Accounting

Tax Fraud Blotter: Incorrect positions

Published

9 months agoon

On ice; the end of the beginning; Speed trap; and other highlights of recent tax cases.

Miami: A federal court has issued a permanent injunction against tax preparer Richard Louis that bars him from preparing federal income tax returns, working for or having any ownership stake in a tax prep business, assisting others (including family members) prepare returns or setting up business as a preparer and transferring or assigning customer lists to any other person or entity.

In June, the court enjoined seven independent contractors who worked with Louis — Harold Bornelous, Romeo Davis, Teddy Davis, Joseph Garrett, Demetrius Knowles, Daniel Oku and Marlyne Wah — from preparing returns for others but allowed them to apply for reinstatement after two years if they successfully complete the IRS Annual Filing Season Program. The contractors agreed to the injunctions.

The complaint alleged that Louis and the seven contractors prepared returns that claimed various false or fabricated deductions and credits, including fabricated residential energy credits, false and exaggerated itemized deductions, and fictitious and inflated business expenses. According to the complaint, Louis marketed himself as Taxman and he with the seven contractors prepared thousands of returns for clients over the past 10 years.

The court also ordered Louis to disgorge $390,000 from the scam that he’d received from his prep business. He agreed to both the injunction and the disgorgement.

Moon Township, Pennsylvania: Business owner Albert Boyd Jr. has pleaded guilty to willfully filing a false return.

For each year from 2017 to 2022, Boyd failed to report income from his company, Boyd Roll-Off Services, on the business return, causing a total tax loss of at least $1,030,000.

Boyd ensured that much of the company’s income from the sale of scrap metal went unreported by causing cash proceeds not to be deposited in the business bank account and causing checks to be deposited into accounts other than the business bank account. Boyd then failed to provide his tax preparer with records relating to the undeposited cash and diverted checks.

Sentencing is Dec. 17. He faces up to three years in prison and a fine.

Des Moines, Iowa: Businessman Mark Francis Davidson, 66, formerly of Adel, Iowa, has been sentenced to 18 months in prison for filing a false income tax return.

Davidson is the majority shareholder of Collegiate Concepts Inc., which rents dorm minifridges to colleges and college students. From 2015 to 2021, Davidson diverted more than $3.8 million from the corporation to himself and failed to report this income to the IRS. Davidson concealed these payments from the corporation’s accountant and tax preparer by providing check ledgers that falsely identified checks from the corporation to Davidson as legitimate business expenses.

After his imprisonment, Davidson will be on supervised release for a year. He was also ordered to pay $1,449,620 in restitution to the IRS and a fine of $20,000.

Frankfort, Illinois: Jeremiah Johnson, owner of three local childcare and transportation businesses, has been sentenced to a year and a day in prison for underreporting more than $1.47 million in income.

Johnson owned New Beginnings Academy, New Beginnings Child Development and Epic Transportation. From 2015 to 2020, he obtained more than $1.47 million of income from the operation of those businesses but failed to report the money on his individual returns, instead reporting lesser W-2 wages and some rental income.

During the same period, Johnson also failed to file corporate returns or pay any of the required employer and employee withholdings for federal income tax, Social Security tax and Medicare.

Johnson, who pleaded guilty earlier this year, was also fined $10,000 and ordered to pay $123,391 in restitution to the IRS.

Wilmington, North Carolina: Businessman George William Taylor Jr. has pleaded guilty to not paying more than $2 million in employment taxes and not filing employment tax returns.

Taylor owned and operated National Speed, a service business for high-speed automobiles. He was responsible for withholding Social Security, Medicare and income taxes from employees’ wages and paying those taxes to the IRS. From 2014 through 2021, Taylor withheld the taxes but did not pay those withholdings over to the IRS, nor did he file the necessary employment returns. During the same period, he also did not pay the employer’s share of those taxes to the IRS.

In total, Taylor caused a federal tax loss of $2,272,072.

Sentencing is Nov. 19. Taylor faces up to five years in prison, as well as a period of supervised release, restitution and monetary penalties.

Cincinnati: A U.S. district court has issued a permanent injunction against tax preparer Emmanuel Antwi and his businesses.

Antwi and his businesses, Manny Travel Agency & Business Services Inc. and Manny Financial, Insurance & Accounting Firm LLC, consented to the injunction, which permanently bars them from preparing federal returns for others. The United States’ claim demanding that Antwi turn over ill-gotten gains he received in tax prep fees remains pending.

According to the civil complaint, since at least 2020 Antwi filed hundreds of returns each filing season with at least 95% of the returns claiming a refund. Allegedly, Antwi knowingly took unreasonable or incorrect positions on returns he prepared that resulted in understatements of the tax that his clients owed and overstatements of refunds.

In particular, the complaint alleges that Antwi prepared returns that claimed deductions for purported business losses or employee business expenses that he knew were false. The complaint also alleges that Antwi prepared returns where he knowingly reported the wrong filing status.

Antwi must send notice of the injunction to each person for whom he or his businesses prepared federal returns, amended returns or claims for refund after Jan. 1, 2019. He must also post a copy of the injunction both on websites that he and his businesses maintain and at physical locations where any business is conducted.

Newnan, Georgia: Business owner Barry Lee White, of Carrollton, Georgia, has been sentenced to 22 months in prison to be followed by three years of supervised release for willful failure to pay more than $2.4 million in payroll taxes.

Between 2012 and 2019, White owned and operated, at different times, two construction maintenance and electrical companies that were required to withhold from employees’ gross pay FICA taxes and as sole operator of the companies, White had the responsibility to collect, truthfully account for, and pay the IRS the payroll taxes.

From at least 2015 to 2018, White withheld more than $1.8 million in payroll taxes from his employees but failed to pay the taxes to the IRS and failed to pay more than $600,000 for the employer’s portion of the payroll taxes.

Convicted of the charges in May after pleading guilty, White was also ordered to pay $2,499,473.07 in restitution.

You may like

More than two-thirds (70%) of U.S. audit clients are ready to change firms within the next three years, according to a new report.

Inflo’s “Creating a New Audit Experience for U.S. Businesses”

Clients with the most employees (250 employees or more) were the highest to report it was “very likely” they would switch firms. Meanwhile, clients with fewer employees (less than 50 employees) were the highest to report it was “very unlikely” they’d switch firms.

