Personal Finance

Federal workers’ money questions answered

Published

4 months agoon

Protesters demonstrate in support of federal workers outside of the U.S. Department of Health and Human Services on Feb. 14, 2025 in Washington, DC.

Anna Moneymaker | Getty Images

On Feb. 11, Elizabeth Aniskevich, an attorney at the Consumer Financial Protection Bureau, received a notice that she was being terminated immediately.

“I was completely shocked,” said Aniskevich, 39. She had been with the CFPB for nine months and imagined spending her entire career in the federal government.

“I didn’t expect it to unfold this way,” she said.

More than a week later, she’s still scrambling for basic answers. “There’s no information about what’s going on with my benefits, or what I need to do with unemployment,” Aniskevich said.

She’s worried about how she’ll pay the mortgage on her Washington, D.C., apartment after her emergency savings runs out in a few months.

“I’ve worked really hard to be financially stable,” Aniskevich said.

Elizabeth Aniskevich.

Courtesy: Elizabeth Aniskevich

Aniskevich is one of thousands of federal workers laid off by the new Trump administration in recent weeks and thrown into financial and career uncertainty. President Donald Trump and Elon Musk‘s secretive government-slashing effort, the Department of Government Efficiency or DOGE, are working to shrink the federal workforce.

Losing one’s job is always difficult. But the suddenness and speed of the firings, which have affected offices from the Environmental Protection Agency to the U.S. Department of Education, have left workers especially in the dark about their rights and next steps, experts said.

“Most people would have selected the public sector because it has a reputation of being a more stable work environment than the private sector,” said Don Moynihan, a public policy professor at the University of Michigan. “But in this case, that stability proved to be an illusion.”

CNBC spoke with financial advisors and policy experts to get answers to some of the many important questions terminated federal workers likely have right now.

Workers may be able to appeal, take legal action

The Trump administration and Musk’s DOGE have largely targeted workers on a probationary status for cuts.

That’s because probationary workers, who have typically been in their position for a year or less, have fewer protections after they’re removed than do career civil servants, said David Eric Lewis, a political science professor at Vanderbilt University.

For example, probationary workers might not meet the requirements to appeal their termination to the U.S. Merit Systems Protection Board. The board reviews cases in which federal workers were laid off or suspended.

Still, there are limited cases when they can appeal, experts said. You should speak to an employment lawyer or your union representative for more details, experts recommend.

The name and logo for the Consumer Financial Protection Bureau (CFPB) is seen scraped off the door of its building in Washington, D.C., U.S., Feb. 20, 2025.

Brian Snyder | Reuters

“They can also seek legal relief,” Lewis said. Your union may help you file your lawsuit in federal court, he added.

It can be more effective to bring your legal challenge as a group, with other terminated federal workers, Lewis said.

“That’s what is happening,” he said. “There’s a hope that there is at least a stop to these orders.”

A federal judge Thursday denied a bid by labor unions to block the mass layoffs across the federal workforce. The National Treasury Employees Union alongside four other groups filed a lawsuit against the firings on Feb. 12.

What to know about unemployment benefits

Federal workers can collect unemployment benefits through the Unemployment Compensation for Federal Employees (UCFE) program. Some government employees — including ex-military personnel discharged under honorable conditions and former members of the National Oceanographic and Atmospheric Administration — receive benefits through a separate program, known as the Unemployment Compensation for Ex-servicemembers (UCX).

The jobless benefits, which are supposed to arrive within two or three weeks after you apply for them, are nearly identical to those of private-sector workers, said Michele Evermore, senior fellow at the National Academy of Social Insurance.

States — as well as U.S. territories and the District of Columbia — administer the payments. Workers must submit an application with the appropriate workforce agency. You should apply in the state or district where your last official duty station was located, Evermore said.

Those working remotely on a full-time basis likely need to file a claim in their state of residence, Evermore said.

Workers should apply for unemployment as soon as possible, experts said. Delays are likely amid the purge of government workers.

Those claiming UCFE benefits will likely need to include certain documents with their claim, including a SF-8, or a Notice to Federal Employee About Unemployment Insurance, as well as a SF-50, or a Notification of Personnel Action, according to the U.S. Labor Department.

Those applying for UCX benefits should have a copy of their service and discharge documents — DD-214 or a similar form, the Labor Department said.

Federal employers are supposed to provide these forms to workers upon separation, but Aniskevich said the Consumer Financial Protection Bureau still hadn’t given her those documents as of Friday.

For now, she filed her unemployment application in Washington, D.C., without them.

“It’s stressful to have uncertainty about whether my claim can be processed given the lack of forms,” Aniskevich said.

Federal agencies appear to be citing lackluster performance as rationale for many job cuts in termination letters, experts said. Even so, workers should still apply for benefits, Evermore said. The cause must generally rise to the level of “gross misconduct” to prevent people from receiving aid.

This could delay benefits if the government contests a claim, however, experts said.

