Accounting

Practice Profile: Dreaming up a better tax season

Published

6 months agoon

Accounting firm ASE Group does not do taxes on April 15, and its employees don’t work Fridays.

That’s the vision founder Al-Nesha Jones conjured up when she asked herself: “What would tax season look like if we had our way?”

Flexibility was a foundational principle for Jones in establishing her New Jersey-based practice in 2016, after she felt rushed back to work at her corporate job following maternity leave.

tamara fleming photography

By the time the pandemic hit four years later, Jones and her fully remote team of four had already mastered the new working models that COVID would normalize, but that period also inspired her to expand the practice from pure tax preparation to full-service accounting.

“We were catering to client needs — whatever brought the money in,” Jones recalled. “We didn’t get serious about [expanding] until the pandemic, when we realized people wanted more. Providing tax prep work was not enough. In a short period, people became day traders, moved out of state … We needed to pivot in the way we operated. We now offer a full-service solution to clients — accounting, tax prep, advisory. It entirely changed how we feel about the profession, how busy season feels. All good changes came out of it.”

However, Jones acknowledged, there was one bad change: having to cut the clients that did not align with the pivot.

“We like to think of it as finding a place that’s a better fit for them,” she explained.

The firm currently serves about 150 clients — specifically individual small-business owners who live or work in New Jersey, New York or Pennsylvania and are sole proprietors or single-member LLCs — though ASE is “slowly working [its] way down to 100.”

Jones exercises empathy in letting these clients go, explaining that the firm has outgrown their more simple service requirements. “We give them plenty of time to evaluate their options,” she said. “When we are parting ways, we don’t say, ‘You can’t stay anymore,’ we give a one-on-one explanation that, ‘You’d be a one-off to us, and that’d be a disservice to you.”

Jones also gives departing clients references to other accountants that specialize in their industry, with the caveat that ASE gets no commission, and they should do their own due diligence.

“We felt better not just sending them out in the wild,” she said, adding that these conversations often happen right after tax season, “so they have six-plus months to seek another accountant. We also provide one hour of transitional services at no additional charge. We gather documents; we are happy to do that at no additional fee. The intent is to not make it any more difficult than it needs to be. I’m training

my own brain: This is better for everyone. We do what’s best for them, and better for us also. Better for both parties. We get the capacity back to serve the clients we’re best equipped to serve.”

What Jones has also found to be universally beneficial is her team’s four-day work week. While her staff is all women, Jones said that it just “sort of worked out that way” after the interviewing process yielded women (and mothers) as the best candidates.

“What I love about working with moms is they tend to get it done, with an any-means-necessary attitude,” Jones shared. “I don’t condone an environment where you burn yourselves out. Moms are creative in their solutions and pivot well. This team adjusts quickly to change.”

No-email Fridays

It was Jones’ own adjustment period, launching her firm with a newborn in tow after she “didn’t want to be rushed back to work sooner than ready” in her prior job, that inspired her team’s flexibility.

In April 2016, she started renting an office with a security deposit and a promise to the landlord that, although she didn’t currently have the first month’s rent, she soon would.

That June and July, she started paying for the office space in the building where ASE Group still resides, though she is the only one of her virtual team who comes in.

“In the first 20 months of running the business, I was bringing my daughter to work two to three times a week,” Jones shared. “I was on meetings with her, Zoom calls; I nursed during meetings. In hindsight it sounds crazy.”

Jones’ philosophy of balancing work and personal life persists in the way her firm supports colleagues who “all prioritize family,” whether that’s a sick child or caring for a parent, as long as staff is accountable and takes care of their work. Productivity is also expected in ASE’s shorter work weeks, which were born out of COVID.

“With so much going on, as a mom of three children, with remote learning, a husband working from home — it was a challenging time to take a small breather… I felt so unbalanced working five to six days a week,” she explained.

“I explored four-day work weeks during the summer to see how clients would adjust,” she continued. “They were the easiest. Then to see how we adjust. What efficiencies of a normal work day can get done in four days instead of five days. I absolutely work some Fridays because of travel and school schedules. But we schedule no meetings or calls on Fridays, with no exceptions.”

While employees can of course still get work done as necessary, instituting the no-email and no-calls rule is so staff “don’t create unnecessary expectations,” Jones explained. “Friday is all of our days off — no one sends messages to anybody. You get to enjoy your Friday off.”

Both this policy and ASE’s mandate to get clients’ tax preparation work done well before the Internal Revenue Service deadline requires planning and adjusting client messaging.

