Accounting

AICPA wants Congress to change tax bill

Published

3 days agoon

The American Institute of CPAs is asking leaders of the Senate Finance Committee and the House Ways and Means Committee to make changes in the wide-ranging tax and spending legislation that was

In a

“While we support portions of the legislation, we do have significant concerns regarding several provisions in the bill, including one which threatens to severely limit the deductibility of state and local tax (SALT) by certain businesses,” wrote AICPA Tax Executive Committee chair Cheri Freeh in the letter. “This outcome is contrary to the intentions of the One Big Beautiful Bill Act, which is to strengthen small businesses and enhance small business relief.”

The AICPA urged lawmakers to retain entity-level deductibility of state and local taxes for all pass-through entities, strike the contingency fee provision, allow excess business loss carryforwards to offset business and nonbusiness income, and retain the deductibility of state and local taxes for all pass-through entities.

The proposal goes beyond accounting firms. According to the

The AICPA argued that SSTBs would be unfairly economically disadvantaged simply by existing as a certain type of business and the parity gap among SSTBs and non-SSTBs and C corporations would widen.

Under current tax law (and before the passage of the Tax Cuts and Jobs Act of 2017), it noted, C corporations could deduct SALT in determining their federal taxable income. Prior to the TCJA, owners of PTEs (and sole proprietorships that itemized deductions) were also allowed to deduct SALT on income earned by the PTE (or sole proprietorship).

“However, the TCJA placed a limitation on the individual SALT deduction,” Freeh wrote. “In response, 36 states (of the 41 that have a state income tax) enacted or proposed various approaches to mitigate the individual SALT limitation by shifting the SALT liability on PTE income from the owner to the PTE. This approach restored parity among businesses and was approved by the IRS through Notice 2020-75, by allowing PTEs to deduct PTE taxes paid to domestic jurisdictions in computing the entity’s federal non-separately stated income or loss. Under this approved approach, the PTE tax does not count against partners’/owners’ individual federal SALT deduction limit. Rather, the PTE pays the SALT, and the partners/owners fully deduct the amount of their distributive share of the state taxes paid by the PTE for federal income tax purposes.”

The AICPA pointed out that C corporations enjoy a number of advantages, including an unlimited SALT deduction, a 21% corporate tax rate, a lower tax rate on dividends for owners, and the ability for owners to defer income.

“However, many SSTBs are restricted from organizing as a C corporation, leaving them with no option to escape the harsh results of the SSTB distinction and limiting their SALT deduction,” said the letter. “In addition, non-SSTBs are entitled to an unfettered qualified business income (QBI) deduction under Internal Revenue Code section 199A, while SSTBs are subject to harsh limitations on their ability to claim a QBI deduction.”

The AICPA also believes the bill would add significant complexity and uncertainty for all pass-through entities, which would be required to perform complex calculations and analysis to determine if they are eligible for any SALT deduction. “To determine eligibility for state and local income taxes, non-SSTBs would need to perform a gross receipts calculation,” said the letter. “To determine eligibility for all other state and local taxes, pass-through entities would need to determine eligibility under the substitute payments provision (another complex set of calculations). Our laws should not discourage the formation of critical service-based businesses and, therefore, disincentivize professionals from entering such trades and businesses. Therefore, we urge Congress to allow all business entities, including SSTBs, to deduct state and local taxes paid or accrued in carrying on a trade or business.”

Tax professionals have been hearing about the problem from the Institute’s outreach campaign.

“The AICPA was making some noise about that provision and encouraging some grassroots lobbying in the industry around that provision, given its impact on accounting firms,” said Jess LeDonne, director of tax technical at the Bonadio Group. “It did survive on the House side. It is still in there, specifically meaning the nonqualifying businesses, including SSTBs. I will wait and see if some of those efforts from industry leaders in the AICPA maybe move the needle on the Senate side.”

Contingency fees

The AICPA also objects to another provision in the bill involving contingency fees affecting the tax profession. It would allow contingency fee arrangements for all tax preparation activities, including those involving the submission of an original tax return.

“The preparation of an original return on a contingent fee basis could be an incentive to prepare questionable returns, which would result in an open invitation to unscrupulous tax preparers to engage in fraudulent preparation activities that takes advantage of both the U.S. tax system and taxpayers,” said the AICPA. “Unknowing taxpayers would ultimately bear the cost of these fee arrangements, since they will have remitted the fee to the preparer, long before an assessment is made upon the examination of the return.”

The AICPA pointed out that contingent fee arrangements were associated with many of the abuses in the Employee Retention Credit program, in both original and amended return filings.