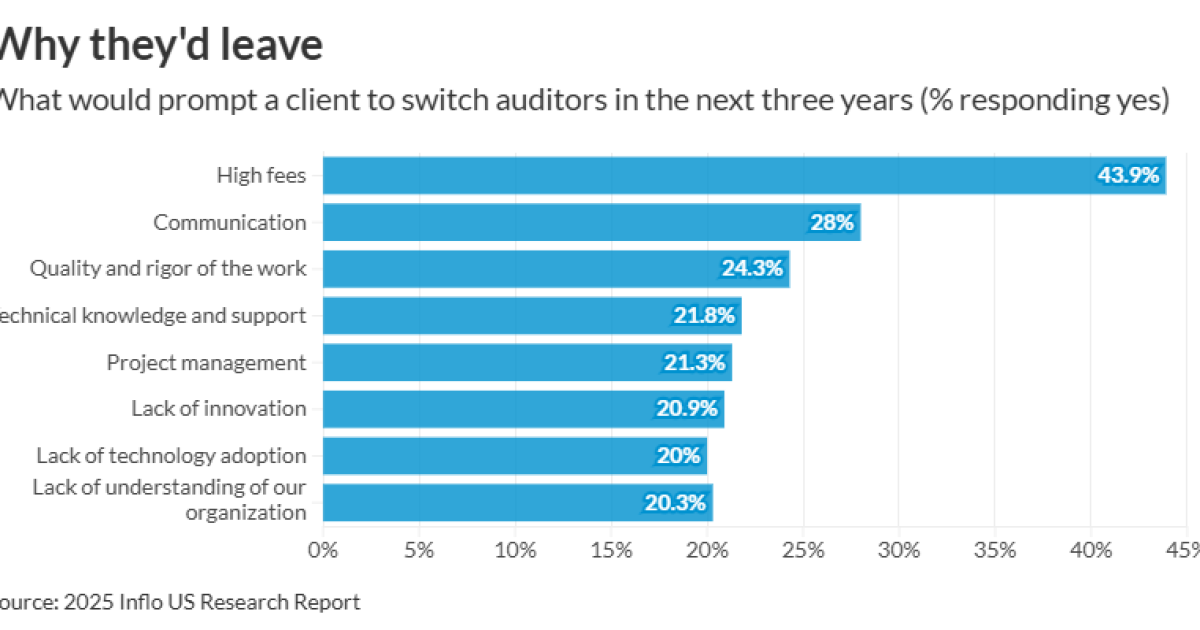

By far the most common reason causing a client to look for a new firm was high fees (44%). When asked how much more clients would be willing to pay for an audit that “gave you more value,” respondents answered 5-10% more (33%), 11-20% (31%) and 21-30% (14%). Five percent of respondents answered “nothing.”

Subsequently, clients said the leading factors influencing their decision to accept or resist fee increases were perceived value and quality of service (42%), relationship with the audit firm (40%), meeting deadlines (39%), level of justifications and transparency regarding an increasing (35%), responsive communication (35%) and the frequency of previous fee increases (34%).

(Read more:

The second most common reason causing a client to switch auditors was communication (28%), followed by quality and rigor of the work (24%), technical knowledge and support (22%), project management (21%), lack of innovation (21%) and lack of technology adoption (20%). Sixteen percent of respondents reported, “We are not experiencing any issues.”

“This research makes one thing clear: U.S. businesses are demanding a better audit experience,” Inflo CEO Mark Edmondson said in a statement. “From high fees based on outdated pricing models to technology that hasn’t changed since the 1990s, the approach of many audit firms is driving business away.”

Additionally, nearly half of respondents (45%) said they’d like auditors to improve on the use of technology to add more value to their audits, followed by the time needed from their team and insights on their organization (38% each).

“The good news is that clients care about their audits. They want them to play a key role in driving operational improvement and consistent business growth,” Edmondson said. “Audit firms that act on the report’s findings will be rewarded with rising fee incomes and a continually growing client base.”

There is no easy way to start this topic other than to hit it hard from the gate: Internal succession strategies for every firm have been broken due to outside investment. The infusion of private equity funding has created a tsunami impacting not just the financial value of a firm but also disrupting emotional decisions.

Most firms of several million dollars or more are being forced to leave significant cash on the table if they opt to conduct an internal succession. Before some of you get upset by this statement, sit back and look at the reality of our environment. Outside investment has disrupted a century of how things have always been done, and it might not sit well with the stated direction of many firms. The math is simple, but emotional elements are complicated.

Before the math, let’s review the emotional side. There is a significant history of tradition and conservative thinking in accounting. This is natural because the accounting profession needs to be conservative to ensure the integrity of their decisions is accurate. However, the tradition and conservative thinking are now clashing with the increased values in today’s market and are often misaligned with the younger professionals’ desire to not wait 30 years to get incentives and buyouts.

Let’s go through the math: The buy-out in most firms is based on a deferred compensation or a like-kind equity buy-back process. In a traditional deferred compensation model, the retiring partner’s buy-out is often the average of their last five years’ income, less the high and the low, multiplied by 2.5 to 3.5 times and paid over 10 years. For example, if their average income was $500,000 x a multiple of 3 equals $1,500,000 or $150,000 per year for 10 years.

Another option is taking the average firm revenue for the last few years and multiplying that by the percentage of the partner’s equity. As an example, if the average revenue is $10,000,000, and the partner owns 25%, they are paid $2,500,000 over 10 years. A twist is that many partnership agreements add a discount to the buyout using a .80 to .90 multiple. The $2,500,000 at .80 is now $2,000,000 or $500,000 less. Some cap the buyout amount.

This is where the discount creeps in. The $10,000,000 firm with the .80 or .90 value is selling internally at $8,000,000 to $9,000,000 or at 1x its value is $10,000,000. That same firm, in today’s market, would likely get a higher value. We hate to quote values because values range greatly by firm, but let’s use a conservative 1.2x multiple. Value calculations are no longer based on a multiple of revenue, but we are keeping this simple.

