Enjoy complimentary access to top ideas and insights — selected by our editors. This is my 600th weekly column being posted here. I am very grateful...

Enjoy complimentary access to top ideas and insights — selected by our editors. The Internal Revenue Service, like other government agencies, is a target of thinning...

PKF O’Connor Davies, a Top 25 Firm based in New York, is adding Rainer & Co., a firm based in Philadelphia. Financial terms of the deal...

The American Institute of CPAs is asking leaders of the Senate Finance Committee and the House Ways and Means Committee to make changes in the wide-ranging...

KPMG anoints next management committee; Ryan forms Tariff Task Force; and more news from across the profession.

In the world of depreciation planning, one small timing detail continues to fly under the radar — and it’s costing taxpayers serious money. Most people fixate...

South Africa’s case against executives in the biggest corporate fraud in the country’s history will be moved to a higher court for complex criminal trials, with...

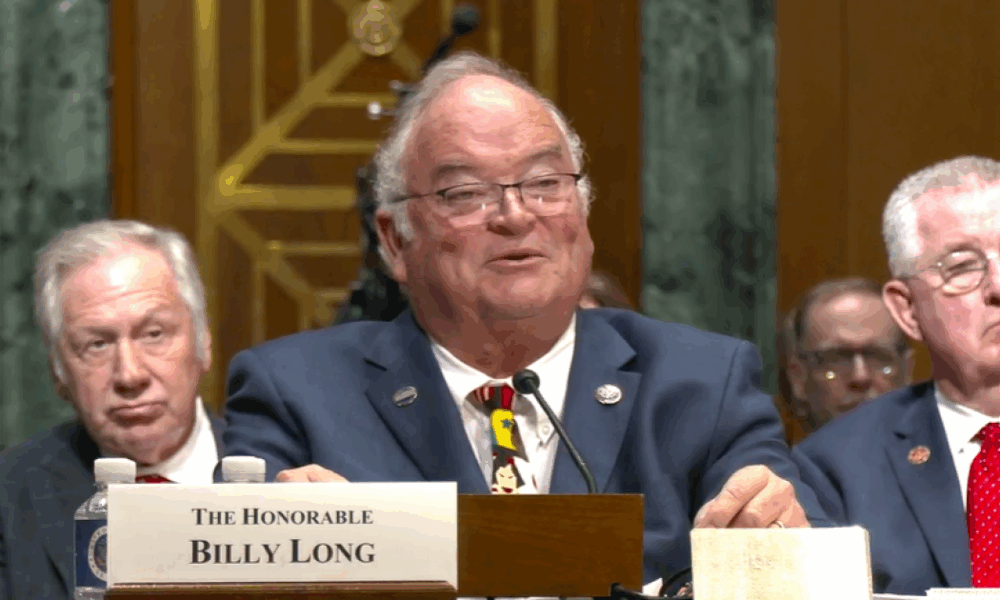

Buried deep in the more than 1,000-page tax-and-spending bill that President Donald Trump is muscling through Congress is an obscure tax measure that’s setting off alarms...

Generative AI has improved to the point where it is now capable of producing fake documents realistic enough to fool automated systems, creating new opportunities for...

Karbon, a provider of accounting practice management software, announced the appointment of Twyla Verhelst as Vice President of Industry Relations and Community. She will spearhead Karbon’s...