It’s no secret that more and more CPAs are offering financial services to their clients. In fact, financial planning questions now have a greater emphasis on...

The Internal Revenue Service reportedly intends to reinstate thousands of probationary employees who were fired after two courts ordered it to do so. IRS acting commissioner...

The requirements for the Clean Vehicle Credit seemed a little complicated when they were introduced in the Inflation Reduction Act in 2022, and they are proving...

An aggressive suite of tariffs announced Wednesday by President Donald Trump will significantly complicate the Federal Reserve’s job as it struggles to quash inflation and avoid...

External auditors have long been tasked with ensuring financial integrity, detecting fraud and providing an independent opinion on a company’s financial statements. Now, with the rise...

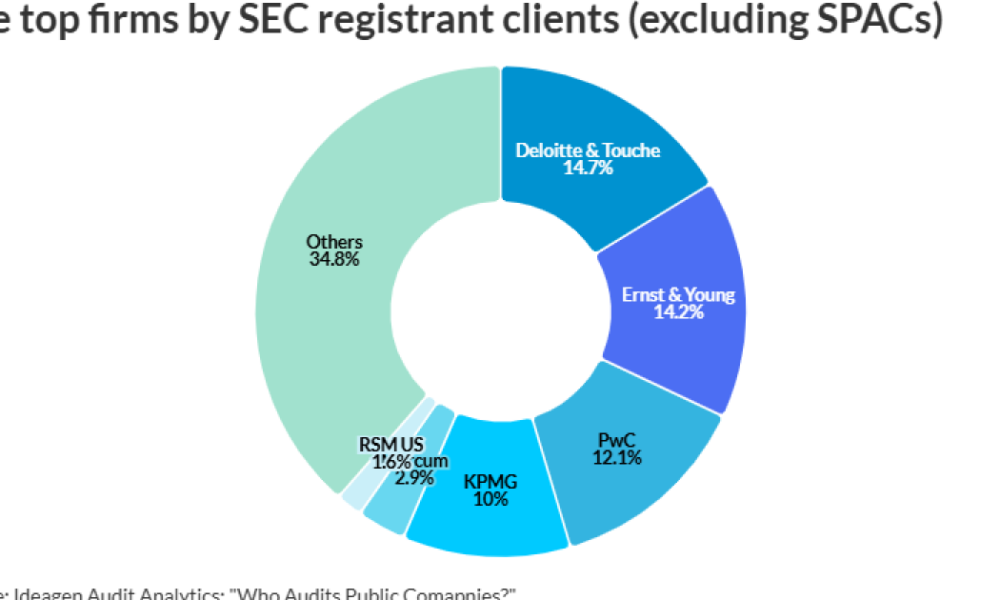

The top accounting firms lost a piece of market share for public company audits in 2024. The 10 firms with the most Securities and Exchange Commission...

External auditors have long been tasked with ensuring financial integrity, detecting fraud and providing an independent opinion on a company’s financial statements. Now, with the rise...

Senate Republicans unveiled a budget blueprint designed to fast-track a renewal of President Donald Trump’s tax cuts and an increase to the nation’s borrowing limit, ahead...

Financial advisors and clients worried about stock volatility and inflation can climb bond ladders to safety — but they won’t find any, if those steps lead...

Loan applicants and mortgage companies often rely on an Internal Revenue Service that’s dramatically downsizing to help facilitate the lending process, but they may be in...