Personal Finance

Federal Reserve holds interest rates steady. What that means for you

Published

3 months agoon

The Federal Reserve Building in Washington, D.C.

Joshua Roberts | Reuters

The Federal Reserve announced Wednesday it will leave interest rates unchanged as President Donald Trump‘s tariff policies weigh on economic growth.

Although inflation receded last month, an escalating trade war threatens to hike prices on consumer goods going forward.

“Tariffs on aluminum, steel and oil are essential elements to production across a wide range of products,” said Brett House, an economics professor at Columbia Business School. “Those price increases are going to ripple more widely across the American economy.”

National Economic Council director Kevin Hassett recently warned of “some uncertainty” in the weeks ahead because of the United States’ tariff agenda.

The inflation risk from tariffs ensured the central bank would take a more cautious approach, according to House. “Greater uncertainty in the world means the Fed is more predictably in a wait-and-see mode,” he said.

More from Personal Finance:

Consumer outlook sinks as recession fears take hold

Here’s the inflation breakdown for February 2025

This step is ‘really important’ for home sellers in 2025

The federal funds rate sets what banks charge each other for overnight lending, but also influences many of the borrowing and savings rates Americans see every day.

When the Fed hiked rates in 2022 and 2023, most consumer borrowing costs quickly followed suit. Even though the central bank began to lower its benchmark rate at the end of last year, consumer rates are still elevated, with credit card annual percentage rates down only slightly from an all-time high.

“The pressure on household budgets is unrelenting,” said Greg McBride, chief financial analyst at Bankrate.com.

As the federal funds rate comes down, consumers may see their borrowing costs decrease as well, making it cheaper to borrow money to purchase a house or a car.

But even with the Fed on the sidelines for now, consumers struggling under the weight of high prices and high borrowing costs could see some relief, experts say. Already, rates for mortgages, auto loans and credit cards are edging lower.

Credit cards

Most credit cards have a variable rate, so there’s a direct connection to the Fed’s benchmark.

Even though the central bank held rates steady at the last few meetings, average annual percentage rates have eased. The average credit card rate is down to 20.09%, from 20.27% at the start of the year, according to Bankrate. That is on the heels of the rate cuts that already went into effect.

“Credit card rates have fallen from their 2024 record highs,” said Matt Schulz, chief credit analyst at LendingTree. “March was the sixth straight monthly decline, but the decreases have slowed as Fed rate cuts get further back in the rearview mirror.”

Mortgages

Because 15- and 30-year mortgage rates are fixed, and largely tied to Treasury yields and the economy, those rates have also been trending lower.

Uncertainty over tariffs and worries about a possible recession have dragged down consumers’ outlook. “Mortgage rates are falling because of concerns about economic weakness,” McBride said.

However, “that’s not the type of environment that’s going to provide a sustainable boost to the housing market,” he added.

The average rate for a 30-year, fixed-rate mortgage is now 6.78% as of March 19, while the 15-year, fixed-rate is 6.24%, according to Mortgage News Daily.

Auto loans

Although auto loan rates are fixed, payments are getting bigger because car prices are rising, in addition to pressure from Trump’s trade policy.

“Sticker prices are still really high and tariffs will only drive those prices higher,” McBride said.

Auto loan rates have also backed down from recent highs but are still up year to date. The average rate on a five-year new car loan is now 7.2% as of the week ended March 14, while the average auto loan rate for used cars is 11.3%, according to Edmunds. At the end of 2024, those rates were 6.6% and 10.8%, respectively.

Student loans

Federal student loan rates are fixed, as well, so most borrowers are somewhat shielded from Fed moves and recent economic turmoil.

Undergraduate students who took out direct federal student loans for the 2024-25 academic year are paying 6.53%, up from 5.50% in 2023-24. Interest rates for the upcoming school year will be based in part on the May auction of the 10-year Treasury note.

Private student loans tend to have a variable rate tied to the prime, Treasury bill or another rate index.

Savings

On the upside, “savings rates really haven’t changed all that much, that’s the good news,” McBride said. “Savings rates are still at attractive levels and the top yields are still well in excess of inflation.”

While the central bank has no direct influence on deposit rates, the yields tend to be correlated to changes in the target federal funds rate.

Top-yielding online savings accounts currently pay 4.4%, on average, according to Bankrate. Although that’s down from roughly 5% last year, it is well above the annual inflation rate of 2.8%.

