Depreciation is a cornerstone of financial accounting, playing a critical role in accurately representing an asset’s value over its useful life. Beyond its technical definition, depreciation...

A well-maintained fixed asset register is a cornerstone of effective financial management for any organization. Often underestimated, this detailed inventory of a company’s tangible assets goes...

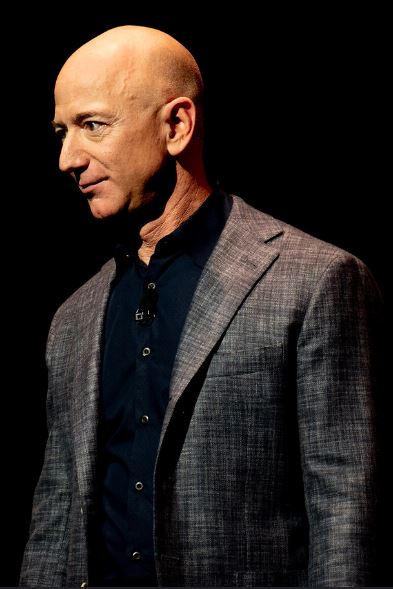

In the pantheon of tech visionaries, Jeff Bezos Is The Architect of Modern Ecommerce. Jeff Bezos stands as a titan who transformed not just how we...

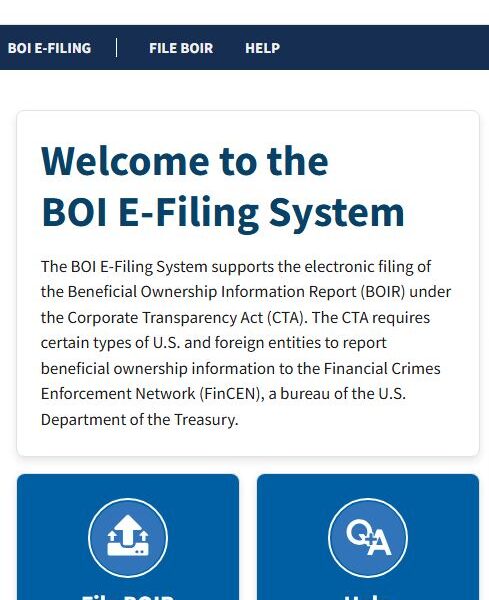

The Corporate Transparency Act (CTA) is a legislative measure designed to enhance financial transparency and mitigate risks such as money laundering, terrorist financing, and other illicit...

Petty cash management is often overlooked in corporate finance, but getting it right can make a big difference in keeping finances accurate and operations running smoothly....

The Economic Squeeze In today’s economic landscape, low-income earners find themselves caught in a relentless battle against inflation, watching helplessly as their hard-earned money loses purchasing...

In the vast landscape of global business, few names resonate as powerfully as Aliko Dangote – a visionary entrepreneur who has single-handedly reshaped Africa’s industrial landscape...

In the dynamic landscape of British politics, few stories are as compelling as that of Rishi Sunak – a man who has shattered glass ceilings and...

A guide to implementing a Zero-Trust security model is fundamental a the new cloud computing ecosystem. In today’s evolving cybersecurity landscape, traditional perimeter-based security approaches are...

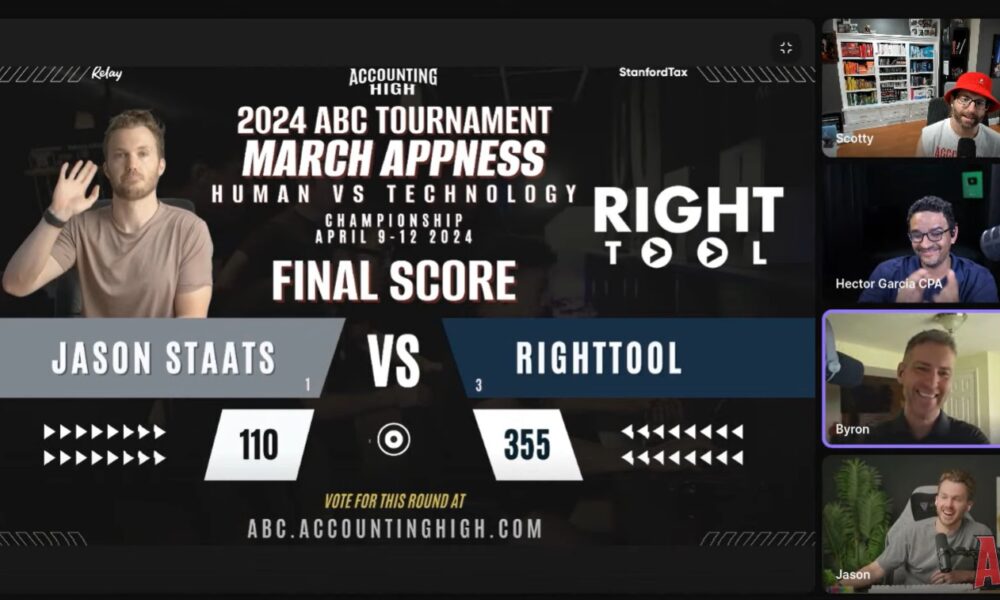

QuickBooks automation tool RightTool is the champion of the 2024 Accountant Bracket Challenge, presented by Accounting High, as the 3 seed defeated 1 seed CPA Jason...