A financial illustration of an internal succession or traditional firm buyout translates to a significant reduction in value for exiting partners. Even the smallest gap from the 1.0x revenue to 1.2x on a $10,000,000 firm with a 25% owner is $500,000 less. Now, add in the time value impact. The 1.2x model will have cash up front and a shorter payment for the balance of a few years instead of 10 years and the 1.2x may be a low estimate for a $10,000,000 firm in a great location. Also, for simplicity we are ignoring the potential impact of rolled equity if you go the private equity route. (Just trying to keep this simple.)

The changing competitive landscape in accounting

Temporarily suspend any personal beliefs you may have that private equity or any other form of buyout might not be right for the profession or your people. Put aside arguments about culture or that younger professionals’ career paths will be impaired. The reality is that owners are selling internally at a steep discount. In addition, many younger professionals are not as anxious to wait 30 years to get a deferred compensation buyout, and, in many firms, there are not enough younger professionals capable of or wanting to take over at any price.

The catalyst of outside investment has impacted deal structures. It is forcing all firms, investment-backed or not, to raise their bids and it is making leaders ask why they would not accept a higher value. If you owned a firm and could exchange its value for a lower value versus a higher value, what would you do?

This dynamic has become a roadblock for firms wanting to remain independent. If independence is your preference, a process needs to be in place starting with internalizing if leadership is willing to accept less in an internal succession. If an internal succession is still an acceptable path, the firm will still need to create an independence plan that embraces the environment we are operating in today. Sitting still and operating as you have been is not an option. You will be facing larger, well-funded competitors.

Those competitors have the financial resources to invest in artificial intelligence, to efficiently outsource, to expand advisory services, to add family offices, and to open or fuel wealth management. They also have the means to hire away key talent by making offers those professionals cannot refuse.

Before putting a stake in the ground with a firm “no” to outside investment, make sure you address three critical issues:

- First, do you have enough people who are willing to and capable of taking over? A huge flaw in succession plans is the limited number of upcoming professionals that can sell and build a referral network.

- Second, are you willing to make the investments in technology, advisory and people that may reduce or flatline partner income?

- Finally, are you willing to accept less by conducting an internal succession?

Watch out for the handcuffs

Unfortunately, the discussion is not quite over. Even if you can create the perfect independence plan, there are still other considerations. Assume you are willing to take less for your firm when you exit. By less, we mean less than the current outside investment values. The reality exists that when you retire at .8 or 1X, that the next leaders can turn around and sell the firm to outside investors for 1.2 or 1.5. Is there a way to prevent that from occurring?

There is no great way to protect yourself from that happening. You can modify the partnership agreement that if the firm is sold, you get your exit revalued to the new price, but that handcuffs the new leadership team. What if their independence plan begins to fail and the new leaders need to sell or merge upward to survive? What if too much of the money needed to survive will be needed to go to the already retired owners? Why would the next generation of potential partners agree to a partnership with these conditions?

We have seen firms already in this situation and it has created a les than favorable operating environment. Plus, that type of partnership agreement will go on forever. Even if Partner Y has that increased valuation in the agreement and the firm never accepts outside investment or sells or merges during their 10-year buyout, there will be Partner X and Z, etc., who continue to retire so the cycle never ends. The real risk of a handcuff agreement is if the firm starts to fail because they cannot compete due to the resources of larger firms, all values could be put at risk.

We are advocates of firms remaining independent if they go into it with open eyes, a non-emotional perspective, and a strong independence plan. An independence plan requires more than raising fees. It requires increased revenue and accelerated metrics to pay higher salaries, distribute profits deeper into staff levels, have the money to constantly invest in new technology, and increase partner compensation. You need to bring yourself to the level where your profitability equals the market value pricing offered by outside investors. That is a difficult task to accomplish, but it can be done.

Even the best independence plan will need to adapt. We have no idea what the next few years will bring, with so many retiring Baby Boomers and rapidly changing technology. Think through the process and do not let emotions or history dictate your decisions. Whatever pathway you elect to pursue, just ensure you have all the data and are using an objective perspective before either waiting too long or reacting too quickly on your next step.

As the Senate takes up the Trump administration’s tax bill, Neil Fishman, the president of the National Conference of CPA Practitioners, dives into the details of the House bill and some of the possibilities in the Senate, as well as other issues from Washington that accountants should be keeping in mind.

Transcription:

Transcripts are generated using a combination of speech recognition software and human transcribers, and may contain errors. Please check the corresponding audio for the authoritative record.

Dan Hood (00:03):

Welcome to On the Air with Accounting Today. I’m editor-in-chief Dan Hood. As you’ve probably heard, there’s a lot going on on the tax front in Washington, D.C., as we record this. So the Trump administration’s “big, beautiful bill” had made its way through the House of Representatives and was heading to the Senate. It’s got a host of tax provisions and some other provisions that could affect their profession in it as well. Here to talk about all that as well as some other developments that accountants should be paying attention to is Neil Fishman of Fishman Associates and the president of the National Association of CPA Practitioners, as well as a return guest to the podcast. Neil, thanks for coming back.

Neil Fishman (00:35):

Thank you very much for having me, Dan. It’s always good to be here.

Dan Hood (00:38):

Yeah, it’s always great to have you on because you’re bringing the latest word on what’s going on on many important things. Let’s start with the headline news, and like I said, we’re recording this in between the House and the Senate of the big beautiful Bill, the latest from that, what are you hearing?

Neil Fishman (00:57):

Well, let’s just go over a few of the facts that have happened. As we know the house well, the White House wants everything passed in one big beautiful bill, and that’s what it’s called that the one big beautiful bill. But we’re just going to really talk about the tax provisions right now that affect that. And there are a lot now, just to go back, just to get some background for the people who are newer to the profession, when they passed the Tax Cut and Jobs Act of 2017, that was the first major reform since 19 86, 30 years.