“We revamped the process and changed the way we communicate with clients,” Jones said. “We had to start from scratch and reverse-engineer how it would work. It started with what we wanted it to look like, not the systems or software, but blue-sky thinking, what tax season would look like if we had our way. What it would look like was: no surprises, talking to clients during the year. We talk to clients at least four times a year. We call 30 days before the estimated tax deadline.”

ASE Group works under internal deadlines. “We don’t care about the April 15 deadline for tax,” Jones said. “We only operate under our own deadlines, which tend to be at least two weeks before external deadlines. If, God forbid, we can’t meet internal deadlines, we can breathe easy with a buffer in place.”

ASE staff meet these self-imposed deadlines with more frequent client communication and weekly team calls internally.

Jones said it’s OK if two or three clients end up falling closer to the April or October deadlines, but “if half of clients go on extension or wait until October, there’s panic. It doesn’t have to be that way, and if the client likes to operate like that, it’s not a good fit.”

Advisory is the cure

Jones was not even sure the accounting profession was a fit for her until she participated in the Goldman Sachs 10,000 Small Businesses program and learned to conceptualize a new future for her career.

“I was thinking, ‘I’m not a good accountant, I can’t do this, it’s way too stressful,'” she explained. “It was realizing it’s not tax I hated, but the constant working toward deadlines, doing things last minute, all a surprise. But it’s not. It’s one of the easiest, most predictable industries. You can plan due dates. Operating with blue-sky thinking, I could step away from what I’m doing now, and it taught me what it could be like and how to make that a reality.”

ASE Group’s lower-stress tax seasons involve scheduled phone calls to check in on clients’ current financial needs and lean more into the advisory side of tax planning.

“What you need first, is advisory all throughout the year,” she said. “So that at the end of the year it’s not a pop quiz — what am I going to do on my taxes? It doesn’t have to be a surprise. I hate delivering bad news, and I also hate surprises. It’s like Groundhog Day, telling people [what to do on their taxes] … having the same conversations over and over again. People expected that they did all they needed all year, then dump it on their accountant. I’m not a magician. I felt so anxiety-ridden. The cure for that suffering is advisory.”

ASE’s regular client calls — scheduled six months out — also alleviate other common ailments, like financial anxiety and procrastination.

“It’s getting us in the position to help them reduce surprises,” Jones explained. “By the time tax season rolls around, it’s just filing season. Not strategizing season, not planning season. When a child has a test, like the SATs, they don’t show up on test day ready to study. When they show up to the test, they make sure they had a good night’s sleep, they ate breakfast, and they sharpened their pencils. All year is study season.”

The phone calls are mandatory, whether or not clients have updates. “Some clients don’t have anything new to tell you. Those clients don’t have to use all the time — if they get on the phone and tell me absolutely nothing … I’m happy to end the phone call early. The beauty is creating a routine, the consistency of it.”

Often, however, clients who think they have nothing new to report realize that they do when Jones and her colleagues engage them in more casual conversation leading to relevant life updates.

“Sometimes they struggle with financial anxiety, and don’t always want to tell you things aren’t great,” Jones shared. “The conversation is relaxed, and those conversations become more fluid and open.”

“We don’t want you to go on Google and Tiktok trying to be your own advisor,” she continued. “We ask that you allow us to prepare you for what creates an issue versus what doesn’t. We are talking in conversations about kids, family trips. In those conversations we have an agenda of listening to what they are saying … . If [for example] they are thinking of starting a new job, ‘We can help you complete a W-4.’ Something we can support you in.” AT

You may like

Accounting

Remaking the partnership model for young accountants

Published

15 minutes agoon

June 9, 2025

I am optimistic about the “trusted advisor” destination that the accounting profession has marked as its territory, but skeptical of the partnership model as a means of transportation to that promised land. Why? It has to do with young, talented people in public accounting, and the choices that I see them make when they are equipped with complete information.

In growing my firm, Ascend, over the last two years, I have invested thousands of hours in conversation with managing partners and executive committees. During these discussions, I have heard many firm leaders that I admire advocate on behalf of their brightest young people: “Lisa is a rockstar … how is partnering with you going to be better for her?”

I have likewise sat in conferences where industry thought leaders proclaim private equity as “the best thing that could happen to young people;” from eyeballing it, the median age in those rooms approached 60! It is encouraging that rising stars of my generation have collectively become the object of deep concern and spirited debate as the profession learns to surf a wave of capital that is challenging tradition, but frankly, it is a shame that young leaders often lack access to the context that would allow them to form their own view and participate in conversation directly.