“Allowing contingent fee arrangements to be used in the preparation of the annual original income tax returns is an open invitation to abuse the tax system and leaves the IRS unable to sufficiently address this problem,” said the letter. “Congress should strike the contingent fee provision from the tax bill. If Congress wants to include the provision on contingency fees, we recommend that Congress provide that where contingent fees are permitted for amended returns and claims for refund, a paid return preparer is required to disclose that the return or claim is prepared under a contingent fee agreement. Disclosure of a contingent fee arrangement deters potential abuse, helps ensure the integrity of the tax preparation process, and ensures compliance with regulatory and ethical standards.”

Business loss carryforwards

The AICPA also called for allowing excess business loss carryforwards to offset business and nonbusiness income. It noted that the One Big Beautiful Bill Act amends Section 461(l)(2) of the Tax Code to provide that any excess business loss carries over as an excess business loss, rather than a net operating loss.

“This amendment would effectively provide for a permanent disallowance of any business losses unless or until the taxpayer has other business income,” said letter. “For example, a taxpayer that sells a business and recognizes a large ordinary loss in that year would be limited in each carryover year indefinitely, during which time the taxpayer is unlikely to have any additional business income. The bill should be amended to remove this provision and to retain the treatment of excess business loss carryforwards under current law, which is that the excess business loss carries over as a net operating loss (at which point it is no longer subject to section 461(l) in the carryforward year).

AICPA supports provisions

The AICPA added that it supported a number of provisions in the bill, despite those concerns. The provisions it supports and has advocated for in the past include

• Allow Section 529 plan funds to be used for post-secondary credential expenses;

• Provide tax relief for individuals and businesses affected by natural disasters, albeit not

permanent;

• Make permanent the QBI deduction, increase the QBI deduction percentage, and expand the QBI deduction limit phase-in range;

• Create new Section 174A for expensing of domestic research and experimental expenditures and suspend required capitalization of such expenditures;

• Retain the current increased individual Alternative Minimum Tax exemption amounts;

• Preserve the cash method of accounting for tax purposes;

• Increase the Form 1099-K reporting threshold for third-party payment platforms;

• Make permanent the paid family leave tax credit;

• Make permanent extensions of international tax rates for foreign-derived intangible income, base erosion and anti-abuse tax, and global intangible low-taxed income;

• Exclude from GILTI certain income derived from services performed in the Virgin

Islands;

• Provide greater certainty and clarity via permanent tax provisions, rather than sunset

tax provisions.

You may like

Accounting

PwC troubles in China deepen with exit of Hong Kong partners

Published

18 minutes agoon

June 2, 2025

PricewaterhouseCoopers’ troubles are now deepening in Hong Kong as the firm is wrestling with the consequences of its audits of China Evergrande Group.

Over the coming month, at least 10 partners in the city are poised to leave, adding to the 20 that have already exited the firm in the past six months, according to people familiar with the matter. On the Chinese mainland, some 77 partners have left their roles since December, according to filings with the unified supervision platform of the Chinese CPA profession.

Some of the partners are being let go because of business reasons while others are leaving voluntarily for early retirement or to join other firms, the people said, asking not be discussing confidential matters.

PwC declined to comment.

PwC China, locally known as Zhongtian, was

PwC China’s revenue dropped about 11% to 6.3 billion yuan in 2024, according to its website.

The exits underscore that the firm is also feeling the pain in Hong Kong from its China woes. PwC Hong Kong and China are legally separate partnerships, but operate in collaboration and effectively share the profit and loss of the business together, the people said.

The firm has 220 mainland partners, according to the Chinese Institute of Certified Public Accountants as of June 2. It had 250 partners in Hong Kong as of Dec. 31, 2024, according to a person familiar with the matter.

Last year, PwC global sent Hemione Hudson, a senior partner from the UK, to head the region. The firm has over the past months conducted internal business reviews, aiming to streamline and consolidate, the people said.

Losing clients

PwC has

Hong Kong’s market regulator, the Securities and Futures Commission, has switched its auditor from PwC to Deloitte, Hong Kong Economic Journal reported this week, citing unidentified sources.

Hong Kong’s audit regulator is still

The firm also

Enjoy complimentary access to top ideas and insights — selected by our editors.

This is my 600th weekly column being posted here. I am very grateful that I haven’t missed a week and that the ideas came, and the columns flowed. The first column was supposed to be one of about two dozen autobiographical experiences with takeaways for readers. I wanted to write what I’ve done with some sort of takeaway that would enable me to pay back my luck and success.