(01:36):

And just to point out that this bill took 49 days. It was introduced on November 2nd, and it became law on December 20th. In 2017. This bill flew through Congress of course, and it went into effect right away, unlike in 86 where they passed it, but they waited a year. So they had one more year under the old laws before the new laws kicked in. They had a year to deal with making any changes, and they did some tweaking back then, and as we’ve seen, they’ve had to do some. Now, there have been a lot of issues now with the TCJA of 17. There were corporate tax provisions which were permanent,

(02:20):

And there were the individual and estate provisions, which under that law are scheduled to sunset at the end of this year. So if Congress were to do nothing, just were to do nothing, which we know is not going to happen, but still tax pockets would go back up one to 4%. The cap on salt stating local taxes would be gone. We’ll talk about that in a little bit. Mortgage interest would go back up to, on the first million dollars of indebtedness casualty and theft losses would be allowed regardless of where and when they happened. Miscellaneous mized deduction would come back, the standard deduction would be reduced. Exemptions would also come back. And of course that would also affect a MT for a lot of people. No. One thing about TCJA was a lot of people who were impacted by A MT were not. Do you want to say there was a good thing there was a good thing?

Dan Hood (03:18):

Well, it’s those sun setting provisions are sort of what spurred this bill was that they realized they had to do something about those they were going to close at the end of this year, and people were concerned about that. The original impetus of the current big beautiful bill.

Neil Fishman (03:32):

Yeah, because I know that when in November I send out a letter to all my clients, letting them know what is coming down the pipeline or may or what may be coming down the pipeline. And then of course in January when I send them the engagement letter for doing their personal returns, I include another letter which also now says, now here are what the changes are that we need to be aware of. So it’s always a constant thing of keeping your clients aware of what may be coming and then what actually is happening. And now like we said, the house passed the bill. Now you have to remember, heres now, here’s the interesting thing. The house right now, the breakdown is two 20 Republican two 12 Democrats, three seats are vacant because members passed away because three members of the house have passed away. And as of this recording, those seats had not have not filled yet.

(04:32):

The bill passed by a vote two 15 to two 14, which means two Republicans voted no, three Republicans basically voted present or abstained. And if you recall from hearing in the news when it was coming out of budget committee, the first time they voted on it, it failed. The vote was 16 21, 5 Republicans voted with the Democrats. They had another meeting and they got it to pass by a vote of 15 of 17 to 16. So they got one Republican to change their vote and the others voted present, and that was well publicized in the media. So now of course, as I said, it’s going to the Senate. You’ve already heard a number of senators say they’re not for this. Now I’m talking Republican senators. I mean, you’ve heard Ron Johnson who is not sure about this. Rand Paul is another one who has come out. I mean, it’s going to be very interesting to see what the Republicans do with it, what changes they make, and then of course they’ll have to have that reconciliation conference to work out all the differences. Who knows what they’re going to be and when they’re going to do that. I know that they would like to have this pass probably by the 4th of July. I don’t know. I really don’t.

Dan Hood (06:06):

Yeah. Well, that’s one of the things when you have bills like this that have a gazillion moving parts, some part

Neil Fishman (06:15):

You’ve heard from the Republicans, they would rather, I mean I should say the Senate Republicans, you’ve heard them in the past say they would rather see this in broken up among several bills, one bill with each thing in particular.

Dan Hood (06:32):

Well, that’s sure. Right? The issue is right, if you have all these things in one place, one, no one could be expected to read them all to read the whole thing or grasp it, but maybe more importantly, every extra piece in it is somebody who either loves it or hates it, and it means that there’s a lot more people asking questions and pushing amendments and pushing changes than there might be a few piecemeal to each one on its own. But it sounds like, go ahead.

Neil Fishman (06:58):

No, we go back to 2008 when they passed the Affordable Care Act, and even then Speaker Pelosi said, we have to pass it to know what’s in it. And then McConnell did that with Tax Cuts and Jobs Act. You have to pass it to know what’s in it.

Dan Hood (07:19):

I think both of them ended up regretting that, or at least Pelosi regretted that phrase because it was ridiculous. Not that it pretty ridiculous, but granting we’re in this weird window, right? We’re in the window between as we record this, we’re in the window between the house having passed its version and the Senate having to take up discussions they haven’t yet. Right? I think they’re slated to start next week. Again, we’re at the beginning of a very end of May being June, so we can’t really speak with any strong degree of certainty about a lot of these things, but we could certainly look at the direction that things are headed. Maybe we could start by, you mentioned the expiring professions, the sun setting professions of the TCJA. Maybe we could run through a couple of those and see what’s the prognosis for those

Neil Fishman (08:07):

Terms

Dan Hood (08:07):

Of getting extended, getting changed?

Neil Fishman (08:10):

Well, personal exemptions are going to, according to the bill that passed the house, let’s emphasize this, that this is not cards in stone yet, but this is what the house passed right now, the personal exemptions, they’re gone. They will be permanently repealed. Basically, they’re taking a lot of the provisions on the individual aspects of TCJA and they’re making them permanent. So exemptions are gone. They’re going to make the child tax credits. They want to make that 2000 credit permanent, and then starting after next year, it’s going to be indexed for inflation. And then of course, for the years 25 to 28, the tax credit will be increased. 2,500 per child, I remember that’s children under 17 or it’s our 17 and under. Okay, next was the QBI qualified business income deduction. They want to make that permanent, but after 25, they will raise the deduction percentage from 20% to 23, and then they will also have a modification of the phase in of the wage and investment limitations. So they’re doing things more so a stating gift tax exemption. Okay. They’re increasing the exemption to 15 million, 30 million for married joints making permanent. The extension of the increased A MT in the phase outs there, like I said, a lot of these things are permanent. The indebtedness on a mortgage, which was originally a million dollars, the original proposal of TCGA made at 500, they settled at seven 50. It’s going to stay at seven 50.

(10:00):

Casualty losses remember remains only in a federally declared disaster area. Now we’ll have something about that because that ties in with both casualty and theft losses. They’re both kept together. Okay? The miscellaneous itemized deductions eliminated becomes that becomes permanent again. Also, the limitation on itemized deductions, remember there was that what’s called the PS limitation, which reduced your itemized deductions by 3%. If your a GI was over a threshold, well that’s going to be gone and it won, and the cap will only affect people who are in the 35 or 37% brackets and those are going up.

(10:52):

The moving expenses again remains only if you’re an active duty military. So you’re in New York, you get a job in California, you relocate. You cannot claim that as a deduction. 20 years ago when I moved from New York to Florida, I moved my business down here. I was able to take advantage of that, but if I were to do that, today would not be allowed. And moving any great distance is not inexpensive. So let’s see, what else? We got a whole bunch of things here. Oh, he wants to, here’s the thing. No tax on overtime, but that’s only going to be for four years, only for 25, 26, 27 and 28.