That needs to change. So, “Lisa,” if you are out there, I am speaking directly to you. You and other young, talented people of our generation need information to plan for your own future, not a scripted ending penned by someone else with positive intent. Getting up to speed involves confronting the challenges of the partnership model, building awareness of alternatives, and thinking about how you should engage in discussion, once you feel informed. Here’s a crash course.

What is happening to the partnership model?

To start, ownership in a CPA firm is more expensive today than it ever has been. There is more than $15 billion of private capital (more than 1x revenue for the remaining, independent G400) that has decided an ownership stake is worth more than what your firm’s partnership agreement says it is.

The offer on display from smart money is tempting — access to liquidity much sooner, with better tax treatment, and the chance for “multiple bites at the apple,” with resources to fuel future value creation. While a growing list of firms have opted into that deal, others still have chosen to hold steady to independence; in doing so, fiercely independent firms are beginning to reprice their partnership agreements to bridge this widening gap between the market valuation of a CPA firm and the discount that has historically been used for internal succession.

What does that mean for you? Partner buy-ins will become more expensive and look-back provisions that allow retired partners to eat into a future sale of the firm will become more common. Young people, your partnership may persist, but the older generation isn’t going to cede all surplus economic value to you forever. It is going to cost more to become an owner, and you need to be prepared for that eventuality.

At the same time, maintaining independence is getting costlier. Independence has long been a virtue of our profession, but make no mistake, it has never been free — growth, fueled by a strong value proposition to clients and employees, is what has propped up the independent partnership model as a way of serving others, organizing talent, and creating wealth for many generations.

Historically, this has taken periodic reinvestment to sustain — hiring talent from competitors before clients follow; putting up working capital to tuck in a new firm; sampling a la carte technology products like SafeSend and Aiwyn that hit the market. Sadly, this window-shopping pace of reinvestment is not going to cut it anymore. Our profession is navigating a rapidly changing backdrop, which is calling for expensive, transformative change in a compressed period.

Here’s what I mean: If you take the time to forecast the next 10 years of public accounting supply (i.e., credentialed CPAs in America) and demand (i.e., U.S. total addressable market), the well-documented conclusions are:

- 75% of today’s CPAs will have retired in the next decade; and,

- Revenue per CPA is projected to 2.7x during that period, because new entrants are declining.

That alone is the most precipitous change in labor dynamics since these statistics have been tracked. What is less covered, but equally important, is that 10 years from now, more than 85% of CPAs in America will have less than 10 years of experience. Think about that: We need to achieve a 2.7x growth in personal productivity, with nine in 10 professionals having less than a decade of experience. What does a 10-year person do in your firm today? Can they drink a tsunami from a fire hose?

It all begs the question of how firm leaders are going to respond to this market-driven reality. Build a global team that can go toe to toe with U.S. CPAs on technical expertise and client service? Automate away half our billable hours? Rebuild a professional development curriculum with “Lean” manufacturing principles to cut partner cook time from 20 years to 10? All the above?

It can be done, and the market share opportunity for firms that do this successfully is hard to overstate, but these initiatives take many millions of dollars to pursue, functional expertise to get right, and deep commitment to test, learn and, ultimately, produce results.

If you are on the outside of a partnership looking in, take a step back with clear eyes and you’ll see that you are being taxed twice for entry: once to purchase your ownership stake relative to its historical cost, and once more to make investments in your firm that are greater than ever before required, at a pace that’s unprecedented, without a guarantee of paying off.

There are some important questions to ask as you take stock of this reality: Have you talked about how much this will cost? Would your firm be effective at deploying the money you choose to set aside? Will today’s senior partners share in the cost with you, and start now? Are you willing to spend the money for the chance of an ordinary income payout between ages 65 to 75, at a discount to the then-market price? Given how these trends affect your ability to win talent, how will you guarantee that someone will stand behind you in 25 years to make the same bet you are making today?

These questions should be discussed broadly. You may have satisfying answers, but to make forward progress as a firm, your partner group must agree with you, and there is no time to waste.

What is the alternative?

If you don’t want to merge your firm into another, the primary alternative to going it alone is to trade in the keys to your unfunded partnership for private equity backing. To offer a pithy comparison, partnering with private equity has several advantages relative to your status quo:

- Important investments are made with other people’s money;

- Corporate governance permits faster decision-making at a moment where pace matters;

- The economic model is more efficient, and can be more generous: equity participation happens earlier; ownership always trades at a market price; liquidity is more frequent and tax-advantaged;

- All of this done right creates a better place to work, and the flywheel turns; and,

- Other industries show us that the flywheel can turn indefinitely.

