Two New York Republican lawmakers promised to block their party’s signature tax legislation unless GOP leaders raise a proposed $30,000 limit on the federal income tax deduction for state and local taxes.

Their public declarations on Monday shortly after House Republicans released a draft version of their tax bill underscores the difficulty party leaders will have securing passage as lawmakers from high-tax states demand greater increases in the SALT limit, politically vulnerable Republicans chafe at Medicaid cuts and fiscal conservatives press for more spending reductions.

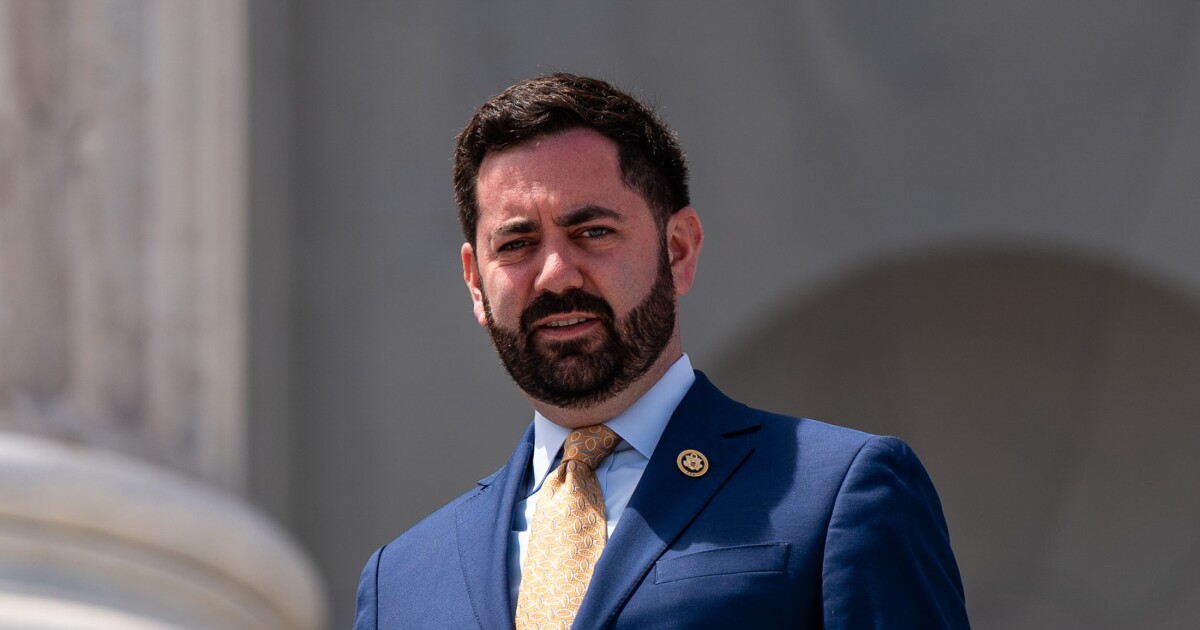

Representative Mike Lawler, a New York Republican, called the proposed SALT limit “woefully inadequate” and said in a Bloomberg Television interview he is a “hard no” on the legislation unless the cap is increased.

Nick LaLota, another New York Republican, said he was “insulted” by the limit and would be a “hell no” vote against it.

Three other Republicans — New York’s Andrew Garbarino and Elise Stefanik and Young Kim of California — have previously rejected a $30,000 SALT cap, calling it insufficient and saying they would vote against a bill including such a limit.

The House tax committee’s draft bill to renew President Donald Trump’s 2017 tax cuts also would impose a new income limit on the deduction, phasing it out for individuals earning more than $200,000, or married couples earning more than $400,000.

That’s just a fraction of what SALT advocates in the House want, LaLota said. A group of lawmakers — largely from New York, New Jersey and California — most committed to expanding the tax break want a $62,000 deduction cap for individuals, or twice that for couples, the person said. They also demand those levels be indexed for inflation in future years, and that the higher limits are available for taxpayers starting in 2025.

House Speaker Mike Johnson told reporters Monday shortly before the draft legislation was released that no final SALT limit had been set yet. The House Ways and Means Committee is slated to debate the legislation Tuesday and party leaders could modify it at any point before a House vote.

“There were lots of numbers discussed,” Johnson said, following a meeting with lawmakers concerned about the tax break.

The draft legislation caps the SALT limit at $30,000 for both individuals and married couples, up from the current $10,000 limit imposed in the 2017 law. Prior to that law, there was no limit on the deduction and without new legislation the limit would automatically be removed when the 2017 law expires at the end of the year.

The SALT issue has been one of the most contentious for the House GOP to resolve as party leaders try to ram a multitrillion-dollar tax cut package through the House in May. The larger the cap adjustment is, the less money there will be for other tax cuts on the Republican agenda.

House Republicans are trying to keep revenue losses from their tax cut package down to a self-imposed limit of $4.5 trillion. They are also aiming for $2 trillion in spending cuts.

The ceiling must accommodate a nearly $4 trillion extension of the expiring 2017 Trump tax cuts as well as new cuts to taxes on tips and overtime. Republicans also want new tax breaks for seniors, car buyers and businesses building factories in the U.S.

Blog Post3 days ago

Blog Post3 days ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Accounting1 week ago

Accounting1 week ago

Economics7 days ago

Economics7 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance7 days ago

Finance7 days ago