Dan Hood (11:45):

Gotcha. That was not in TCJA, right? That was

Neil Fishman (11:48):

No, this is something that’s brand new, brand new. And then of course there’s also the no tax on tips. I remember both candidates advocated on that. Now here’s the thing with taxes on tips, and this is again, out of the bill and something, it must be an occupation where you customarily traditionally get tips. The tips must be voluntary. This will include beauty services like the borrower shop, the beauty salon, the restaurants. And again, it’s only for four years, 25, 26, 27, and 28. Now of course, I have a question on that, which I don’t have an answer for you because remember, it says the tips must be voluntary. There are a number of restaurants where if your party is over so many people, they automatically put on a gratuity of 18 or 20%. So the $64 question there is, is that going to be included?

Dan Hood (12:55):

That’s an interesting question. Was it ever, right. I mean it’s always billed. Usually you bill as a service charge or often billed as a service charge, and it’s not really specifically, some places say it’s a gratuity, but some places called it a service charge. You wonder whether they tried to

Neil Fishman (13:11):

Have

Dan Hood (13:11):

It not be tips to start.

Neil Fishman (13:12):

Well, actually at the end of April, I actually went away for a few days when my wife and I went over to the Gulf Coast. We went and we stayed, got away for a few days in the Sarasota Longboat key area. We were at this resort and the meals we had there, we had on their bills for the restaurant services, they automatically put in a 20% gratuity. I mean, I could have added to it if I wanted to, but it was already there. So now,

Dan Hood (13:43):

Yeah, what do you need to add?

Neil Fishman (13:45):

So now the question is, if this becomes the law for the resorts and the restaurants that automatically do that, would that qualify or are they going to have to revamp how they do that aspect? Very

Dan Hood (14:08):

Interesting question. Like I said, do you call it something other than a gratuity, otherwise it is. Yeah. That’s very interesting. I want to talk, you had mentioned the salt cap and it’s TCGI thing, but it really is its own crazy animal. So I want to talk a little bit about that because it was definitely seemed like a big political football for the wrangling in the house because the high tech states, Republicans in high-tech states were concerned about their constituents.

Neil Fishman (14:46):

Yes, and actually let’s talk about last year for a moment on that because last year a number of house Republicans specifically from the Long Island, New York area, so that’s I think the first four or five congressional New York, first four or five congressional districts, they were advocating for an increase of solves from 10 to $20,000. Didn’t go anywhere, but again, you had them here and you had several that were extremely vocal. One in particular was Mike Lawler, who is I believe from the Westchester Rockland area just north of New York City. He was advocating, I believe for a hundred thousand dollars cap, a hundred thousand dollars cap. So originally they increased the salt or they were going to increase it to $40,000, but they were putting in the provision that in this case, a modified adjusted gross income, if you broke over $400,000, it would be reduced by 20% of your A GI or your MAGI, in this case over $400,000.

(16:03):

So for argument’s sakes, if that was the law, so if you had $500,000, a hundred thousand dollars over that 30,000 cap went down back down to 10 because you lost $20,000, it cannot go down below 10. What they did was they increased it Now in the bill that the house passed to 40,000 and they increased the A GI threshold to half a million dollars. Now, I still have clients up in New York and in some areas they’re paying 15 $20,000 in property taxes. If you go to the North Shore to the, I guess you’d call Port Washington, sands Point area of Long Island, you’ve got people there paying close to six figures in property taxes.

Dan Hood (16:56):

You came in Westchester and some other

Neil Fishman (16:58):

Areas and you goes to area, look, even here in Florida, you go down to Miami, you go to Palm Beach, you go to Wellington, Boca, just a few places. You have some areas where the property taxes are greater than $10,000, but of course they have also supersized as I call it, the standard deduction, which also makes it difficult. I’ll say for this year, the standard deduction for a married couple joint was 29 2, 20 $9,200. I believe next year is going to be $30,000. So 15,000 for an angel, they’ve made it harder, but now they’re trying to make that a little bit easier for some people with the higher incomes to be able to itemize.

Dan Hood (17:53):

We tend to be focusing on New York. We know New York, but,

Neil Fishman (17:57):

But the big thing was

Dan Hood (17:58):

New Jersey, Illinois, California all have

Neil Fishman (18:01):

Similar places. You had a lot of Republicans from the high tax states, New York, New Jersey, Connecticut, Illinois, California. They were all advocating for this and we’ll now have to wait and see what the Senate does, if anything. With that, they go ahead

Dan Hood (18:22):

Because one of the things I’m taking you as we talk about all these different provisions, this one seemed to be the one that had the biggest elasticity in it, right? In terms of where it might come. People were talking about, you mentioned 40,000 people were talking 80,000 numbers were all over the map, and it seems like this is, of all the provisions we’ve been talking about, one of the ones that’s most likely to change significantly or it seems to me, I could be wrong, you go to DC much more often than I do and are much more tied in down there, but it seems like this is one of the areas where we should really be expecting a lot of change or potentially a lot of change in the Senate and house reconciliation.

Neil Fishman (18:59):

Yep. It’s going to be very interesting to see everything. We’re just talking taxes, but of course there are all the other provisions which we will not get into at this time, which a lot of people are looking at and gives them cost of concern, but we don’t have the time to go through all that right now.

Dan Hood (19:21):

I will just throw out one of them because it’s particularly important, and again, I’m not even sure if this made it into the final version of the House Bill, but there was a provision about closing down the P-C-A-O-B Public Company Accounting Oversight Board and moving it under the SECI am not a hundred percent sure whether it made it into the final bill or not, but I know it was under consideration. That’s one of those ones they’d have to pass it. So we’ll find out if it’s in it, but that’s rare that you see a piece of provision that directly affects the accounting profession. But so that’ll be one thing to keep in mind. But as you say, lots of other provisions, too many to dive into here, but I think we’ve done a pretty good job of covering all the big tax ones. I think we could take a step back and talk about what do you think maybe the overall impact of the legislation is going to be, knowing obviously that we may change a fair amount between now and July 4th or whenever it’s finished?