Health coverage for terminated workers

Meanwhile Chris, who worked as a transportation program specialist at the Federal Transit Administration, was laid off on February 14. Like Aniskevich, he was a probationary worker, and had been employed by the FTA for around nine months. (He requested to use his first name only, out of fear of retaliation from the Trump administration.)

Despite the financial stability usually associated with a federal job, he found himself with no protections.

“There was no severance pay,” said Chris, 33, who is based in the Los Angeles area.

Chris did learn that his health benefits will continue for 31 calendar days after Valentine’s Day.

Similarly, federal employees should try to determine the specific date their health coverage will end, experts said. While the timelines may vary, most probationary workers will need to find new health insurance soon.

Those who wish to continue with their current health care should look into the federal government’s Temporary Continuation of Coverage, experts say. Under this option, you’re able to extend your federal workplace plan for up to 18 months after termination. (It’s similar to COBRA, or the Consolidated Omnibus Budget Reconciliation Act, for private-sector workers.)

Keep in mind that, with TCC, you’ll be responsible for the full cost of your premiums, plus any administrative fees.

“It’s going to be [a] pretty big hike,” said Brennan Rhule, a Reston, Virginia-based certified financial planner who specializes in federal workers.

If the new premium cost is too high to shoulder under TCC, you may qualify for a special enrollment period of the Affordable Care Act marketplace, according to Kate Ende, leader of the policy team at the Consumers for Affordable Health Care, a nonprofit. The special enrollment period typically gives you 60 days to sign up for a marketplace plan after you lost your coverage.

Medicaid might also be an option, Ende said, and if you qualify you can enroll at any time for it.

Relief options for recurring bills

Federal workers concerned about staying current with their bills should reach out to their lenders and explain their situation, consumer advocates said.

For instance, contact your mortgage lender and ask about forbearance or deferment options, said John Breyault, vice president of public policy at the National Consumers League. If you’re a renter, landlords and property managers may offer temporary payment plans or deferments.

More from Personal Finance:

How IRS layoffs could impact your tax filing, refund

As tariffs ramp up, here’s an investment option

DOGE’s FDIC firings put banking system at risk

Some auto lenders allow deferments, too, especially if you have a good payment track record. Meanwhile, your auto insurer may be able to adjust your coverage and lower your costs if you will no longer be driving long distances to work, Breyault said.

For utilities like electricity, water, gas, internet and phone service, see if your providers offer a grace period or deferred payments, Breyault said.

Those with student loan bills can request an unemployment deferment with their servicer.

Keep in mind that such concessions and breaks can be helpful in the near-term, but read the terms thoroughly. There could be long-term costs associated, such as interest continuing to accrue or other fees.

Watch out for ‘undoable’ retirement account missteps

Federal workers who find themselves unexpectedly out of work may be tempted to take money from their retirement plans. However, experts emphasize it is important to know the ins and outs of each plan’s rules to avoid unexpected costs.

“Before you do anything, make sure you talk to somebody who understands and can guide you,” said CFP Mark Keen, who is a federal benefits expert with the National Active and Retired Federal Employees Association.

“Make sure that you don’t make any mistakes that are undoable,” said Keen, who is also a partner at Keen & Pocock.

Federal workers generally have access to a pension through the Federal Employee Retirement System, or FERS, and to a defined contribution savings plan, known as the Thrift Savings Plan, or TSP.

FERS provides a guaranteed income stream once a worker reaches a certain age, a perk that’s mostly unavailable in the private sector, Keen said.

Federal workers may withdraw their FERS contributions if they leave federal employment, but that may not be the best choice. It will take a while to build your pension back up if you return to federal service, said Katelyn Murray, a chartered federal employee benefits consultant and director of relationship management at Serving Those Who Serve.

If you leave the balance intact, you retain the years of service you’ve accumulated, Murray said. Having a FERS pension also allows retirees to continue health coverage through the Federal Employees Health Benefits, or FEHB, in retirement.

Even if you’re not sure you may return to federal work, you may want to think twice before cashing out, Murray said.

“It’s more about flexibility and keeping your options open,” Murray said.

Federal workers may have some flexibility with a Thrift Savings Plan that is like a 401(k) plan and allows employees to make contributions that are matched by government agencies.

Generally, participants who are at least age 59½ can make withdrawals without penalties.

In some cases, workers may qualify for the Rule of 55, which may allow them to take withdrawals from the TSP without having to pay a 10% early withdrawal penalty, provided they are at least age 55 when they leave their job (or age 50 for some public safety employees).

If you haven’t found another job yet, you can’t take a TSP loan, but you may be able to look at doing a hardship withdrawal, Murray said. Importantly, by doing so you may incur taxes and/or penalties, as well as delay your anticipated retirement date.

You may like

Personal Finance

Social Security cost-of-living adjustment may be 2.5% in 2026: estimates

Published

13 hours agoon

June 11, 2025

Sdi Productions | E+ | Getty Images

Millions of Social Security beneficiaries received a 2.5% boost to their benefits in 2025, thanks to an annual cost-of-living adjustment that went into effect in January.

