Accounting is in the midst of a massive transformation that may leave some firms behind if they don’t keep up, industry leaders told attendees at a major event on Monday.

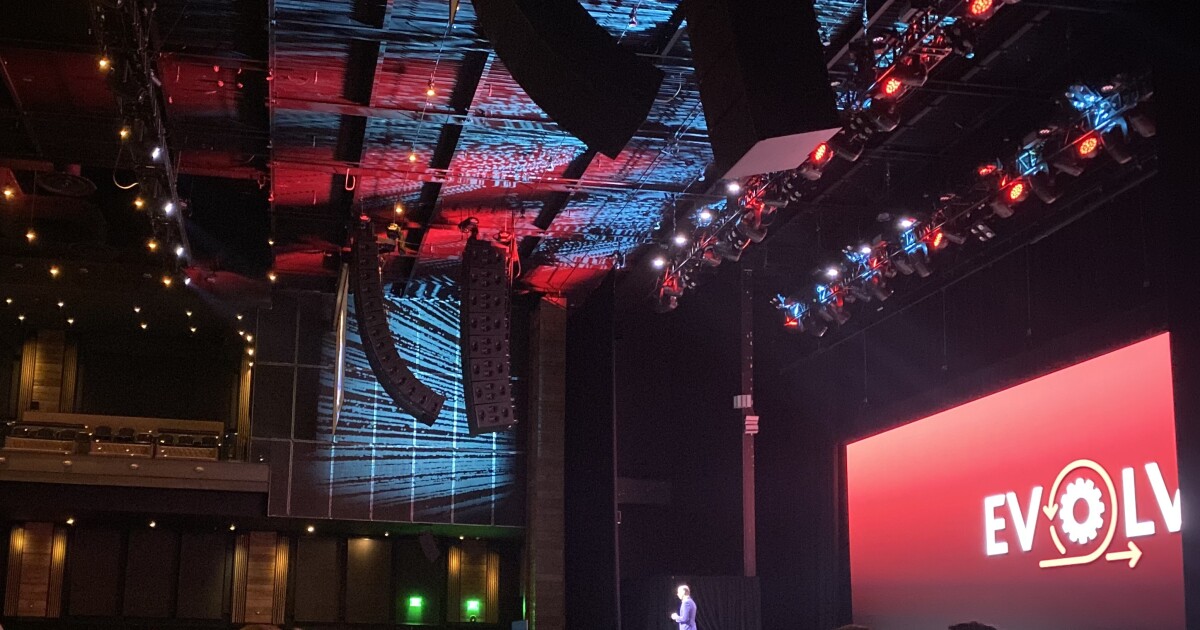

Delivering a keynote address at the BDO Alliance’s 2025 Evolve Conference, held this week in Las Vegas, alliance executive director Michael Horwitz likened the process to hiking the Grand Canyon from the North Rim to the South Rim — a grueling but ultimately rewarding journey that takes hikers down to the bottom of the canyon and then requires them to climb thousands of feet back up.

“There will more than ever be firms that will be left behind,” Horwitz said. “They’ll be able to see the other rim, but they won’t be able to reach it.”

And the rift will only get wider, he noted: “I believe that the tectonic shift that started in our business just a few years ago is only going to accelerate, and the difference between firms that have invested in transforming their relationships will only widen,” he told attendees.

Horwitz laid out a number of the largest challenges that accounting firms face — from the need to make significant investments in both staff and technology, to the aging of CPA firm leadership and the lack of succession planning, rapidly expanding service expectations (particularly around advisory services), the entrance of private equity into the accounting landscape, and an erosion in accountants’ confidence to insist on their own value — but noted that these issues also come with potential upsides.

“For every challenge, we can see the opportunity for those on the right side of the canyon to differentiate themselves,” he said, and offered four major steps firms can take to emerge successfully:

1. Invest in people. “Firms are spending more time being intentional about helping their staff thrive,” Horwitz said, in areas ranging from compensation and incentivizing of top producers to offering a wide range of training.

As part of the same keynote session, BDO USA CEO Wayne Berson talked about the Top 10 Firm’s prioritization of this area: “Our strategy will focus on the wellbeing of our professionals,” he said. “We’ve seen significant changes in the workforce, and we have embraced those changes.”

Initiatives like adapting to an ever-more flexible workforce, becoming a C corp and then establishing an employee stock ownership program, and otherwise working to help their team members thrive have helped drive down turnover significantly, he explained.

2. Invest in technology. “The risks of not leveraging AI will be significant,” Horwitz warned. Berson highlighted the benefits of the firm’s introduction of its own instance of ChatGPT: “Since we launched ChatBDO, this tool has saved 1,200 users 600,000 hours on everyday tasks over two years,” he explained. “Regular users have increased their billable hours, without significantly increasing their hours spent — saving countless hours spent on administrative tasks.”

3. Invest in service offerings. To meet client needs, accountants need to go beyond traditional compliance services, whether by focusing extremely narrowly or offering a much wider range of service lines. “Some firms go deep, and some firms go broader,” Horwitz said. “I think the firm of the future will be rewarded for doing either one.”

4. Invest in relationships. Deepening connections with the right clients is critical for firms that want to reach the other rim of the canyon. “We’re all more or less in the relationship business,” he said. “Our vision is to establish trusted advisory relationships across what we call ‘priority accounts.'”

Changing the accounting model

Other speakers in the opening session highlighted another aspect of transformation that accountants need to focus on: the multiplying number of business models available to accounting firms.

“The Big Four are restructuring their businesses and thinking about their models,” said BDO Global CEO Pat Kramer. “There are models for every type of firm around the world, but making the right choice is critical.”

Mark Koziel, the new president and CEO of the AICPA, said the traditional structure of accounting firms needs some serious rethinking.

“There are many ways to improve on the business model that we have — the partnership model that was established over 150 years ago,” he told attendees. “The partnership model isn’t dying – it’s dead, and we have to figure out different ways of doing business.”

He was quick to emphasize the profession’s strong position of trust in the market, however, and the fact that there is upside to all the challenges faced by accountants. He noted how, when he took the helm at the AICPA on Jan. 1, many of his initial discussions with staff were focused on the problems.

“Internally, everyone kept talking about the issues, the issues, the issues,” he said. “But I said, ‘Wait a minute — these are all opportunities.'”

Finance4 days ago

Finance4 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Finance5 days ago

Finance5 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Economics6 days ago

Economics6 days ago

Personal Finance7 days ago

Personal Finance7 days ago

Economics6 days ago

Economics6 days ago