And yet, these easily understood benefits are subject to valid lines of inquiry from those peering in:

- If ownership changes hands frequently, who is to say the ride will be smooth?

- Are incentives aligned in a way that upholds quality standards?

- How should I sort through all the different forms of private equity that exist (local equity versus parent equity; minority versus majority, dealing with PE directly versus through an operating company like Ascend; etc.)?

All good questions, especially because not all private equity is created equally. These pros and cons can only be weighed appropriately through education, and there would be much more to discuss.

Where to go from here?

Get your seat at the table. My purpose in writing is not to drive you to a specific conclusion, but instead to give you the context needed to form your own.

If you are on a path to becoming an owner in your firm, you are committing (consciously or not) to what is becoming one of the more expensive investments in the U.S. economy. I understand how busy practitioners are, but it is worth knowing if you are positioned to realize a return on that investment via the partnership model.

You can do that by:

- Demanding clarity on your firm’s direction;

- Seriously assessing the “how” behind the vision that is shared with you; and finally,

- Encouraging leadership to explore options, which I have found to sharpen thinking regardless of a firm’s ultimate decision around go-it-alone versus sponsorship.

Our generation is the one that will navigate this sea change in public accounting. Create the time to underwrite your future and make your opinion known.

Accounting

Boomer’s Blueprint: 4 ways algorithms can improve your accounting firm

Published

46 minutes agoon

June 9, 2025

As CPA firms grow into the $10 million to $100 million revenue range, operational complexity increases, especially during peak periods like tax season. Leadership must prioritize strategies to reduce friction, improve efficiency, and enhance the client and staff experience. Algorithms, defined as systematic processes designed to solve specific problems, are a key enabler in achieving these goals.

By automating repetitive tasks, algorithms can save hundreds of hours during the busiest times, allowing staff to focus on high-value activities and improving client satisfaction.

Four specific examples of areas where algorithms can help firms are described below, but no matter the area, adopting algorithms requires deliberate planning and execution:

1. Identify opportunities

- Assess pain points in tax, audit, scheduling, and advisory workflows.

- Identify routine tasks that consume excessive time during peak periods.

2. Gather and analyze data

- Evaluate the availability of client and internal data to support automation.

- Determine additional data needs and acquisition strategies.

3. Experiment and iterate:

- Pilot small-scale solutions, such as automating a single tax form process or scheduling tool.

- Refine based on results and user feedback.

4. Scale and integrate:

- Implement successful pilots across teams or departments.

- Provide staff training to maximize adoption and effectiveness.

5. Measure and optimize:

- Use key performance indicators such as time savings, error reduction, and client satisfaction to assess the impact.

Quick wins for immediate impact

To build momentum, start with high-impact initiatives:

- Tax workflow automation: Automate the completion, e-signature, and filing of forms like 8879 and 4868, and notify clients of estimated tax payments due via an automated communication system.

- Audit data preparation: Use algorithms to download client data, generate trial balances, and perform risk analysis.

- Scheduling optimization: Implement an algorithm-driven scheduling tool to automate meeting coordination, resource allocation, and deadline tracking.

Conclusion

Algorithms are transformative tools that empower CPA firms to operate more efficiently while delivering enhanced value. By automating routine tasks in tax, audit, scheduling, and advisory services, firms can save significant time, improve accuracy, and foster stronger client relationships. The key to success lies in adopting a strategic roadmap — identifying opportunities, running experiments, and scaling solutions. Mindset is paramount.

For CPA firms navigating the challenges of growth and complexity, algorithms represent a critical investment in operational excellence, enabling staff to focus on what truly matters: delivering exceptional client experiences. Think — plan — grow!

More than two-thirds (70%) of U.S. audit clients are ready to change firms within the next three years, according to a new report.

Inflo’s “Creating a New Audit Experience for U.S. Businesses”

Clients with the most employees (250 employees or more) were the highest to report it was “very likely” they would switch firms. Meanwhile, clients with fewer employees (less than 50 employees) were the highest to report it was “very unlikely” they’d switch firms.