Neil Fishman (20:18):

The one thing that I will, I would like to point out is the very last provision that came out of the Ways and Means committee, and that is they’re going to increase the debt limit by $4 trillion right away. You’ve had CBO and JCT have come out and saying that this bill, if it passes, will increase the debt by three to $4 trillion. But there’s one thing that everybody forgets about that is never included in a government budget, I don’t think. I’ve never seen it, and that is contingencies. What happens if there’s a natural disaster and we’ve already had them. You’ve had hurricanes and you’ve had tornadoes and you’ve had the hurricanes from late last year. You have flooding and the states are now crying for aid. I mean, I’ll just give this one example. Arkansas got hit with those storms and got a lot of damage. Who is the current governor of Arkansas

Dan Hood (21:38):

Sanders?

Neil Fishman (21:39):

Yes, Sarah Huckabee Sanders, who was for a good chunk of Trump’s first term, she was his press secretary. She loves him. He loves her. She went to the federal government asking for aid. They said, no,

Dan Hood (22:00):

Well, that’s how you handle contingencies. Just refuse to pay them. Refused to refuse to engage in them. But you’re quite right. It’s interesting because that’s not included. You’re right, I’ve never seen it in a budget or anything like that, and I’m not sure how they would do that, but it’s probably something wise, given that almost every presidency of either political party ends up with some wild, the unexpected thing, I mean,

Neil Fishman (22:27):

If you transfer this to the corporate world, to the publicly held companies, when they do their financial statements, when they do their noting do their notes, they have to put in the notes about contingencies, things that might happen. There might something happened, there may be a recall of something. There may be a lawsuit filed or there’s a lawsuit going on and we don’t know if we’re going to win, but if we don’t win, we anticipate we might have to pay X amount of dollars, which will have an impact and on the financial statements, and it has to be reported in the financial statements if you know about it

Dan Hood (23:10):

Actually. I mean, just that report alone would be fascinating for the federal government, but as you say, not something they’re currently working on and not something they’re preparatory and does seem as if our contingencies come up more often than not from all the natural disasters you mentioned, but then you think about COVID or the war in Ukraine or a million other things that might pop up at any given moment. Yeah, that would be interesting to see, but would require us to go way beyond. I think that the scope of the big beautiful Bill, so

(23:40):

We’ll come back to that. I think there’s a lot more at, you said there’s a gazillion provisions in this. We could dive more deeply, we could dive more deeply into the ramifications of the tax thing. But I want to take a switch a little bit int and talk about what’s going on in Washington on a broader scale. Nick Papp goes down to Washington every year meets goes to the Hill, meets with representatives and committee members and all sorts of people in the know down there bringing issues from your membership and their clients to Washington, but also coming back with a lot of super useful intelligence. I know you’ve recently done that annual trip. I would like to talk about that. But before we do, we’re going to take a quick break.

(24:26):

Alright, and we’re back with Neil Fishman, the president of the National Conference of CPA Practitioners talking about all things about the “big beautiful bill.” We’ve talked a lot about that. We could spend the next seven to eight hours talking about it and still barely scratch the surface. But what I want to talk about for now is your annual trip to Washington. Like I said, the group goes down every year bringing issues and concerns that the people on the Hill should know about, but also coming away with a lot of valuable insights about what they’re thinking about and what they’re planning. So maybe we start, what were some of the issues you all brought to Washington, things you wanted them to be aware of that were affecting either you or your clients?

Neil Fishman (25:06):

Okay, well first, okay, so we brought up a few things. We just had a few things to go to Washington this year. So the first one is the Taxpayer Protection and Prepare Proficiency Act, and this is the legislation that would give the Treasury Department, therefore the Internal Revenue Service, the authority to regulate prepares. Now, let me preface that. I went to Washington back in January and I met with a staff person for the Republican on the Republican side for ways and means, spoke with her about it. She seemed very interested and she did actually asked me, do you know any Democrats who are interested in this? I said, yes, actually, I’m having a meeting with a Democrat office later that afternoon, which I did, said, well see if they’ve reached out to anybody. And actually I did bring that up when I was there and they said, when I met with their legislative director, they said they reached out to every Republican on the Ways and Means committee about co-sponsoring this legislation, and they were turned on by each and every one of them.

(26:16):

Now that got me, when you hear that, that’s very disillusioning because there are some things that just make sense. I mean, even in the 24 annual report to Congress, the National Taxpayer Advocate said, this is basically a no brainer. Remember to do this, you requiring that the person get the pt, every preparer has a PT in no big deal. For the people who are not credentialed, that is the non CPA, the non-attorney, the non enrolled agent. You have to take one time just once a minimum competency exam, minimum competency, pass it one time and then you’re good for life. And then of course you have to do I think 15 hours of continuing education annually. I am licensed as a CP in New York and Florida. New York is a three year cycle. Florida is a two year cycle, but I still have to have an average of 40 hours per year per cycle.

(27:28):

So 80 hours in Florida, one 20 in New York when my licenses come up for renewal. This makes common sense to everybody. I mean, you own your residence, you have a plumber, you have an electrician come in, they have to be licensed and bonded. You go to the beauty portal, you go to the barbershop, they have more protection than a person who prepares tax returns. Now, every month, the IRS comes out with a list on information on active pns. So I can go by the one for beginning of May and lemme just find it and I have it right here. Okay, so this is as of May 1st, there were 807,307 active penins is it issued over 2.1 million since September of 2010. Now of the other 807,000, they do provide some breakdowns of professional credentials. So they have attorneys, CPAs, enrolled agents, a couple of others which are very minor.

(28:39):

So CPAs, there were 204,522 CPAs with thein. That is 25 point 33%. And the IRS says on this list here on the credentials that the credentials overlap. So attorneys 25,795, that’s three point 19% enrolled agents, 65,371. That’s 8.09. But the IRIS has pointed out, as I just said, you could be multiple credentialed. You’re counted in each category. So it is safe to say that 70% of the people who prepare tax returns are not credentialed. Now, I am not saying that that is bad. I’m not saying that these people are bad and credentials is good. I’m not saying that because you can have competent people with or without credentials. You can have incompetent people with or without credentials. But if you are credentialed, there is oversight. If you have a problem with me as a CPA in Florida, you can file a complaint with the Board of Accountancy in New York.