I wrote a dozen short columns and sent four or five to editors I knew with a memo of what they were about and how I wanted the written style to look like. I “developed” a particular writing style in a way that I thought would convey my feelings at the time of the event I wrote about. I gave this a lot of thought and even researched oddball writing styles to see if I was doing something totally off the wall. Specifically, I looked at William Faulkner and Gertrude Stein, but there were many others. With the confidence I was right, I sent them with a “demand” that I only wanted them published in that style. They all turned me down, and these were editors I knew and was writing for.

I was leaving an Accounting Today sponsored conference in 2013 with a few people when I was introduced to Michael Cohn, now the editor-in-chief of the web edition of Accounting Today. I gave him my spiel, and he said he would look at what I wrote. After I sent him what I wrote, he edited two of them into a more conventional style and sent me a draft of what he wanted to publish. Actually it read better with his changes so I gave the OK.

Since then, I have collaborated with Michael on 599 other columns, requiring regular contact. He is easy to work with, smart and a good editor/writer, and we never had any conflicts. Of my original 24 columns, about a dozen were published, with the others pushed aside for more relevant or timely topics, and the ideas kept coming. I have an inventory of over 200 column ideas (on a spreadsheet of course) which all seemed great when I thought of them, but newer ideas kept coming up. My inventory has many great ideas, but the ideas I used were better. Occasionally Daniel Hood picked up some columns for the monthly print edition and also occasionally some went viral on LinkedIn. But I seem to have developed steady followers who also email me comments or ideas or who call me with specific practice management issues they have.

Before these 600 columns, I posted 250 weekly answers to questions colleagues asked me on

In addition to these 850 MAP columns, I have written and posted 1,175 blogs at

I like writing and like having to come up with a topic each week, and I like how I examine and dissect everything I come across looking for something fresh to write about. However, things are changing for me and time is getting short, and I have other projects I want to pursue, including a series of two-minute videos for YouTube and Instagram that are easily accessible on mobile devices and new age media, a series of mini e-books, and some topics I want to research and write about.

Posting a weekly column for 16 and a half years here and on CPA Trendlines provided a platform for me to be influential in the profession and to help move the careers forward of many starting their careers in public accounting. That was a personal honor I am very appreciative and proud of.

Something has to give and hitting No. 600 here seems like a good time to move on to some new things. I’ll still be around and, if something strikes me where I want to offer or inject my opinion, you will be able to read it here. But for now, I will take a halt to delve into some new projects.

I thank you for reading these columns and the many thousands that contacted me with whom I interacted one-on-one these 11 and a half years and five years before them when I wrote the Q&As. You can also search the AccountingToday.com database and as long as you put “Mendlowitz+topic” you should be able to find some columns I posted about that topic. Try to be as specific as possible and you should be able to get something that would help you.

I am not going away. I am still at Withum and still at my laptop and will reply to everyone who emails me with a practice management concern they have. I will either email you something I posted or included in a speech handout, will call you, or will set up a short Zoom meeting to discuss your issue. I’ve been doing this my entire career and do not intend to stop now.

Thank you for reading these columns and being a part of my life the last 11 and a half years and a big thank you to Michael Cohn who has become a good friend.

All the best,

Ed

Enjoy complimentary access to top ideas and insights — selected by our editors.

The Internal Revenue Service, like other government agencies, is a target of thinning and deregulation under the Trump administration and the Department of Government Efficiency, formerly led by Elon Musk. With a new commissioner on the horizon, and everchanging guidelines, here are the latest moves from the IRS.

A campaign to grant Immigration and Customs Enforcement agents

In exchange for ICE’s provision of a person’s name, address and deportation order date, the IRS can release taxpayer data — but only for non-tax criminal matters.

Read more:

The IRS has gone through a host of acting commissioners since Donald Trump took office and following the resignation of

After O’Donnell was

Shapely held the role for two days, ceding it to present acting IRS Commissioner

These moves, combined with mass layoffs, have created an air of uncertainty at the IRS.

According to a

“There have been news reports about audits that are in process or that are even close to being wrapped up being canceled because members of that audit team were let go and they just didn’t have the staff to carry them on,” Anne Gibson, a senior legal analyst at Wolters Kluwer, told Accounting Today. “I imagine we’ll see more of that.”

Read more:

Below are noteworthy changes from the IRS and what accountants need to know.

