tax Pro Account helps tax professionals manage their authorization relationship with taxpayers, view the taxpayers’ information and act on the taxpayers’ behalf. New features include

- The ability to view individual and business taxpayer payment activity;

- A new virtual assistant that allows tax professionals access to an automated chatbot to resolve tax issues, with the ability to escalate to live chat for help with collection related issues; and,

- The ability to view and act on behalf of individual taxpayers to set up and revise payment plans; and,

- Make up to five same day payments on behalf of authorized clients using a checking or savings account.

“We’ve also made several enhancements to the tax professional online account to expand the work tax pros can do on behalf of taxpayers,” said Werfel. “Tax professionals are vitally important to the nation’s tax system. We have taken some initial steps with this tool. We’ve added the ability for tax professionals to easily navigate secure two-way messaging to digitally communicate with the IRS on behalf of their clients. There is also a new virtual assistant, which allows tax professionals access to an automated chat bot to help them resolve tax issues. Tax professionals can escalate to live chat for collection-related issues for assistance. These are important steps, but we’ve heard from tax professionals, and we know we need to do more with this important tool.”

When fully developed, the Tax Pro Account will become a stronger online tool, including the ability to initiate power of attorney and tax information authorizations for business taxpayers that they can review and approve in their Business Tax Account, link and manage business Centralized Authorization File access, view refund and audit status for individual and business taxpayers and much more.

Business Tax Accounts

As part of its Digital First Initiative, the IRS is expanding the features in Business Tax Account, an online self-service tool for business taxpayers. C corporations can now activate a Business Tax Account, bringing the total number of business entities eligible for this online self-service tool into the millions.

“The IRS has further expanded its Business Tax Account tool to include C corporations,” said Werfel. “That means millions of businesses now qualify to use this self service tool.”

Some of the other recent additions include:

- Authorized individuals of C corporations and S corporations who can legally act on behalf of their corporation are now able to view and pay tax balances and Federal Tax Deposits.

- The IRS also introduced a new feature that helps to speed up the lending process by providing sole proprietors and authorized individuals with access to the long-standing IRS Income Verification Express Service to approve or reject a tax transcript authorization request from a lending company.

- Business taxpayers can now access available tax returns, account and most entity transcripts in Spanish.

“IVES enables sole proprietors and authorized individuals to deal with the tax transcript authorization requests from lending companies, and we are also pleased that the Business Tax Account is now available in Spanish,” said Werfel.

The changes follow upgrades in September enabling business taxpayers to view and submit balance-due payments.

The IRS has also expanded the types of Transcript Delivery System transcripts available to business taxpayers, historically an underserved population. Previously, taxpayers and their representatives had to call to request information not available through a TDS transcript. Customer service representatives would provide an internal print with the requested information, manually masking the personally identifiable information before providing the prints to the caller. Masking the transcripts was time consuming. Now taxpayers and their representatives can access these new transcripts through online self-help tools that include Business Tax Account and e-Services TDS.

Business Entity and Form 94X Series Tax Return transcripts are now available through TDS for tax professionals and reporting agents with access to TDS through e-Services. IRS employees can access these transcripts through the Employee User Portal, and authorized users of Business Tax Account can download these transcripts. Transcript expansion will continue in a phased approach through December 2026. Future releases will include the Form 990 series, Form 1041. Form 2290, Form 1042 and Form 706. And transcripts in Spanish.

Individual Online Accounts

Taxpayers can also get more help for their personal accounts through the IRS Individual Online Account, Werfel noted. “For example, they can retrieve tax related information from a single source, including digital copies of notice and letters,” he added. “We have redesigned 247 of the most common notices, all of which are now available in the Individual Online Account. They can see their refund status and check updates on certain audits. They can access a complete overview of their account information, including detailed historical data. This is extremely helpful for people to have at tax time and throughout the year. They can access Identity Protection Services and a lien payoff calculator, and those who need help with a tax bill can apply for an installment agreement more easily by using smartphones or tablets.”

The online accounts are not the only way the IRS is helping to provide a better digital experience, he added. “Taxpayers now have access to more than 60 mobile adaptive forms, allowing them to fill out common tax forms on cell phones and tablet devices and then submit them to the IRS digitally,” said Werfel. “The three most recent forms feature save and draft capabilities, which allow taxpayers to start a form, save it and return to it later.”