(29:53):

It is a department of Education. If it is an attorney, you’ll file a complaint with the state bar. If it is an enrolled agent, which is an IRS credential, you complain. You file a grievance with the IRS. There is somebody too over that. We all have people who come to us this year and go elsewhere next year. For whatever reason, our fee was too high. I said, you came to me late. You’re going on extension. I don’t want to go on extension. So they found somebody who could do it right away for them. A couple of reasons just there, but that is a concern. The number of people taking the CPA exam is down. The number of people who get the credential and go into accounting in order to this aspect of accounting is down. I heard there was a slide uptick last year, but where are those people going? You hear from the college students, they want to go into the higher end work. They want to do forensics, they want to do artists, and that’s fine. Now, there is a more bigger push for quality of life doing tax and accounting work. There are certain months out of the year where don’t plan on any vacations. So if you’re into snow skiing and you live in Florida and you’re going to be a CPA in Florida, don’t you can’t disappear for a week during season.

Dan Hood (31:17):

Not anybody from coming into the profession. Let’s not.

Neil Fishman (31:20):

No, I’m not.

Dan Hood (31:22):

We can go down all the reasons why. It’s

Neil Fishman (31:25):

Lemme say, but what I tell people who are thinking about this, there’s plenty of opportunity in this aspect in the future. Okay.

Dan Hood (31:34):

Well, I mean there’s certainly, I know this has been a concern of yours and of Nick P’S for a long time, and it certainly is kind of a no-brainer. At the same time, given all those trends you talked about in terms of their Sure people, there’s not enough people coming into the profession, not enough people coming into the broader tax and accounting profession, regardless of whether it’s TBAs one makes a strong argument saying, we don’t want to make it any more difficult to come into this. Right?

Neil Fishman (31:58):

Yeah, but one other thing I want to point out from that report from the taxpayer advocate, in fiscal year 23, there was 21.9 billion in fraudulent earned income tax credits given out, which represented about a third of the tax returns that had the EITC credit on there. They estimate that 96% of those payments were attributable to a non-credentialed preparer.

Dan Hood (32:28):

Yep. No question. But I think even with all that certainly being too, the issue really is nobody wants to give the IRS more power. Nobody in Congress wants to give the IRS more

Neil Fishman (32:39):

Power, but it’s giving them the right power and this is right up their alley. Okay. The other thing I like to bring up is theft losses. Remember how I talked about before casualty and theft losses are linked together?

Dan Hood (32:51):

Yep. Why

Neil Fishman (32:54):

Are theft losses considered casualty losses? I have a colleague in Texas, he has this client, an older woman around 90 years old. All she has is her social security and her pension. Her IRA money, she fell victim to one of those publisher clearing clearinghouse scams to the tune of about $200,000 out of her retirement money. She gets a 10 99 R for the full amount. She has to pick it up as income. She is not allowed to claim it as a theft loss. So we have been advocating that that should be the case. Casualty losses is fine. Theft losses should be treated differently. It shouldn’t matter if you’re declared Federal disaster area. I mean, in 2017, there were just over 301,000 complaints, theft losses to the tune of about 1.4 billion. That number has gone up in 2023, it was 880,000. The losses were 12 and a half billion dollars. These are people who they got hit twice. First they got hit by getting scammed or losing whatever they lost, and then they had to pick it up as income and repay tax on it, and in the case of this woman, does she have the money to pay the tax? Probably not. Yeah,

Dan Hood (34:36):

She just got scammed. She’s got enough.

Neil Fishman (34:37):

Exactly. Okay. Third item, I’ll just bring this up, was about fiduciary returns, especially if it’s the final year of a tax return of a 10 41 for the state of Joan Smith. Now sometimes these are one and done. Sometimes they’ll go, they could last for a couple of years. Now in the final year of the return, all the income goes to the beneficiaries, but that also includes if there are any unused capital losses. That also appears on the K one. The one thing that does not appear on the K one is if the estate or trust made federal tax deposits, so the 10 41 has to be filed showing that estimated taxes were paid. There’s no tax liability, and so that money is going to get refunded to the estate or trust. Whereas if that was allowed to be carried over on the K one to the beneficiaries, it would help them with their additional potential tax liability. Again, this is something that is simple. This is something that would help taxpayers remember. The primary way to avoid underpayment penalties on tax returns is you have to pay in either the equivalent of last year’s liability or 90% of this year’s liability. In the case of higher income people, they could require, I think it’s about 110% of last year, your estimated liability in any of those cases. If this was carried over, this would help them. It may not help them entirely, but it might. Yep. Yes.

(36:36):

Excellent.

(36:38):

Now, in our meetings, and we had about 14 of them, and this was in both house and Senate, both sides of the aisle. We met with people, we met with the staffers who knew what we were talking about, who understood what we were talking about, who actually asked very intelligent questions to make sure that they were understanding it. Now, of course, telling it to them, relaying it from them to their boss, the senator, the representative, and then seeing it, excuse me, seeing it get incorporated into a bill, unfortunately, that takes time. Unfortunately, it’s getting the right year at the right time. As

Dan Hood (37:26):

I got to tell you, this always fascinates me. You talk about this, we usually talk generally every year after year trip to Washington, and one of the things about it that fascinates me is that fact, the fact of law, right? That it’s really not necessary to meet with the lawmaker themselves. It’s the staff member who’s an expert in that issue or that area that you need to meet with, and they’re the ones who have you hope that they then have the ear of the lawmaker to push things forward. The lawmaker then brings the political considerations and their own priorities, but it’s fascinating that that’s how I was fascinated, that that’s how Washington really works,

Neil Fishman (38:03):

And especially in the Senate where the senates are on five or six committees in the house. They could be on just one committee depending on what, depending on assignments, they could just be on one committee or they could be on two. But especially in the Senate, five or six committees, the senators need the staff to make sure they’re up on everything.

