Public accounting is a vibrant and strong profession and also a business.

The following is some data I abstracted from the Accounting Today March 2025 listing of the Top 100 Firms with my take on what they indicate.

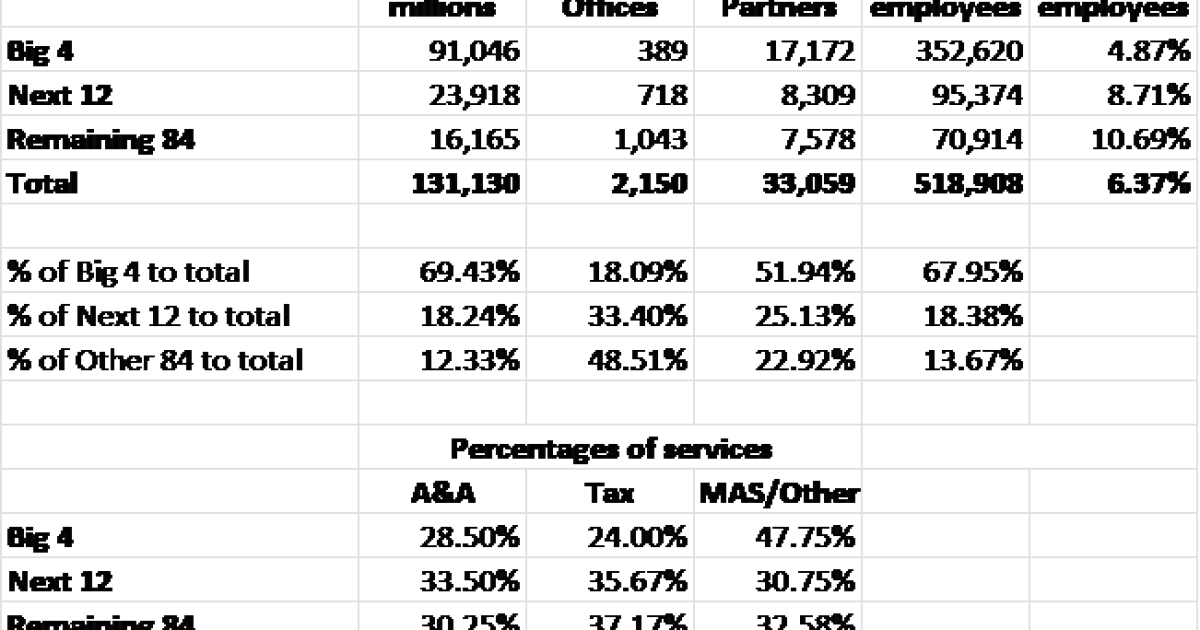

The totals are revealing, but I wanted to see how the smaller firms are faring against the larger firms. When I did my analysis, I decided there are three groupings that make sense in providing a better picture of the Top 100. I broke the firms into the Big Four, which are a totally different world than the others and whose numbers distort the results for the Top 100. I then distinguished the next group of practices with over $1 billion in revenues last year, and there were 12 such firms. The balance is made up of the remaining 84 firms. While the firms in each group varied greatly, I believe the information shown provides interesting information that can be used to better measure the firm’s performance and back up some of the conclusions I reached.

The revenues of the Big Four were 69% and the next group 24% of the total. This left the remaining 84 firms with 12% of the total. The partners in the Big Four represented 5% of their total personnel, while for the next 12 it was about 8.7% and the remaining 84 it was 10.7%. This indicates that the 12 firms with over a billion in revenues had a partner-to-staff ratio much closer to smaller 84 than the larger Big Four. I also came up with the revenues per partner in my chart, and there were gigantic differences in the three groups, but with the 12 much closer to the smaller group. This makes sense with the much smaller numbers of partners in the Big Four. I don’t think the number of offices is a significant measure, except the larger firms would have more offices than the smaller ones. The ground rules for the rankings and details are in the March 2025 Accounting Today report.

The breakout of the total employees was fully proportionate with the revenues for all groups, indicating a relationship between the number of employees and the revenues. While the revenue per partner was significantly greater for the Big Four, the revenue per employee was not considerably different. The Big Four was a little over $7,000 per employee greater than the group of 12, and that group was about 10% greater than the remaining 84. I view this as a pricing, cost and efficiency measure. Considering the much greater size of the top two groups, I do not see the smaller firms doing badly in this regard.

One reason why this may be so could be that the larger practices have a higher pay scale with greater benefits, more costly layers of management and review, and the pressure of containing fees on the more traditional services of auditing and tax compliance. Also, in smaller firms, many of the client relationship partners perform higher-level tax and audit planning and review in place of spending a great deal of their time managing the client relationships. I know many smaller firms are more focused on providing added high-value advisory service that the larger firms treat as added product lines with the same built-in infrastructure costs they have for the audit and tax compliance.

All three groups perform the same general percentage of A&A work while the Big Four perform, as a percentage of their total services, much lower tax work. I added the MAS, CAS and other services together as different firms report these differently. In doing so, the Big Four run away with this, but the smaller grouping is outperforming the Next 12 group. It would seem that the group of 12 would be mimicking the Big Four in the nontraditional services, but instead they are behind the smaller group. Since private equity is entering the playing field, they might see opportunities in the growth of advisory services, but it may be that the existing partner group is performing to the best of their ability and perhaps that opportunity does not exist. I know partners and senior staff in many firms in the 96, and the really successful partners are supercharged with focused experience in niche areas, making them “go-to” people commanding top fees and a flood of referrals. These people are really great and, because they are with smaller practices, they generate a higher proportion of the revenue for their firms. The Big Four compete with large advisory firms and that squeezes fees, while the “experts” in the smaller practices literally have no serious competition regarding their pricing.

The numbers I came up with present a lot of questions. I’ve alluded to some of them, and I am sure readers will have more. That is a benefit of analyzing aggregate data and breaking it down. I have been doing this my entire career and have developed great relationships with my clients.

A further observation about the Top 100 numbers is that the average revenues of the bottom five (No. 96 to 100) are $64.5 million and the total employees are 312. I do not want to pass any judgment with these numbers but wish to point out that while these are substantial accounting practices, they are relatively small businesses. I averaged the five firms since the 100th on the list appears to be an outlier with much fewer employees. The Accounting Today report includes a listing of 45 “Beyond the Top 100: Firms to Watch.” The last firm on that list has revenues of $38 million with 170 employees, an even smaller business. It is believed that public accounting comprises about 45,000 firms, with about a couple hundred being large businesses. I see this as an opportunity for smaller firms to grow while limiting opportunities for larger firms to grow organically.

I hope you find the above interesting and have followed the process I used to look beyond the chart and come up with helpful observations. This process can be easily applied to your business clients.

Do not hesitate to contact me at [email protected] with your practice management questions or about engagements you might not be able to perform.

Blog Post3 days ago

Blog Post3 days ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Accounting1 week ago

Accounting1 week ago

Economics7 days ago

Economics7 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Finance7 days ago

Finance7 days ago