You may like

Personal Finance

Trump admin seeks Education Department layoff ban lifted

Published

3 hours agoon

June 6, 2025

A demonstrator speaks through a megaphone during a Defend Our Schools rally to protest U.S. President Donald Trump’s executive order to shut down the U.S. Department of Education, outside its building in Washington, D.C., U.S., March 21, 2025.

Kent Nishimura | Reuters

The Trump administration on Friday asked the Supreme Court to lift a court order to reinstate U.S. Department of Education employees the administration had terminated as part of its efforts to dismantle the agency.

Officials for the administration are arguing to the high court that U.S. District Judge Myong Joun in Boston didn’t have the authority to require the Education Department to rehire the workers. More than 1,300 employees were affected by the mass layoffs.

The staff reduction “effectuates the Administration’s policy of streamlining the Department and eliminating discretionary functions that, in the Administration’s view, are better left to the States,” Solicitor General D. John Sauer wrote in the filing.

A federal appeals court had refused on Wednesday to lift the judge’s ruling.

In his May 22 preliminary injunction, Joun pointed out that the staff cuts led to the closure of seven out of 12 offices tasked with the enforcement of civil rights, including protecting students from discrimination on the basis of race and disability.

Meanwhile, the entire team that supervises the Free Application for Federal Student Aid, or FAFSA, was also eliminated, the judge said. (Around 17 million families apply for college aid each year using the form, according to higher education expert Mark Kantrowitz.)

The Education Dept. announced its reduction in force on March 11 that would have gutted the agency’s staff.

Two days later, 21 states — including Michigan, Nevada and New York — filed a lawsuit against the Trump administration for its staff cuts at the agency.

After President Donald Trump signed an executive order on March 20 aimed at dismantling the Education Department, more parties sued to save the department, including the American Federation of Teachers.

This is breaking news. Please refresh for updates.

Personal Finance

Health insurance coverage losses under House GOP tax, spending bill

Published

7 hours agoon

June 6, 2025

Fatcamera | E+ | Getty Images

The House tax and spending bill would push millions of Americans off health insurance rolls, as Republicans cut programs like Medicaid and the Affordable Care Act to fund priorities from President Donald Trump, including almost $4 trillion of tax cuts.

The Congressional Budget Office, a nonpartisan legislative scorekeeper, projects about 11 million people would lose health coverage due to provisions in the House bill, if enacted in its current form. It estimates another 4 million or so would lose insurance due to expiring Obamacare subsidies, which the bill doesn’t extend.

The ranks of the uninsured would swell as a result of policies that would add barriers to access, raise insurance costs and deny benefits outright for some people like certain legal immigrants.

The legislation, known as the “One Big Beautiful Bill Act,” may change as Senate Republicans now consider it. Health care cuts have proven to be a thorny issue. A handful of GOP senators — enough to torpedo the bill — don’t appear to back cuts to Medicaid, for example.

More from Personal Finance:

How debt impact of House GOP tax bill may affect consumers

3 key money moves to consider while the Fed keeps interest rates higher

How child tax credit could change as Senate debates Trump’s mega-bill

The bill would add $2.4 trillion to the national debt over a decade, CBO estimates. That’s after cutting more than $900 billion from health care programs during that time, according to the Penn Wharton Budget Model.

The cuts are a sharp shift following incremental increases in the availability of health insurance and coverage over the past 50 years, including through Medicare, Medicaid and the Affordable Care Act, according to Alice Burns, associate director with KFF’s program on Medicaid and the uninsured.

“This would be the biggest retraction in health insurance that we’ve ever experienced,” Burns said. “That’s makes it really difficult to know how people, providers, states, would react.”

Here are the major ways the bill would increase the number of uninsured.

No population ‘safe’ from proposed Medicaid cuts

Speaker of the House Mike Johnson, R-La., pictured at a press conference after the House narrowly passed a bill forwarding President Donald Trump’s agenda on May 22 in Washington, DC.

Kevin Dietsch | Getty Images

Federal funding cuts to Medicaid will have broad implications, experts say.

“No population, frankly, is safe from a bill that cuts more than $800 billion over 10 years from Medicaid, because states will have to adjust,” said Allison Orris, senior fellow and director of Medicaid policy at the Center on Budget and Policy Priorities.

The provision in the House proposal that would lead most people to lose Medicaid and therefore become uninsured would be new work requirements that would apply to states that expanded Medicaid under the Affordable Care Act, according to Orris.

The work requirements would affect eligibility for individuals ages 19 to 64 who do not have a qualifying exemption. Affected individuals would need to demonstrate they worked or participated in qualifying activities for at least 80 hours per month.

