ORENTHAL JAMES (O.J.) SIMPSON, who died on April 10th, was in many ways an inspiring figure before he murdered his ex-wife. He overcame a childhood disease, rickets, which made him slightly bow-legged. In 1973 he was rated the “Most Valuable Player” in America’s National Football League. He was “the first black athlete to become a bona fide lovable media superstar”, according to People magazine. He starred in movies (“The Towering Inferno”, “The Naked Gun”), and made a fortune endorsing Hertz rental cars.

Then, on June 12th 1994, his former wife, Nicole Brown, and a friend of hers, Ron Goldman, were found stabbed to death. Simpson, whom Brown had previously accused of violence and threats, was immediately suspected. But on the day he was supposed to surrender for questioning, he fled. A cavalcade of cop cars slowly pursued his white Bronco truck along the freeways of Los Angeles. News helicopters beamed live coverage to sitting rooms around the world. His trial brought America to a standstill. Perhaps 150m people watched it on television. As the verdict was read out, trading of stocks and currencies all but ceased. When he was acquitted, white America gasped with disbelief. Black Americans celebrated: more than 80% agreed with the jury. Gil Garcetti, one of the prosecutors, lamented that the verdict was “based on emotion that overcame reason”.

Simpson’s grim story illuminates two enduring ills. Most obviously: racial division. Simpson was black; Brown and Goldman were white. The jury that acquitted Simpson was three-quarters black. The jury that reached the opposite conclusion in a civil trial in 1997, finding him liable for the two murders and ordering him to pay millions of dollars to the victims’ families, was mostly white. Presented with the same set of facts, white and black Americans saw a different reality.

