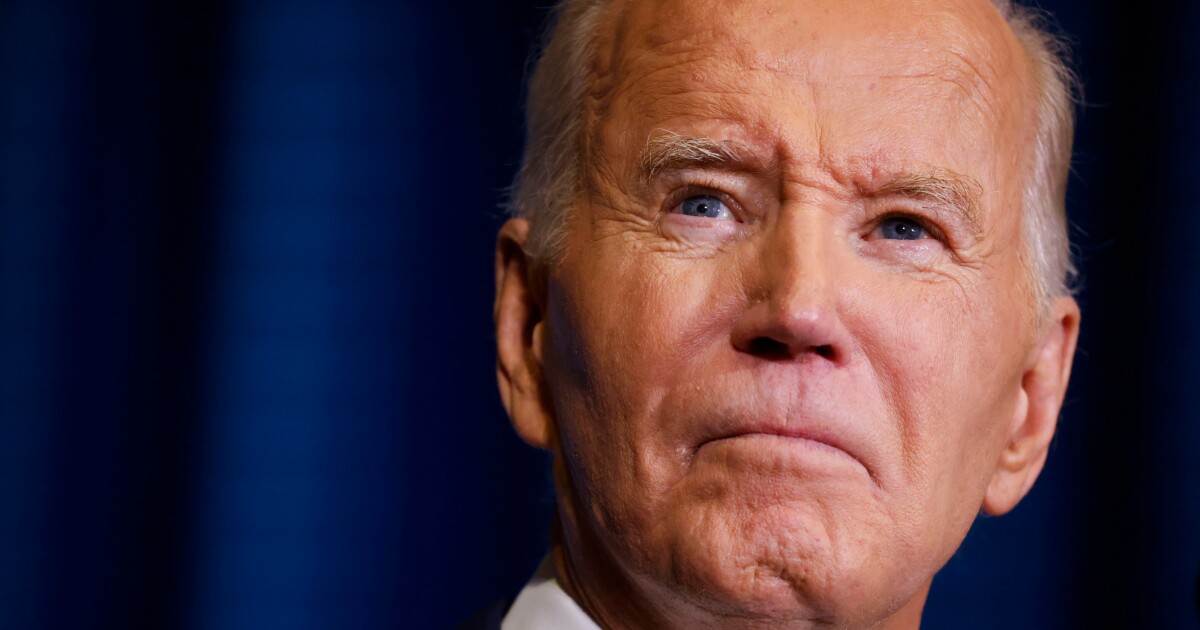

President Joe Biden warned that Republican Donald Trump’s plans to extend tax cuts and reshape global trade through tariffs risked reversing economic gains, even as dissatisfaction with his own handling of the economy contributed to last month’s stinging electoral loss.

Biden, speaking at an event Tuesday at the Brookings Institution, sought to reverse perceptions of his economic performance, arguing his policies had worked to help Americans recover from the shocks of the COVID-19 pandemic.

“Most economists agree the new administration is going to inherit a fairly strong economy, at least at the moment,” Biden said in an address at the think-tank in Washington. “It is my profound hope that the new administration will preserve and build on this progress.”

That’s unlikely, after Trump vowed dramatic change to economic policy on the campaign trail, helping propel his return to the White House and Republican control of both chambers of Congress. The defeat of Vice President Kamala Harris, who entered the race with just months before Election Day after Biden stepped aside, underscored dissatisfaction with his post-pandemic tenure among the electorate.

Still, the president argued that his policies have planted the seeds that will grow the economy in a way that bolsters working and middle-class families and warned that those gains could be imperiled if Trump enacts tax cuts for the wealthy, cuts entitlement program spending, rolls back investments in infrastructure and levies fresh tariffs. He also warned that a retreat from free trade policies threatened to allow adversaries to take a greater role shaping the world.

“I believe this approach is a major mistake,” Biden said.

“If we do not lead the world, who does?,” he added.

Biden jabbed at Trump over many of the Republican’s first-term policies, saying that tax cuts he implemented had benefited the wealthy and seeking to draw a contrast with his own agenda, touting measures to help expand access to health insurance and a push to expand the child tax credit.

“The previous administration, quite frankly, had no plan, real plan, to get us through one of the toughest periods in our nation’s history,” Biden said, referring to the COVID-19 pandemic.

Focus on legacy

Tuesday’s event had the tone of a valedictory address, as Biden spoke to a largely friendly audience of economists, consumer advocates and business and labor leaders. But Biden acknowledged that outside the room, many remained wary of his handling of the economy.

“I know it’s been hard for many Americans to see, and I understand it,” Biden said.

Biden cited 16 million new jobs, the lowest average unemployment rate of any administration in the last 50 years, 20 million applications for new business and a stock market “at record highs” to defend his economic playbook.

“401(k)s are up, more than a trillion dollars in private sector investment in clean energy and advanced manufacturing in just two years alone. After decades of sending jobs overseas for the cheapest labor possible, companies are coming back to America, investing and building here and creating jobs here in America,” Biden said.

And he said that inflation — which fueled much of the public angst over his economic agenda — was “coming down faster than almost anywhere in the world.”

But also evident was a sense of frustration from Biden that his record had not been celebrated. At one point, Biden noted that Trump as president had sent out stimulus checks during the pandemic with his signature on them.

“I also learned something from Donald Trump. He signed checks for people,” Biden said. “And I didn’t.”

Trump plans

Trump has vowed to undo many of the hallmark policies of Biden’s tenure, including elements of the Inflation Reduction Act, a sweeping tax and climate package, and the Chips and Science Act, which provides billions in incentives to bolster domestic chip manufacturing and reduce U.S. reliance on Asia.

Most notably, Trump has said he would scrap an electric vehicle tax credit, part of a Biden push to transition the U.S. to cleaner energy that fueled anxiety among blue-collar workers worried about its impact on jobs.

Trump has also derided the Chips Act subsidies as a bad deal that is costing the U.S. billions. Republican lawmakers, who will control both the House and Senate, may look to claw back funding from laws Biden signed.

Biden said the investments his administration backed had helped both Republican and Democratic states and predicted that GOP lawmakers would buck at efforts to undo projects in their communities.

Messaging challenge

Tuesday’s speech highlights how Biden, and Harris after she replaced him atop the Democratic ticket, struggled to translate positive economic data into support at the polls.

During his own campaign, Biden briefly embraced the term “Bidenomics” — coined by his critics to disparage his approach — and crisscrossed the country to highlight domestic manufacturing, clean energy and infrastructure investments from legislation he signed, arguing that they were bringing high-paying jobs. But those efforts failed to reverse the negative perceptions of his handling of the economy.

Harris in her campaign struggled to distance herself from Biden even as she sought to assure voters that she would be more attuned to helping middle- and working-class families deal with high costs.

Blog Post1 week ago

Blog Post1 week ago

Economics1 week ago

Economics1 week ago

Finance1 week ago

Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance7 days ago

Personal Finance7 days ago

Personal Finance1 week ago

Personal Finance1 week ago