States would also need to verify that applicants meet requirements for one or more consecutive months prior to coverage, while also conducting redeterminations at least twice per year to ensure individuals who are already covered still comply with the requirements.

In a Sunday interview with NBC News’ “Meet the Press,” House Speaker Mike Johnson, R-La., said “4.8 million people will not lose their Medicaid coverage unless they choose to do so,” while arguing the work requirements are not too “cumbersome.”

The Congressional Budget Office has estimated the work requirements would prompt 5.2 million adults to lose federal Medicaid coverage. While some of those may obtain coverage elsewhere, CBO estimates the change would increase the number of people without insurance by 4.8 million.

Those estimates may be understated because they do not include everyone who qualifies but fails to properly report their work hours or submit the appropriate paperwork if they qualify for an exemption, said KFF’s Burns.

Overall, 10.3 million would lose Medicaid, which would lead to 7.8 million people losing health insurance, Burns said.

Proposal creates state Medicaid funding challenges

Protect Our Care supporters display “Hands Off Medicaid” message in front of the White House ahead of President Trump’s address to Congress on March 4 in Washington, D.C.

Paul Morigi | Getty Images Entertainment | Getty Images

While states have used health care provider taxes to generate funding for Medicaid, the House proposal would put a stop to using those levies in the future, Orris noted.

Consequently, with less revenue and federal support, states will face the tough choice of having to cut coverage or cut other parts of their state budget in order to maintain their Medicaid program, Orris said.

For example, home and community-based services could face cuts to preserve funding for mandatory benefits like inpatient and outpatient hospital care, she said.

The House proposal would also delay until 2035 two Biden-era eligibility rules that were intended to make Medicaid enrollment and renewal easier for people, especially older adults and individuals with disabilities, Burns said.

States would also have their federal matching rate for Medicaid expenditures reduced if they offer coverage to undocumented immigrants, she said.

Affordable Care Act cuts ‘wonky’ but ‘consequential’