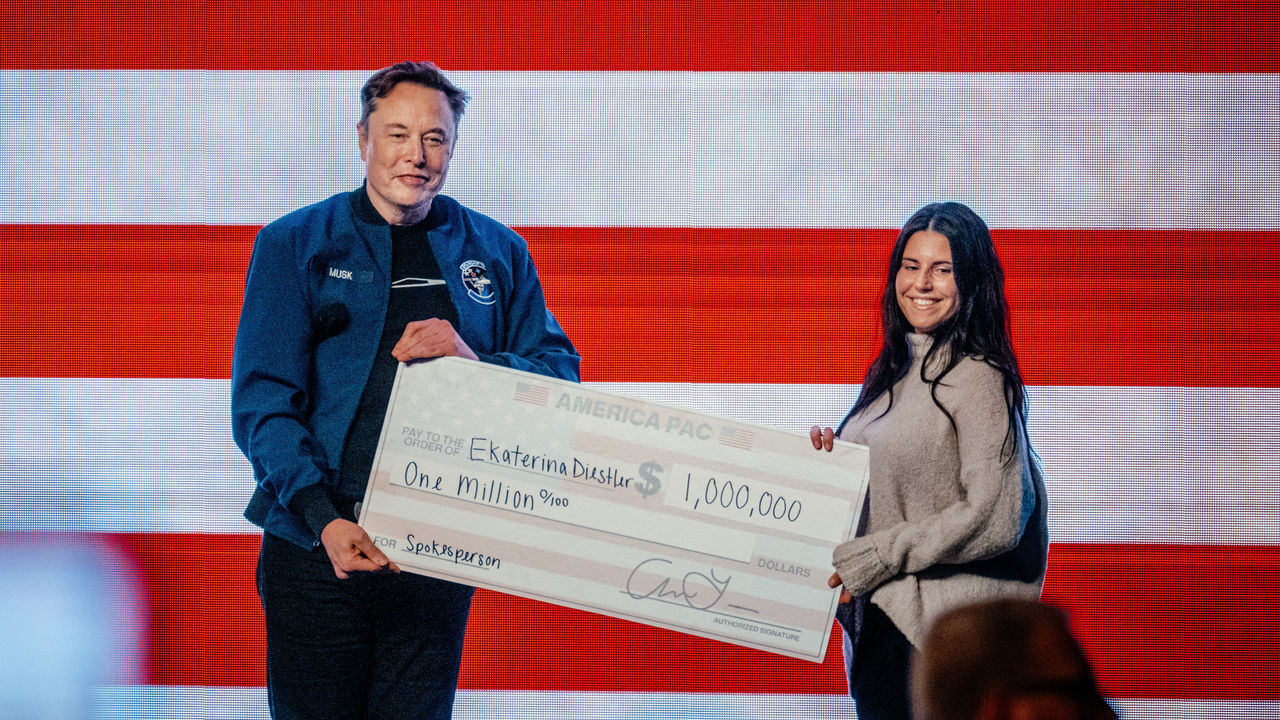

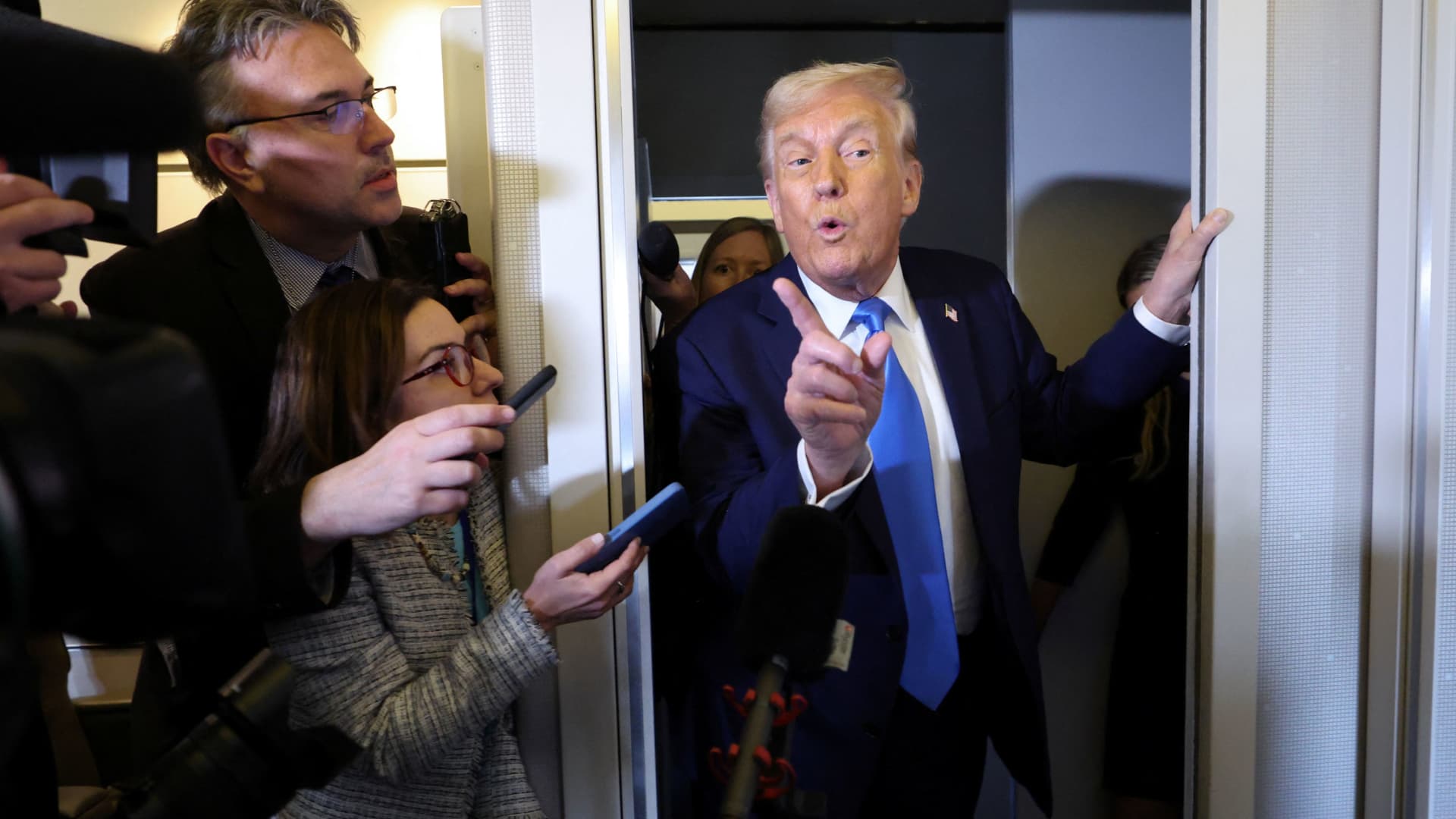

The second ill is conspiratorial thinking. The techniques of persuasion deployed by Simpson’s defence lawyers were a harbinger of those deployed by populists such as Donald Trump today. In effect, they urged the jurors to disregard the facts—Simpson’s blood was found at the crime scene, both victims’ blood was found in his car and in his house—and back the group they identify with. Just as Mr Trump has persuaded his supporters that all the criminal charges against him are cooked up by malign Democrats, so Simpson’s lawyers invited the jurors to imagine a nebulous conspiracy perpetrated by an institution they distrusted: the police. Someone else committed the murders and racist cops planted evidence to incriminate Simpson, they suggested.

One of the cops, Mark Fuhrman, had indeed used racial slurs in the past. But no actual evidence of a conspiracy was produced. Nonetheless, in a city where, only a couple of years before, three cops had been filmed savagely beating a black motorist, Rodney King, and were then acquitted of all charges, many African-Americans found the idea of one plausible.

Simpson’s lawyer fanned this notion with incendiary, them-and-us rhetoric. He likened Mr Fuhrman to Adolf Hitler, saying that Hitler won power because people didn’t try to stop him, and suggesting that it was the jurors’ duty to stand up to Mr Fuhrman before he took “all black people” and burned them.

Americans are less racist than they were in the 1990s. At the time of the Simpson trial, only half told Gallup, a pollster, that they approved of marriage between black and white people. Now 94% do. But conspiracism shows no sign of ebbing: half of Americans think President John F. Kennedy’s assassin had accomplices and a quarter think the billionaire financier George Soros has a secret plot to rule the world. Two of the three highest-polling presidential candidates this year, Mr Trump and Robert Kennedy junior, habitually dabble in conspiracy theories. If the lesson from the Simpson trial is that skilful demagogues can win over a big chunk of the public by inflaming divisions and “flood[ing] the zone with shit”, as a Trump adviser once put it, it has been well learned.■

Blog Post1 week ago

Blog Post1 week ago

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance5 days ago

Personal Finance5 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Accounting3 days ago

Accounting3 days ago

Economics5 days ago

Economics5 days ago