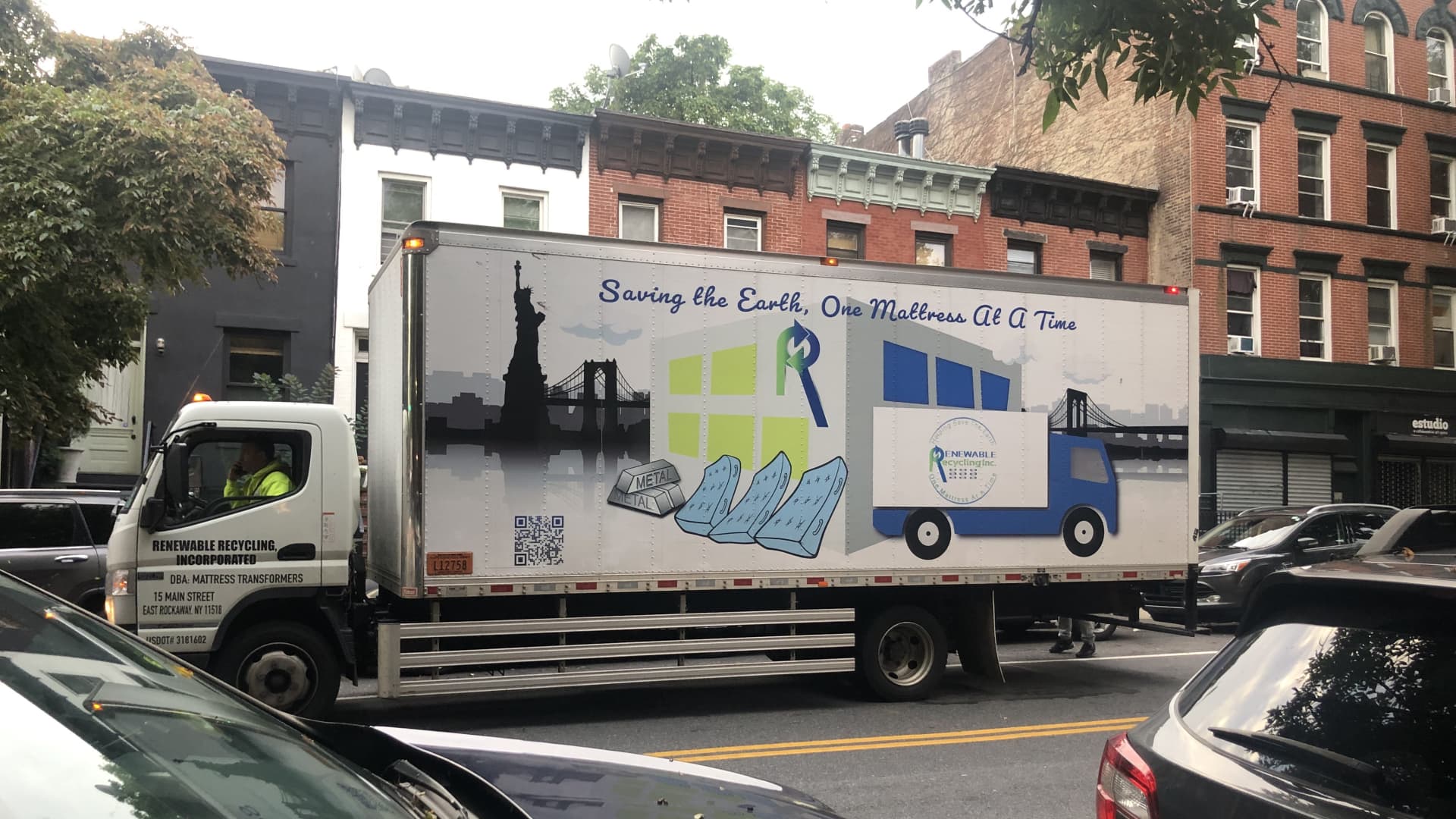

The author paid a company, Renewable Recycling, to pick up and recycle his queen-size mattress in New York City.

Greg Iacurci

I paid $95 to recycle a mattress.

It may sound odd, silly even, to pay so much to dispose of a run-of-the-mill household item.

But the economics of mattress recycling illustrate why it can be difficult — and costly — to be an eco-friendly consumer in the U.S.