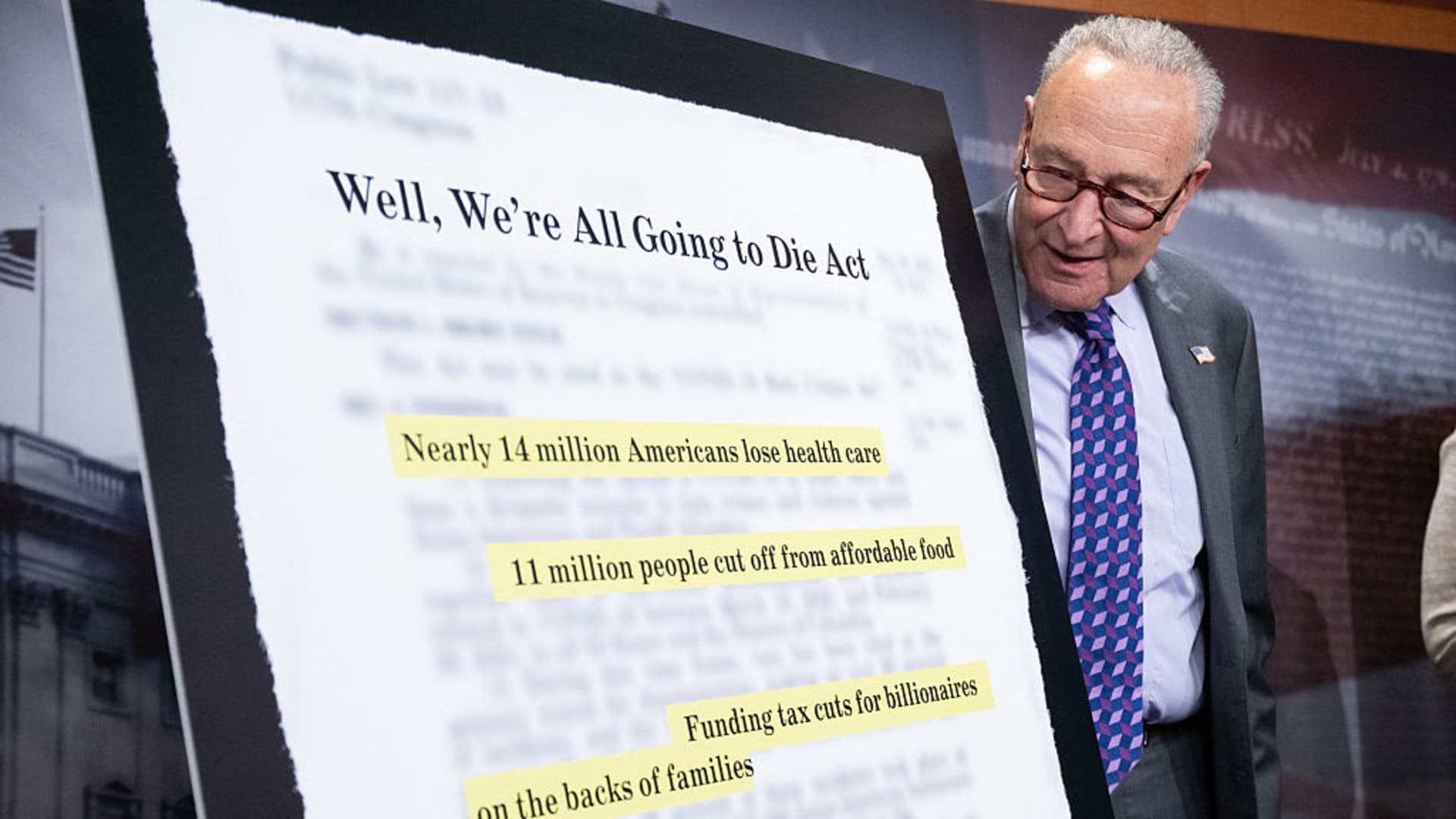

Senate Minority Leader Chuck Schumer, D-N.Y., speaks about the health care impacts of the Republican budget and policy bill, also known as the “One Big Beautiful Bill Act,” during a June 4 news conference in Washington, D.C.

Saul Loeb | Afp | Getty Images

More than 24 million people have health insurance through the Affordable Care Act marketplaces.

They’re a “critical” source of coverage for people who don’t have access to health insurance at their jobs, including for the self-employed, low-paid workers and older individuals who don’t yet qualify for Medicare, according to researchers at the Center on Budget and Policy Priorities, a left-leaning think tank.

The House legislation would “dramatically” reduce ACA enrollment — and, therefore, the number of people with insurance — due to the combined effect of several changes rather than one big proposal, wrote Drew Altman, president and chief executive of KFF, a nonpartisan health policy group.

“Many of the changes are technical and wonky, even if they are consequential,” Altman wrote.

Expiring ACA subsidies add to coverage costs

ACA enrollment is at an all-time high. Enrollment has more than doubled since 2020, which experts largely attribute to enhanced insurance subsidies offered by Democrats in the American Rescue Plan Act in 2021 and then extended through 2025 by the Inflation Reduction Act.

Those subsidies, called “premium tax credits,” effectively reduce consumers’ monthly premiums. (The credits can be claimed at tax time, or households can opt to get them upfront via lower premiums.)

Congress also expanded the eligibility pool for subsidies to more middle-income households, and reduced the maximum annual contribution households make toward premium payments, experts said.

The enhanced subsidies lowered households’ premiums by $705 (or 44%) in 2024 — to $888 a year from $1,593, according to KFF.

The House Republican legislation doesn’t extend the enhanced subsidies, meaning they’d expire after this year.

About 4.2 million people will be uninsured in 2034 if the expanded premium tax credit expires, according to the Congressional Budget Office.

“They might just decide not to get [coverage] because they simply can’t afford to insure themselves,” said John Graves, a professor of health policy and medicine at Vanderbilt University School of Medicine.

Coverage will become more expensive for others who remain in a marketplace plan: The typical family of four with income of $65,000 will pay $2,400 more per year without the enhanced premium tax credit, CBPP estimates.

Adding red tape to eligibility, enrollment

More than 3 million people are expected to lose Affordable Care Act coverage as a result of other provisions in the House legislation, CBO projects.

Other “big” changes include broad adjustments to eligibility, said Kent Smetters, professor of business economics and public policy at the University of Pennsylvania’s Wharton School.

For example, the bill shortens the annual open enrollment period by about a month, to Dec. 15, instead of Jan. 15 in most states.

It ends automatic re-enrollment into health insurance — used by more than half of people who renewed coverage in 2025 — by requiring all enrollees to take action to continue their coverage each year, CBPP said.