Enforcement campaign

Werfel also discussed the launch of a new enforcement campaign at the IRS aimed at improving taxpayer compliance among those with complex returns and those who intentionally evade tax responsibilities.

One of the issues the IRS is targeting involves the exploitation of deferred legal fees. The IRS has begun an examination campaign to address a tax deferral transaction where taxpayers, specifically plaintiff’s attorneys or law firms, fail to report legal fees earned from representing clients in litigation on a contingency fee basis.

The IRS noted that plaintiff’s attorneys or law firms representing clients in lawsuits on a contingency fee basis can receive up to 40% of the settlement amount that they then defer by entering an arrangement with a third party unrelated to the litigation, who then may distribute to the taxpayer in the future; generally, 20 years or more from the date of the settlement. The taxpayer fails to report the deferred contingency fees as income at the time the case is settled or when the funds are transferred to the third party. Instead, the taxpayer defers recognition of the income until the third party distributes the fees under the arrangement.

The goal of the new campaign is to ensure taxpayer compliance and consistent treatment of similarly situated taxpayers which requires the contingency fees be included in taxable income in the year the funds are transferred to the third party.

The IRS is also staying focused on offshore tax evasion through unreported financial accounts and structures, employing data analytics and other tools to spot various forms of offshore tax evasion. The agency is also encouraging whistleblowers to come forward and report on offshore tax evasion and other tax schemes by filing a whistleblower claim. The IRS pays awards to eligible individuals whose information can be attributed to taxes and other amounts collected. In fiscal year 2024, the IRS paid awards totaling approximately $123 million based on tax and other amounts collected of approximately $475 million attributable to whistleblower information.

“Our compliance work is protecting billions of dollars of revenue by enforcing laws already on the books, and we’re cracking down on terrorist financing and drug dealers through IRS Criminal Investigation’s work,” said Werfel. “The momentum from this historic work at the IRS is real, and we’re continuing to build on these successes month after month. We still have a long way to go to deliver the IRS the taxpayers deserve. But I firmly believe the agency is on the right path, and the agency is well positioned for continued modernization efforts, including those from the incoming administration.”

IRS Criminal Investigation

On the compliance front, IRS Criminal Investigation agents helped deliver convictions in several high-profile criminal cases, resulting in the recovery of billions of dollars and long prison sentences for dangerous criminals, he noted.

The IRS has now recovered $4.7 billion from new initiatives underway during the period of its strategic operating plan, he added. “We have recovered $2.9 billion related to IRS Criminal Investigation work into tax and financial crimes, including drug trafficking, cyber crime and terrorist financing, and another $475 million in proceeds from criminal and civil cases,” said Werfel.

The $4.7 billion figure also includes more than $1.3 billion from high income, high wealth individuals who have not paid overdue tax debts or filed tax returns.

The IRS Criminal Investigation Division has worked on cases covering terrorist financing and drug trafficking, Werfel noted. These cases include an 18-year sentence for a fentanyl trafficker for attempting to support terrorist activity connected to ISIS. In two other cases, IRS CI efforts played a part in a nearly 20-year sentence for one drug dealer and netted nearly four years for another.

Werfel also provided some updates on the IRS’s work on high income nonfilers who have not filed tax returns since 2017. The IRS has now collected $292 million from more than 28,000 nonfilers, an increase of $120 million since September.

“These are cases where the IRS has received third-party information, such as Forms W-2 and 1099, where we see people receive income from between $400,000 and $1 million, and in some cases more than $1 million, but failed to do their basic civic duty under the law to file a tax return,” said Werfel. “This is an important effort. The nonfiler program ran sporadically since 2016 due to severe budget and staff limitations that did not allow these cases to be pursued. With additional funding, the IRS had the capacity to resume this core tax administration work earlier this year.”

Improving taxpayer service

Werfel believes it’s crucial to improve IRS technology, provide new tools, add more efficiency and continue the agency’s work on taxpayer service.

“At the same time, we remain focused on improving taxpayer services and advancing our monetization efforts,” said Werfel. “Our work in these areas has made a world of difference for taxpayers during the past two tax seasons, and we believe taxpayers will continue to see benefits of our modernization work as we head into the 2025 filing season.”

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Personal Finance1 week ago

Personal Finance1 week ago