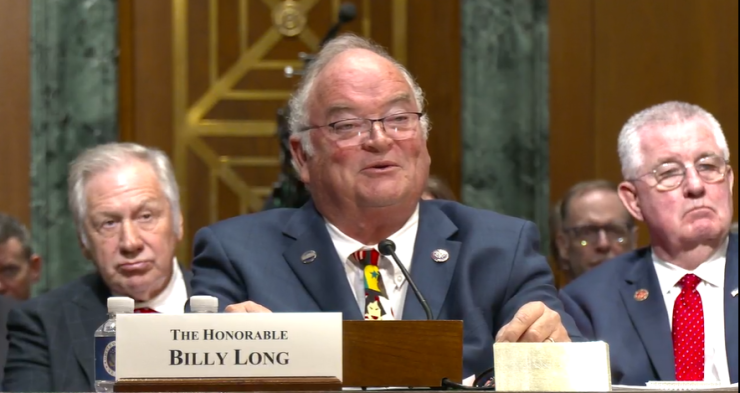

IRS lead nominee Billy Long grilled by Senate Finance panel

Billy Long, the Trump nominee for IRS commissioner, faced probing questions from the Senate Finance Committee on monetary sums earned from promoting tribal tax credits and a failed 2022 Senate campaign, his plans for the agency if confirmed and more.

The former Republican congressman’s

“I am eager to implement the necessary changes to maximize our effectiveness while also remaining transparent with both Congress and taxpayers,” Long said in his opening statement. “It is important to also recognize the dedicated professionals currently at the IRS whose hard work too often goes unnoticed.”

Read more:

Samuel Corum/Bloomberg

DOGE cuts oust roughly one-third of IRS auditors

Between layoffs and deferred resignations under the Department of Government Efficiency, the IRS has parted ways with roughly 31% of its auditors.

This announcement follows in the wake of the

Findings from the Treasury Inspector General for Tax Administration’s

Read more:

IRS falls short of improper payment rate benchmark

A

The 2019 act’s goal directs the IRA to reduce improper payment rates to less than 10% for four refundable tax credits — the Additional Child Tax Credit, the American Opportunity Tax Credit, the Earned Income Tax Credit and the Net Premium Tax Credit. For the 2024 fiscal year, improper payments for the four credits amounted to roughly $21.4 billion.

The rates for each were 29% for the Net Premium Tax Credit, 28% for the AOTC, 27% for the EITC and 11% for the ACTC.

Read more:

IRS to slightly raise HSA limits for 2026

IRS executives said the agency will

Individuals with self-only coverage tied to a high-deductible health plan have an annual limitation of $4,400 for the 2026 calendar year, which is a $100 bump from 2025’s limit.

Other noteworthy increases include the $8,750 annual limitation for individuals with family coverage under a high-deductible health plan and the limits for what defines a high-deductible health plan, which have deductibles not less than $1,700 for self-only coverage (up $50 from 2025) or $3,400 for family coverage (from $3,300 in 2025), and for which annual out-of-pocket expenses (but not premiums) are less than $8,500 for self-only coverage (up $100 from this year) or $17,000 for family coverage (up from this year’s $16,600).

Read more:

Stefani Reynolds/Bloomberg

IRS crackdown on high-income non-filers needs improvement

Officials with the Treasury Inspector General for Tax Administration found that IRS “sweeps” that uncovered instances of high-income people not filing taxes were more productive than their non-sweep counterparts, both in terms of closure rate and dollars collected.

The TIGTA

“When people don’t file a tax return they’re required to, it’s not fair to those hardworking taxpayers who responsibly do their civic duty under the laws of our nation,” Danny Werfel, former IRS commissioner, said during a press call last year. “When people don’t file their taxes, they need to know there’s a consequence, [and] this is why I was particularly troubled to learn when I became commissioner that the IRS had to back off our core compliance work on non-filers.”

Read more:

PwC troubles in China deepen with exit of Hong Kong partners

People cooking at home at highest level since Covid, Campbell’s says

Art of Accounting: My 600th and final column

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoHow appealing property taxes can benefit new homeowners

-

Blog Post1 week ago

Blog Post1 week agoHow to Implement Internal Controls to Prevent Business Fraud

-

Economics1 week ago

Economics1 week agoMAGA: protecting the homeland from Canadian bookworms

-

Economics5 days ago

Economics5 days agoElon Musk says Trump’s spending bill undermines the work DOGE has been doing

-

Personal Finance1 week ago

Personal Finance1 week agoHow to pay college tuition bills with your 529 plan

-

Economics6 days ago

Economics6 days agoHow young voters helped to put Trump in the White House

-

Accounting5 days ago

Accounting5 days agoHighest paid jobs in corporate accounting

-

Economics1 week ago

Economics1 week agoTrump greenlights Nippon merger with US Steel