Senate Majority Leader Sen. John Thune (R-SD) (C) speak alongside Sen. John Barrasso (R-WY) (L) and Sen. Mike Crapo (R-ID) (R) outside the White House on June 4, 2025. The Senators met with President Donald Trump to discuss Trump’s “One, Big, Beautiful Bill” and the issues some members within the Republican Senate have with the legislation and its cost.

Anna Moneymaker | Getty Images News | Getty Images

The bill also bars households from receiving subsidies or cost-sharing reductions until after they verify eligibility details like income, immigration status, health coverage status and place of residence, according to KFF.

Graves says adding administrative red tape to health plans is akin to driving an apple cart down a bumpy road.

“The bumpier you make the road, the more apples will fall off the cart,” he said.

Uncapping subsidy repayments

Another biggie: The bill would eliminate repayment caps for premium subsidies.

Households get federal subsidies by estimating their annual income for the year, which dictates their total premium tax credit. They must repay any excess subsidies during tax season, if their annual income was larger than their initial estimate.

Current law caps repayment for many households; but the House bill would require all premium tax credit recipients to repay the full amount of any excess, no matter their income, according to KFF.

While such a requirement sounds reasonable, it’s unreasonable and perhaps even “cruel” in practice, said KFF’s Altman.

“Income for low-income people can be volatile, and many Marketplace consumers are in hourly wage jobs, run their own businesses, or stitch together multiple jobs, which makes it challenging, if not impossible, for them to perfectly predict their income for the coming year,” he wrote.

Curtailing use by immigrants

The House bill also limits marketplace insurance eligibility for some groups of legal immigrants, experts said.

Starting Jan. 1, 2027, many lawfully present immigrants such as refugees, asylees and people with Temporary Protected Status would be ineligible for subsidized insurance on ACA exchanges, according to KFF.

Additionally, the bill would bar Deferred Action for Childhood Arrivals recipients in all states from buying insurance over ACA exchanges.

DACA recipients — a subset of the immigrant population known as “Dreamers” — are currently considered “lawfully present” for purposes of health coverage. That makes them eligible to enroll (and get subsidies and cost-sharing reductions) in 31 states plus the District of Columbia.

PUNTA GORDA – OCTOBER 10: In this aerial view, a person walks through flood waters that inundated a neighborhood after Hurricane Milton came ashore on October 10, 2024, in Punta Gorda, Florida. The storm made landfall as a Category 3 hurricane in the Siesta Key area of Florida, causing damage and flooding throughout Central Florida. (Photo by Joe Raedle/Getty Images)

Joe Raedle | Getty Images News | Getty Images

It’s officially hurricane season, and early forecasts indicate it’s poised to be an active one.

Now is the time to take a look at your homeowners insurance policy to ensure you have enough and the right kinds of coverage, experts say — and make any necessary changes if you don’t.

The National Oceanic and Atmospheric Administration predicts a 60% chance of “above-normal” Atlantic hurricane activity during this year’s season, which spans from June 1 to November 30.

The agency forecasts 13 to 19 named storms with winds of 39 mph or higher. Six to 10 of those could become hurricanes, including three to five major hurricanes of Category 3, 4, or 5.

You should pay close attention to your insurance policies.

Charles Nyce

risk management and insurance professor at Florida State University

Hurricanes can cost billions of dollars worth of damages. Experts at AccuWeather estimate that last year’s hurricane season cost $500 billion in total property damage and economic loss, making the season “one of the most devastating and expensive ever recorded.”

“Take proactive steps now to make a plan and gather supplies to ensure you’re ready before a storm threatens,” Ken Graham, NOAA’s national weather service director, said in the agency’s report.

Part of your checklist should include reviewing your insurance policies and what coverage you have, according to Charles Nyce, a risk management and insurance professor at Florida State University.

“Besides being ready physically by having your radio, your batteries, your water … you should pay close attention to your insurance policies,” said Nyce.

More from Personal Finance:

How child tax credit could change as Senate debates Trump’s mega-bill

This map shows where seniors face longest drives

Some Social Security checks to be smaller in June from student loan garnishment

You want to know four key things: the value of property at risk, how much a loss could cost you, whether you’re protected in the event of flooding and if you have enough money set aside in case of emergencies, he said.

Bob Passmore, the department vice president of personal lines at the American Property Casualty Insurance Association, agreed: “It’s really important to review your policy at least annually, and this is a good time to do it.”

Insurers often suspend policy changes and pause issuing new policies when there’s a storm bearing down. So acting now helps ensure you have the right coverage before there’s an urgent need.

Here are three things to consider about your home insurance policy going into hurricane season, according to experts.