Dan Hood (38:26):

And it’s also, it helps explain. It’s one of those we didn’t know it was in it until we passed it kind of things because it many cases you said they’re staff members of the real experts. The senator or the representative may know something about the things that they’re on a committee for, but they also have staff members who are genuinely deep experts in the narrow aspects of it. And so that’s one of the reasons why those bills end up getting so complicated and why senators are congressmen are like, well, I don’t really know what’s in it, but my aide do, my staff members do, and they tell me this. I think that’s a fascinating insight into Washington. Let’s turn around and say, obviously you’re there pitching these things that would make things better for taxpayers or for the system as open. In the case of the registration of tax preparers, what are some of the things you picked up? What are some of the things you were hearing? Was it mostly mostly about the big beautiful bill? Are there other issues going on in Washington that they were talking about?

Neil Fishman (39:25):

The big beautiful bill was the thing that everybody was talking about. It was starting to go introduce into the house, going into the committee, and everybody was waiting to see what was going to be the final result with regard to the tax aspects, I’m sure with the others as well. And now that is the thing that everybody’s talking about. You again, you hear the senators, you’ve already heard some say that they’re going to be making changes. You’ve heard from house leadership saying, don’t make changes, just past will be passed,

(40:06):

But right now it’s June will be how the Senate deals with all this and we’ll have to wait. Unfortunately, we will have to wait and see, and then of course react. Going back to the Affordable Care Act, when that was passed being, there was a provision in there that would’ve required all businesses to issue a 10 99 to every business they do business with regardless, and that was buried deep in there, and when that was read N Pap came out, we advocated for it, I’m sure, and I’m sure the other organizations representing tax preparers also because that would’ve been a logistical nightmare. They got that repealed, so the 10 99 rule still stay into effect $600. Oh, there was something about the Schedule K. It’s going to go back up on the threshold because that’s affecting, a lot of, that’s affecting a lot of people, was never intended to affect, but still going back to just doing 10 90 nines for every business, that would’ve been a logistical nightmare.

(41:15):

Keeping track of every business you dealt with. Let’s just say, I’ll give this example. Let’s say Staples, staple Stores, office Depot. You can go online and buy, you can phone in and buy, or you can go to a store and buy, let’s just say for argument’s sakes, that those stores were franchises, and depending on where you went and using your office as a central hub, there are three different stores you could go to in different directions depending on, you have to keep track. They were franchises. You have to keep track of each store that you went to and how much you bought from them and issue them a 10 99. That would’ve been a logistical nightmare, thankfully, that got repealed. So again, what’s in it? What will come out when it comes out? You can bet that there will be a lot of reaction. There will be a lot of calls for changes to be made in the bill once it becomes law,

Dan Hood (42:22):

Once it becomes law, once it becomes law, we’re going to want to have you back to talk about that, but also back to talk about what those questions are, what are the issues that popped up, the unexpected surprises that we found out once we passed the bill so that we could read it and find out what was in it. We’ll have to have you back to dive deep into that. In the meantime, any final thoughts that tax preparers accountants should be thinking about either as this bill moves towards, its pretty inevitable passage. It may change, but it seems highly likely that we’ll have a bill as that moves forward. Anything accountants and taxpayers should be thinking about?

Neil Fishman (42:56):

Well, you should pay attention as much as you can to what’s going on. I do know that there are organizations and there are people who are offering presentations on the tax bill. Right now, I’m, I’ve gotten several emails for do a program. In fact, I’m giving a presentation next June 5th for the Florida chapter. I’m giving a presentation on the one big beautiful Bill. Of course, I’m prefacing it that this is what passed the house. I’m disclaiming that, take what I’m saying, what it is that this may be. It may no, it may be, it may not be. We don’t know what the final versions going to be, but start educating yourself on it. Make sure you click, you’re going to go to these presentations. Make sure that they’re from a reputable organization that end hopefully that the presenter knows what they’re talking about

Dan Hood (43:55):

And be aware of which things score everything. Is it highly likely? Is it middling, likely? Is this going to be a bone of contention? Is this the kind of thing that’s likely to change? The worst thing is to spend a lot of time learning stuff that learning things that may in the end be completely upended in the negotiations, but But a good point. Good advice.

Neil Fishman (44:13):

Yeah, because when you look at the one big beautiful bill out of ways and means, there are over a hundred different sections to it,

(44:22):

And each one is separate, and some of them are very relevant and some of them will be, well, when am I going to come across that? And one thing they’re talking about also is get the energy credits, which are just existing and being phased out. They want to eliminate them immediately. So be aware of what’s coming down be No, even if you hear that this may be happening, it’s better than all of a sudden the bill passes and, huh, I got to do what? I got to know my client. They can’t do this anymore. Be aware. No, your clients will appreciate that. You take no, your clients want to know that they’re dealing with somebody who’s on top of this.

Dan Hood (45:08):

Excellent. And on that note, I’m going to let you go, but we’ll have you back. As I said, once the bill passes, we’ll have you back so we can dive deeply into it. In the meantime, Neil Fishman of the National Conference of CPA Practitioners, thanks so much for joining us.

Neil Fishman (45:22):

Thank you very much for having me, Dan. I look forward to seeing you again soon.

Dan Hood (45:26):

Excellent. As soon as the bill passes, we will arrange that. And in the meantime, thank you all for listening. We hope you’ll be back when Neil is back, but also on a regular basis. This episode of On the Air was produced by Accounting Today. Rate or review us on your favorite podcast platform and see the rest of our content on accounting today.com. Thanks. Get to our guest and thank you for listening.

Two-thirds of clients ready to change auditors

Student loan borrower in SAVE forbearance says interest growing

Doing the math on private equity in accounting

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Blog Post1 week ago

Blog Post1 week agoCommon Bookkeeping Challenges and Solutions for Small Businesses

-

Economics1 week ago

Economics1 week agoWhy the president must not be lexicographer-in-chief

-

Finance1 week ago

Finance1 week agoThis is why Jamie Dimon is so gloomy on the economy

-

Accounting1 week ago

Accounting1 week agoSteinhoff fraud trial moved to South Africa’s high court

-

Personal Finance7 days ago

Personal Finance7 days agoWhat the national debt, deficit mean for your money

-

Personal Finance1 week ago

Personal Finance1 week agoHow to save on summer travel in 2025

-

Personal Finance1 week ago

Personal Finance1 week agoDenmark raises retirement age to 70; U.S. might follow

-

Finance1 week ago

Finance1 week agoWhy JPMorgan hired NOAA’s Sarah Kapnick as chief climate scientist