A measure of wholesale prices increased less than expected in March, providing some potential relief from worries that inflation will hold higher for longer than many economists had expected.

The producer price index rose 0.2% for the month, less than the 0.3% estimate from the Dow Jones consensus and not as much as the 0.6% increase in February, according to a release Thursday from the Labor Department’s Bureau of Labor Statistics.

However, on a 12-month basis, the PPI climbed 2.1%, the biggest gain since April 2023, indicating pipeline pressures that could keep inflation elevated.

Excluding food and energy, the core PPI also rose 0.2%, meeting expectations. Excluding trade services from the core level, the increase was 0.2% monthly but 2.8% from a year ago.

The release comes a day after the BLS reported that consumer prices again rose more than expected in March, raising concerns that the Federal Reserve will be unable to lower interest rates anytime soon.

On the producer price side, March’s gain was pushed by services, which saw a 0.3% increase on the month. Within that category, the index for securities brokerage and other investment-related fees jumped 3.1%.

Conversely, goods prices decreased 0.1%, flipping a 1.2% increase in February. Final demand costs for energy, which have been on the rise lately, actually fell 1.6% on the month. However, wholesale prices for final demand food and goods less food and energy climbed 0.8% and 0.1%, respectively.

Though prices have been rising at the pump, the final demand index for gasoline fell 3.6%. That contrasted with the consumer price index, which showed gasoline up 1.7% on the month.

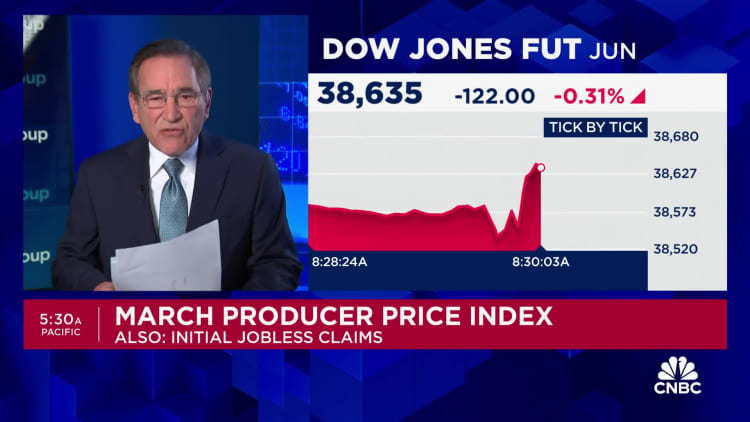

Markets showed little reaction to the data, with futures tied to major stock indexes slightly higher though Treasury yields declined.

In other economic news Thursday, initial filings for jobless benefits fell to 211,000, a decline of 11,000 from the previous week’s upwardly revised level and below the 217,000 estimate from Dow Jones.

Continuing claims, which run a week behind, increased to 1.82 million, up 28,000 for the period, according to the Labor Department release.

The economic data points are being watched closely as the Federal Reserve contemplates its next moves on monetary policy.

Wednesday’s CPI release jolted markets, which had been anticipating an aggressive series of interest rate cuts this year. The report showed annual inflation running at 3.5%, well above the Fed’s 2% target.

The market now is pricing in the possibility of just two cuts this year, likely not starting until September, according to CME Group data.

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics5 days ago

Economics5 days ago

Economics1 week ago

Economics1 week ago

Accounting5 days ago

Accounting5 days ago

Economics1 week ago

Economics1 week ago