Americans discard about 15 million to 20 million mattresses each year, according to the Mattress Recycling Council. That’s an average of about 50,000 per day.

Most end up in a landfill, experts said.

Mattresses are “one of the hardest things to recycle,” said Alicia Marseille, a sustainability and circular economy expert at Arizona State University.

“It’s a massive waste stream,” she said.

‘It’ll probably be there for hundreds of years’

Mattresses at a garbage dump.

Robert Brook | Corbis | Getty Images

My mattress — a queen-sized hand-me-down from family and probably close to two decades old — was in desperate need of replacement. The average mattress has a lifespan of about 14 years, from manufacture to consumer disposal, according to MRC.

But what to do with it?

I live in Brooklyn, where residents can dispose of a mattress for free as part of routine trash pickup.

As someone who meticulously tries to cut waste in everyday life — avoiding single-use plastics, composting food scraps — it was painful to think of mine wasting away in a landfill.

“If you put your mattress in a landfill, it’ll probably be there for hundreds of years, just sitting there,” said Meg Romero, the recycling and litter control superintendent for Charles County, Maryland.

Surely, I can find a new home for it instead, I thought.

Wrong.

After two weeks of unsuccessful dispatches to local homeless shelters, organizations like The Salvation Army and Goodwill, and community forums like Buy Nothing and The Freecycle Network, I’d exhausted my patience for a free-giveaway option.

Individuals who donate a mattress to certain groups may be able to claim a tax deduction for its fair market value on their federal tax return. Taxpayers would need to itemize their deductions to benefit.

Did I neglect to reach out to some interested parties? Probably. Might someone else have different results? Yes. But my personal cost-benefit analysis dictated that it was time to ditch donations.

I researched some recycling options, and selected Renewable Recycling Inc., based in East Rockaway, New York. There are few other U.S. companies that do such work, experts said. A directory compiled by MRC lists just 55.

How a mattress is recycled

Mattresses are picked up and placed into a truck to be hauled to a recycling facility at the Prima Deshecha landfill in San Juan Capistrano, California, on March 10, 2022.

Mark Rightmire/MediaNews Group/Orange County Register via Getty Images

More than 75% of a mattress is recyclable, according to MRC. Some companies put it at closer to 90%.

Recyclers strip them of materials like wood, steel, and various foams and fibers, and sell them into secondary markets.

The materials are then re-purposed: Shredded foam and fibers as carpet padding, animal beds or insulation; wood as mulch and fuel; and springs as scrap steel, for example.

“If you can recycle, it will give those materials another life to be used as something else,” said Romero of Charles County, which launched a mattress recycling program for residents on Aug. 1.

More from Personal Finance:

How EVs and gasoline cars compare on total cost

Here’s how to buy renewable energy from your electric utility

8 easy — and cheap — ways to cut your carbon emissions

That re-use has other environmental benefits. For example, there’s a reduced need to extract or source new materials for manufacturing, which cuts greenhouse gas emissions and water and energy use, experts said.

Unusually, the Charles County service is largely free for residents. They can bring two items a day — like a mattress and box spring — to the Charles County Landfill for recycling for no charge. Additional items cost $10 per piece.

Residents recycled more than 900 mattresses in September, over double officials’ estimates, Romero said. The county contracts with a Baltimore-based company, Deco Solutions, to manage the process.

Charles County’s motivations weren’t purely environmental, though.

Mattresses are bulky, taking up precious real estate in the county landfill, Romero said.

“A landfill is a limited, finite space,” said Peter Conway, the president of Spring Back Colorado, a recycler based in Commerce City. “They want to put things that break down, things that are easily compactible.”

“Mattresses are kind of the antithesis of that,” Conway said. He expects to divert 8 million pounds of waste from Colorado landfills this year.

Why mattress recycling can be expensive

Shredded old mattress materials.

Guillaume Souvant | Afp | Getty Images

The $95 fee I ultimately paid to Renewable Recycling is “pretty standard” among mattress recyclers, Conway said.

The expense covered mattress pickup from my Brooklyn apartment and transport to the company’s warehouse in Oceanside, New York. (I could have saved $55 by dropping off the mattress myself, but I don’t own a car.)

Spring Back Colorado also charges $40 for each mattress and box spring that a consumer drops off. An additional fee of $60 or more applies, depending on the travel distance, if a consumer asks for home pickup.

