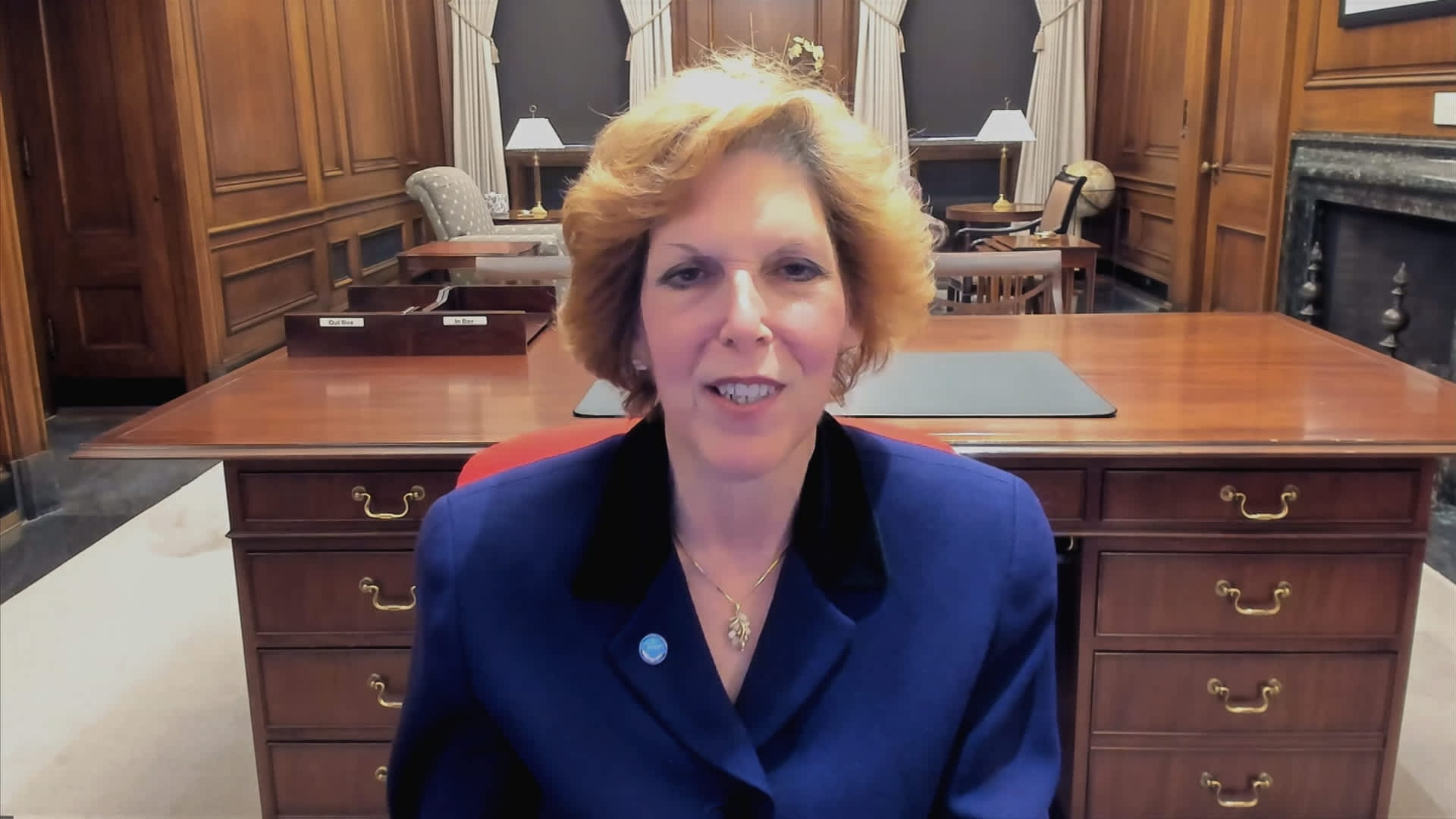

Cleveland Federal Reserve President Loretta Mester said Tuesday she still expects interest rate cuts this year, but ruled out the next policy meeting in May.

Mester also indicated that the long-run path is higher than policymakers had previously thought.

The central bank official noted progress made on inflation while the economy has continued to grow. Should that continue, rate cuts are likely, though she didn’t offer any guidance on timing or extent.

“I continue to think that the most likely scenario is that inflation will continue on its downward trajectory to 2 percent over time. But I need to see more data to raise my confidence,” Mester said in prepared remarks for a speech in Cleveland.

Additional inflation readings will provide clues as to whether some higher-than-expected data points this year either were temporary blips or a sign that the progress on inflation “is stalling out,” she added.

“I do not expect I will have enough information by the time of the FOMC’s next meeting to make that determination,” Mester said.

Those remarks come nearly two weeks after the rate-setting Federal Open Market Committee again voted to hold its key overnight borrowing rate in a range between 5.25%-5.5%, where it has been since July 2023. The post-meeting statement echoed Mester’s remarks that the committee needs to see more evidence that inflation is progressing toward the 2% target before it will start reducing rates.

Mester’s comments would seem to rule out a cut at the April 30-May 1 FOMC meeting, a sentiment also reflected in market pricing. Mester is a voting member of the FOMC but will leave in June after having served the 10-year limit.

Futures traders expect the Fed to start easing in June and to cut by three-quarters of a percentage point by the end of the year.

While looking for rate cuts, Mester said she thinks the long-run federal funds rate will be higher than the long-standing expectation of 2.5%. Instead, she sees the so-called neutral or “r*” rate at 3%. The rate is considered the level where policy is neither restrictive nor stimulative. After the March meeting, the long-rate rate projection moved up to 2.6%, indicating there are other members leaning higher.

Mester noted the rate was very low when the Covid pandemic hit and gave the Fed little wiggle room to boost the economy.

“At this point, we are seeking to calibrate our policy well to economic developments so we can avoid having to act in an aggressive fashion,” she said.

Blog Post1 week ago

Blog Post1 week ago

Economics6 days ago

Economics6 days ago

Economics1 week ago

Economics1 week ago

Accounting6 days ago

Accounting6 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics7 days ago

Economics7 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Personal Finance6 days ago

Personal Finance6 days ago