1. Review your policy limits

First, take a look at your policy’s limits, which represents the highest amount your insurance company will pay for a covered loss or damage, experts say. You want to make sure the policy limit is correct and would cover the cost of rebuilding your home, Passmore said.

Most insurance companies will calculate the policy limit by taking into account the size of your home and construction costs in your area, said Nyce. For example, if you have a 2,000 square foot home, and the cost of construction in your area is $250 per square foot, your policy limit would need to be $500,000, he said.

You may risk being underinsured, however, especially if you haven’t reviewed your coverage in a while. Rising building costs or home renovations that aren’t reflected in your insurer’s calculation can mean your coverage lags the home’s replacement value.

Repair and construction costs have increased in recent years, experts say. In the last five years, the cost of construction labor has increased 36.3% while the building material costs are up 42.7%, the APCIA found.

Most insurance companies follow what’s called the 80% rule, meaning your coverage needs to be at least 80% of its replacement cost. If you’re under, you risk your insurer paying less than the full claim.

2. Check your deductibles

Take a look at your deductibles, or the amount you have to pay out of pocket upfront if you file a claim, experts say.

For instance, if you have a $1,000 deductible on your policy and submit a claim for $8,000 of storm coverage, your insurer will pay $7,000 toward the cost of repairs, according to a report by NerdWallet. You’re responsible for the remaining $1,000.

A common way to lower your policy premium is by increasing your deductibles, Passmore said.

Raising your deductible from $1,000 to $2,500 can save you an average 12% on your premium, per NerdWallet’s research.

But if you do that, make sure you have the cash on hand to absorb the cost after a loss, Passmore said.

Don’t stop at your standard policy deductible. Look over hazard-specific provisions such as a wind deductible, which is likely to kick in for hurricane damage.

Wind deductibles are an out-of-pocket cost that is usually a percentage of the value of your policy, said Nyce. As a result, they can be more expensive than your standard deductible, he said.

If a homeowner opted for a 2% deductible on a $500,000 house, their out-of-pocket costs for wind damages can go up to $10,000, he said.

“I would be very cautious about picking larger deductibles for wind,” he said.

3. Assess if you need flood insurance

Floods are usually not covered by a homeowners insurance policy. If you haven’t yet, consider buying a separate flood insurance policy through the National Flood Insurance Program by the Federal Emergency Management Agency or through the private market, experts say.

It can be worth it whether you live in a flood-prone area or not: Flooding causes 90% of disaster damage every year in the U.S., according to FEMA.

In 2024, Hurricane Helene caused massive flooding in mountainous areas like Asheville in Buncombe County, North Carolina. Less than 1% of households there were covered by the NFIP, according to a recent report by the Swiss Re Institute.

If you decide to get flood insurance with the NFIP, don’t buy it at the last minute, Nyce said. There’s usually a 30-day waiting period before the new policy goes into effect.

“You can’t just buy it when you think you’re going to need it like 24, 48 or 72 hours before the storm makes landfall,” Nyce said. “Buy it now before the storms start to form.”

Make sure you understand what’s protected under the policy. The NFIP typically covers up to $250,000 in damages to a residential property and up to $100,000 on the contents, said Loretta Worters, a spokeswoman for the Insurance Information Institute.

If you expect more severe damage to your house, ask an insurance agent about excess flood insurance, Nyce said.

Such flood insurance policies are written by private insurers that cover losses over and above what’s covered by the NFIP, he said.

XcelLabs launches to help accountants use AI

Accounting is changing, and the world can’t wait until 2026

Republicans push Musk aside as Trump tax bill barrels forward

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Economics1 week ago

Economics1 week agoHow young voters helped to put Trump in the White House

-

Accounting1 week ago

Accounting1 week agoHighest paid jobs in corporate accounting

-

Economics1 week ago

Economics1 week agoElon Musk says Trump’s spending bill undermines the work DOGE has been doing

-

Blog Post6 days ago

Blog Post6 days agoCommon Bookkeeping Challenges and Solutions for Small Businesses

-

Personal Finance1 week ago

Personal Finance1 week agoHarvard, Trump international enrollment battle affects college applicants

-

Economics1 week ago

Economics1 week agoWhy the president must not be lexicographer-in-chief

-

Personal Finance1 week ago

Personal Finance1 week agoCrypto in 401(k) plans: Trump administration eases rules

-

Accounting1 week ago

Accounting1 week agoTrump to pardon stars of reality show ‘Chrisley Knows Best’