Mattresses are harder to recycle than other items like plastic bottles, aluminum cans and cardboard, said Romero, of Charles County.

“They’re all made completely differently,” Romero said. “There’s no uniform construction, and there are several different types of materials used to make one mattress.”

The process is more time- and labor-intensive, she said. Often, workers must break them down by hand.

For example, cotton remnants must be picked off steel mattress springs before it can be shredded or baled for sale to scrap markets, according to the Mattress Recycling Council. Staples also need to be removed from wood frames before going to market, it said. Each coil in a “pocket coil mattress” is individually wrapped in fabric and must be separated, Romero said.

‘Razor-thin margins’

Additionally, mattress materials yield only “modest revenues” when sold, Reid Lifset, a research scholar and resident fellow in industrial ecology at Yale School of the Environment, wrote in an e-mail.

Those revenues often depend on fluctuating commodity prices.

“We don’t set the price for a ton of foam or steel,” Conway said. “One day we might get 18 cents a pound and the next week only get 10 cents.”

If you put your mattress in a landfill, it’ll probably be there for hundreds of years, just sitting there.

Meg Romero

recycling and litter control superintendent for Charles County, Maryland

There must also be a market demand for those commodities — and sometimes those markets aren’t nearby, adding to shipping costs.

For example, Spring Back Colorado used to send all its foam and ticking to a recycling center in California, Conway said. It cost the company about $2,000 to ship each truck load.

About a year ago, that California partner stopped accepting shipments: Demand had dried up for material, Conway said. He called companies as far afield as Mexico, Canada, India and Egypt to find alternative placement, but ultimately found a new partner in Texas, he said.

“It’s pretty razor-thin margins we operate on,” Conway said.

Spring Back Colorado earns additional revenue from mattress pickups and drop-offs, and from partnerships with businesses and municipalities, he said.

“Someone has to pay,” said Marseille, of Arizona State University. “It usually falls to consumers.”

Consumer fees subsidize recycling efforts

Kosamtu | E+ | Getty Images

Some states and municipalities are making it more cost-effective for consumers to recycle their mattresses.

For example, Charles County, Maryland, funds its fledgling mattress program largely with taxpayer money. About $150 of residents’ taxes are allocated to the county’s Environmental Resources division each year, for services like curbside recycling, disposal of yard waste, oil and anti freeze — and now mattress recycling, Romero said.

Three states — California, Connecticut and Rhode Island — have enacted mattress recycling laws since 2013. A similar program in Oregon is launching Jan. 1, 2025.

The laws require the mattress industry to develop and administer state programs to collect and recycle discarded mattresses for free.

The initiative is funded by consumers, though.

Someone has to pay. It usually falls to consumers.

Alicia Marseille

sustainability and circular economy expert at Arizona State University

Individuals and institutions (like hotels and dormitories) in such states pay a fee each time they buy a mattress: $10.50 in California, $11.75 in Connecticut, $20.50 in Rhode Island and $22.50 in Oregon, said Amanda Wall, a spokesperson for the Mattress Recycling Council. MRC is a nonprofit created by the International Sleep Products Association, a mattress industry trade group, to build and run these state programs.

Retailers forward those fees to MRC, which funds the consumer recycling efforts. Ultimately, the fees subsidize free mattress drop-off and recycling at any MRC-funded collection site in participating states, Wall said. (Recyclers can still charge a fee for mattress pickup, she said.)

The mattress industry has pushed for similar legislation in New York, Massachusetts, Maryland and Virginia this year, and plans to keep working with these state legislatures in 2025, Wall said.

The laws are an example of “extended producer responsibility” policies states have adopted more broadly, forcing companies to bear some end-of-life responsibility for their products, said Marseille.

Some question whether consumers shoulder too much of the burden right now.

“Companies aren’t making, for the most part, more easy-to-recycle products,” Conway said. “It’s on the consumer to figure out how to responsibly get rid of their items in a conscious way.”

He thinks it needs to be easier and more affordable for consumers to recycle to promote that behavior.

“At the end of the day, if you have two options, and one is throw it in a hole in the ground, and the other is recycle it, 95% of the people will go with that cheaper option,” Conway added.

Blog Post7 days ago

Blog Post7 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago

Finance1 week ago