Economics

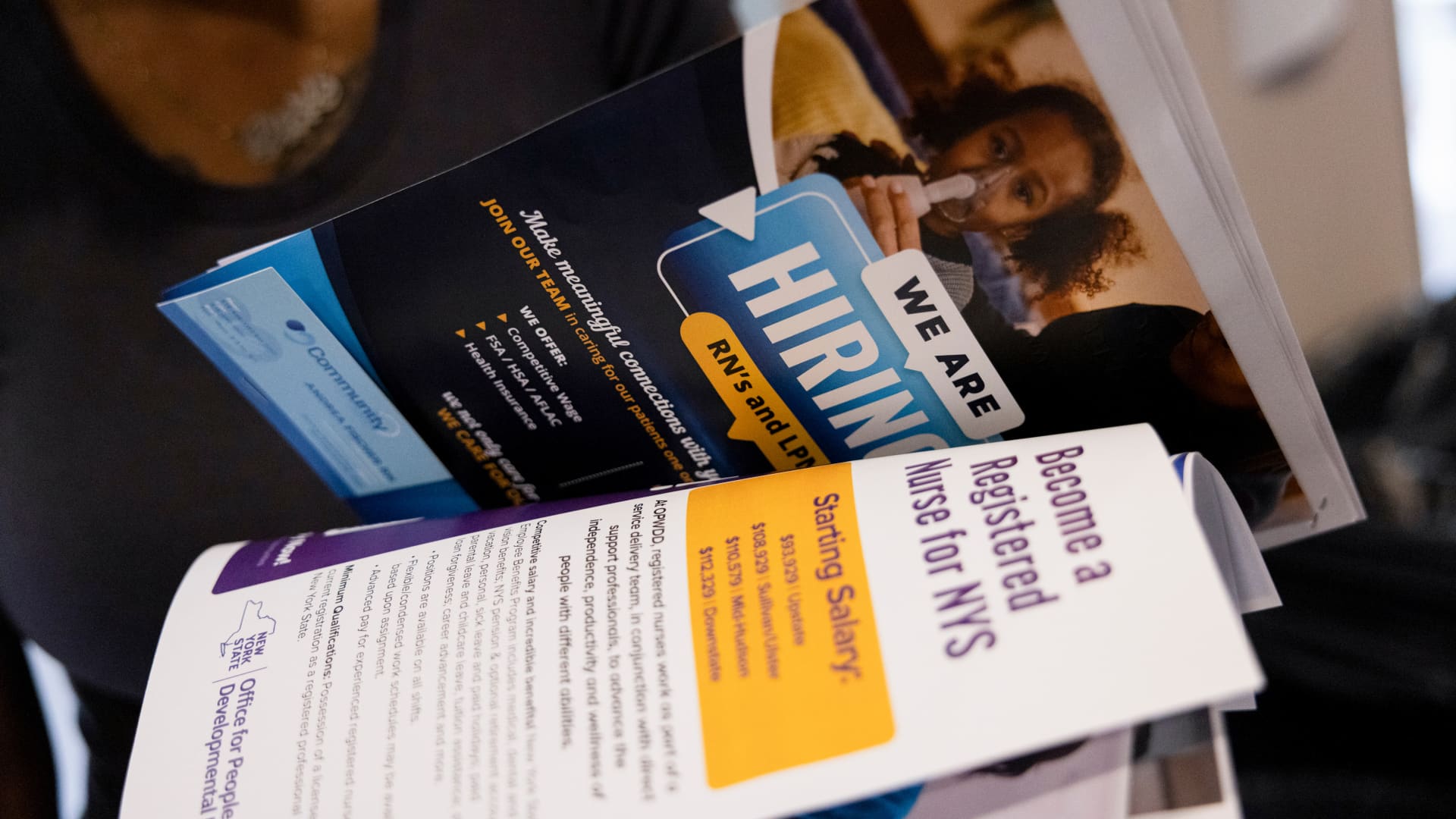

Private payrolls grew by 146,000 in November, less than expected, ADP says

-

Finance1 week ago

Finance1 week agoPersonal finance app Monarch raises $75 million

-

Blog Post1 week ago

Blog Post1 week agoHow to Implement Internal Controls to Prevent Business Fraud

-

Personal Finance1 week ago

Personal Finance1 week agoHow appealing property taxes can benefit new homeowners

-

Personal Finance1 week ago

Personal Finance1 week agoHow to pay college tuition bills with your 529 plan

-

Economics1 week ago

Economics1 week agoTrump greenlights Nippon merger with US Steel

-

Economics5 days ago

Economics5 days agoHow young voters helped to put Trump in the White House

-

Economics1 week ago

Economics1 week agoMAGA: protecting the homeland from Canadian bookworms

-

Accounting4 days ago

Accounting4 days agoHighest paid jobs in corporate accounting