U.S. executives are shifting to long-term U.S.-focused strategies to deal with the volatility of the first months of the Trump administration, according to a new survey...

The vast majority of President Donald Trump’s global tariffs were deemed illegal and blocked by the U.S. trade court, dealing a major blow to a pillar...

An IRS proposal to drop a Biden administration rule targeting basis-shifting strategies by complex partnerships is getting support from key stakeholders, as well as calls for...

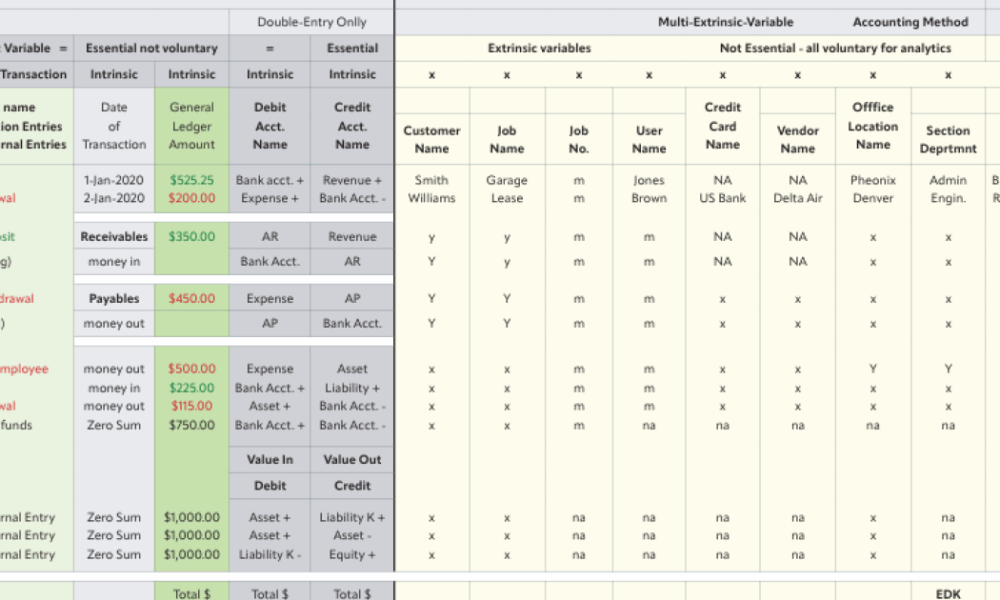

Edward Kellman, CEO and chief design engineer of Trakker Apps, holds two U.S. patents for an innovative take on double-entry accounting The system, known as the...

The Committee of Sponsoring Organizations of the Treadway Commission and the National Association of Corporate Directors have released an exposure draft of their Corporate Governance Framework...

Elon Musk expressed dissatisfaction with President Donald Trump’s giant tax bill, saying it undercut his efforts to slash government spending. Musk, who has announced he’s stepping...

A recent article about private equity in the medical field raises important questions about the evolving landscape of the accounting industry, particularly concerning consolidation and private...

Big Four firm Deloitte announced the launch of the Global Agentic Network, a connected ecosystem of AI agents for business purposes to augment and automate client...

Growing companies can unlock valuable credits and incentives to support their strategic expansion or new location projects. When a company considers adding new jobs or making...

Exchange-traded funds have amassed trillions of dollars by offering investors greater tax efficiency, liquidity and lower costs than mutual funds. Now, a looming regulatory shift is...