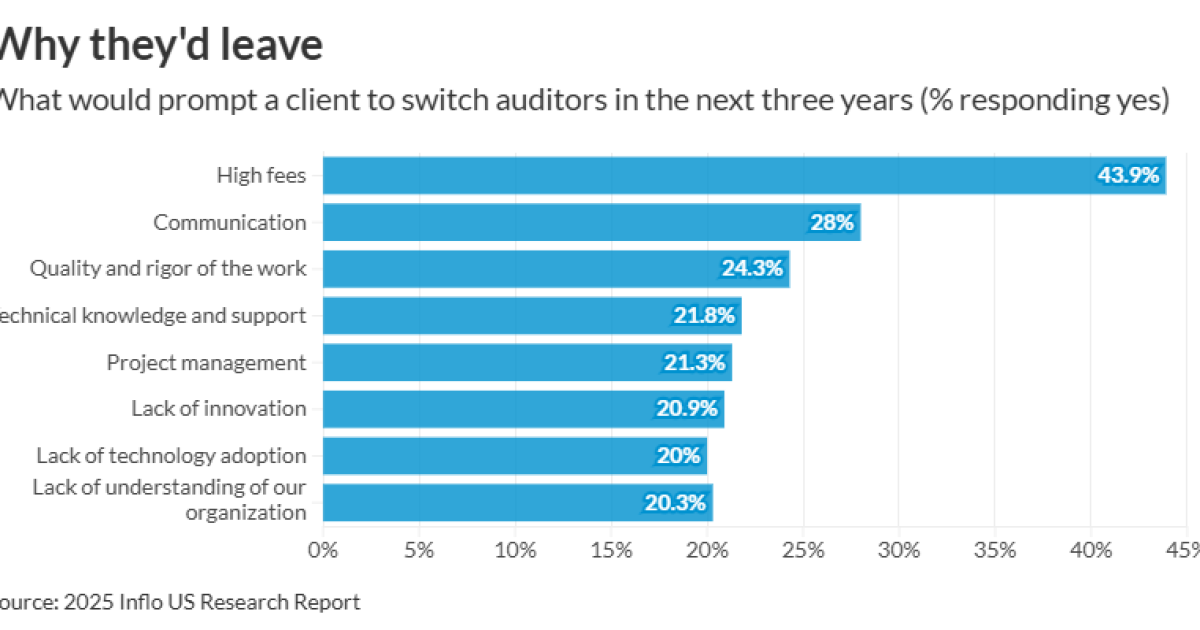

By far the most common reason causing a client to look for a new firm was high fees (44%). When asked how much more clients would be willing to pay for an audit that “gave you more value,” respondents answered 5-10% more (33%), 11-20% (31%) and 21-30% (14%). Five percent of respondents answered “nothing.”

Subsequently, clients said the leading factors influencing their decision to accept or resist fee increases were perceived value and quality of service (42%), relationship with the audit firm (40%), meeting deadlines (39%), level of justifications and transparency regarding an increasing (35%), responsive communication (35%) and the frequency of previous fee increases (34%).

(Read more:

The second most common reason causing a client to switch auditors was communication (28%), followed by quality and rigor of the work (24%), technical knowledge and support (22%), project management (21%), lack of innovation (21%) and lack of technology adoption (20%). Sixteen percent of respondents reported, “We are not experiencing any issues.”

“This research makes one thing clear: U.S. businesses are demanding a better audit experience,” Inflo CEO Mark Edmondson said in a statement. “From high fees based on outdated pricing models to technology that hasn’t changed since the 1990s, the approach of many audit firms is driving business away.”

Additionally, nearly half of respondents (45%) said they’d like auditors to improve on the use of technology to add more value to their audits, followed by the time needed from their team and insights on their organization (38% each).

“The good news is that clients care about their audits. They want them to play a key role in driving operational improvement and consistent business growth,” Edmondson said. “Audit firms that act on the report’s findings will be rewarded with rising fee incomes and a continually growing client base.”

Walmart taps own fintech firm for credit cards after Capital One exit

Remaking the partnership model for young accountants

Boomer’s Blueprint: 4 ways algorithms can improve your accounting firm

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Blog Post1 week ago

Blog Post1 week agoCommon Bookkeeping Challenges and Solutions for Small Businesses

-

Economics1 week ago

Economics1 week agoWhy the president must not be lexicographer-in-chief

-

Finance1 week ago

Finance1 week agoThis is why Jamie Dimon is so gloomy on the economy

-

Accounting1 week ago

Accounting1 week agoSteinhoff fraud trial moved to South Africa’s high court

-

Personal Finance7 days ago

Personal Finance7 days agoWhat the national debt, deficit mean for your money

-

Personal Finance1 week ago

Personal Finance1 week agoHow to save on summer travel in 2025

-

Personal Finance1 week ago

Personal Finance1 week agoDenmark raises retirement age to 70; U.S. might follow

-

Finance1 week ago

Finance1 week agoWhy JPMorgan hired NOAA’s Sarah Kapnick as chief climate scientist