The American Institute of CPAs teamed up with the National Association of State Auditors, Comptrollers and Treasurers on a joint report calling attention to the urgent...

The Financial Accounting Standards Board has decided to tweak some of its standards related to contract assets and liabilities for construction contractors in response to recommendations...

The days of the individual retirement account “stretch” are long gone. But the appeal of Roth conversions is enduring — especially under the current tax rates....

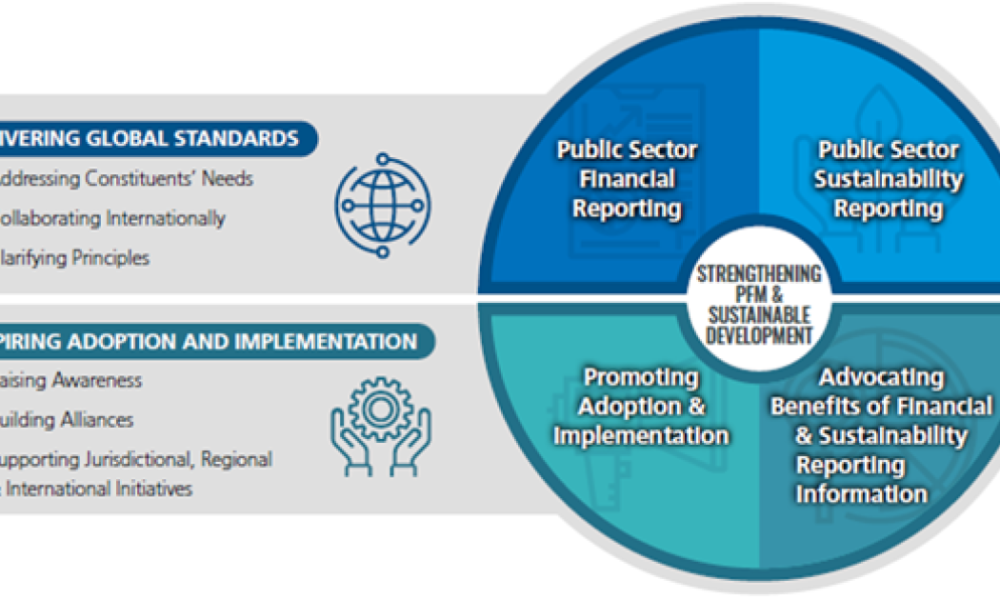

The International Public Sector Accounting Standards Board issued its updated five-year strategy and work program. The 2024-2028 Strategy and Work Program builds on the foundation of...

Christopher Dilts/Bloomberg Donald Trump said he’d consider exempting police officers, firefighters, active duty military and veterans from paying taxes, the Republican nominee’s latest campaign trail idea...

Enjoy complimentary access to top ideas and insights — selected by our editors. Most accountants have just completed their tax season for last year’s returns and...

Preparer Tax Identification Number renewal season is underway for all tax professionals Tax professionals and Enrolled Agents must have a valid PTIN to prepare any federal...

In today’s fast-paced, digital environment, businesses have an abundance of bookkeeping software options to choose from. However, not all platforms are equally suited to every organization’s...

Maintaining well-organized financial records is essential for both individuals and businesses. A robust record-keeping system ensures accountability, aids in financial planning, supports legal compliance, and prepares...

The Governmental Accounting Standards Board issued guidance today that will require separate disclosures for certain types of capital assets for the purposes of note disclosures. GASB...