In 2026, Social Security checks may go up by the same amount — 2.5% — based on the latest government inflation data, according to new estimates from both The Senior Citizens League and Mary Johnson, an independent Social Security and Medicare policy analyst.

That is up from the 2.4% increase for 2026 that those sources forecast last month. A 2.5% cost-of-living adjustment would be “about average,” according to Johnson.

The Social Security cost-of-living adjustment, or COLA, is an annual adjustment to benefits aimed at helping to ensure monthly checks keep pace with inflation.

The COLA for the following year is calculated based on third quarter inflation data. The official change is typically announced by the Social Security Administration in October.

With four more months of data yet to come before that calculation, the new estimate for the Social Security COLA for 2026 is subject to change.

The COLA may go higher if President Donald Trump’s tariff policies prompt inflation and consumer prices move higher, according to Johnson.

Broadly, the consumer price index rose less than had been expected in May, with an annual inflation rate of 2.4%, showing limited impact from Trump’s tariff policies.

The measure used to calculate the Social Security COLA — the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W — is up 2.2% over the past 12 months, according to the May data.

While that inflation rate is lower than the 2.5% COLA for 2025, a Senior Citizens League survey finds 80% of seniors feel inflation in 2024 was more than 3% based on their expenses.

As the Trump administration has reduced the size of the federal work force, that has also led to changes in the way the Bureau of Labor Statistics assesses inflation. The government agency has restricted data collection and turned to models that help fill in incomplete data.

More from Personal Finance:

Here’s the inflation breakdown for May 2025

What’s happening with unemployed Americans — in five charts

How investors have performed amid Trump market volatility

The Senior Citizens League has raised concerns that those changes may negatively influence the accuracy of the annual Social Security COLA calculations.

“Inaccurate or unreliable data in the CPI dramatically increases the likelihood that seniors receive a COLA that’s lower than actual inflation, which can cost seniors thousands of dollars over the course of their retirement,” Shannon Benton, executive director at The Senior Citizens League, said in a statement.

The Bureau of Labor Statistics did not immediately respond to CNBC’s request for comment.

President Donald Trump‘s proposal for a new savings account for children with a one-time deposit of $1,000 from the federal government just got an important stamp of approval.

At the “Invest America” roundtable at the White House this week, several top CEOs, including Michael Dell and Goldman Sachs chief David Solomon, expressed support for “Trump Accounts,” which are part of the landmark Republican-backed “big beautiful bill” moving through Congress. The executives committed to contributing to the accounts of their employees’ children, and, in Dell’s case, matching the government’s seed money “dollar for dollar.”

Still, policy experts and financial advisors question whether the provision is the most effective way to save on behalf of your child.

How ‘Trump Accounts’ would work

Under the House measure, Trump Accounts — previously known as “Money Accounts for Growth and Advancement” or “MAGA Accounts” — can later be used for education expenses or credentials, the down payment on a first home or as capital to start a small business. Earnings grow tax-deferred, and qualified withdrawals are taxed at the long-term capital-gains rate.

More from Personal Finance:

Trump’s ‘big beautiful’ bill could curb low-income tax credit

What a ‘revenge tax’ in Trump’s spending bill means for investors

What’s happening with unemployed Americans — in 5 charts

Trump’s massive tax and spending bill still faces a battle in the Senate, but if it passes as drafted, parents and others will be able to contribute up to $5,000 a year to a child’s Trump Account. The balance would be invested in a diversified fund that tracks a U.S.-stock index.

Sen. Ted Cruz, R-Texas, who spearheaded the effort, told CNBC in May that the accounts give children “the ability to accumulate wealth, which is transformational.”

“This will afford a generation of children the chance to experience the miracle of compounded growth and set them on a course for prosperity from the very beginning,” the White House also said in a statement Monday.

Biggest Trump Account benefit: $1,000 bonus

Armand Burger | E+ | Getty Images

Some experts say the biggest benefit of Trump Accounts is the seed money for all children born between Jan. 1, 2025, and Jan. 1, 2029, funded by the Department of the Treasury.

There are no income requirements. To be eligible, the child must be a U.S. citizen and both parents must have Social Security numbers.

Although some states, including Connecticut and Colorado, already offer a type of “baby bonds” program for parents, Trump Accounts — along with a bigger child tax credit proposed in the budget bill and potential employer-sponsored matching funds — “could certainly help a lot of families at a lot of different income levels,” Sam Taube, NerdWallet’s lead investing writer, recently told CNBC.

Invested in a broad equity index fund for 20 years, a $1,000 government grant for newborns could grow to an average $8,000, according to a March report from the Milken Institute. “If the policy also permitted a tax-deductible match by employers of the children’s parents, such initial matches would double an account’s value,” researchers wrote.

Trump Accounts are expensive, ‘needlessly complex’

Depositing $1,000 into an account “is a good idea, but with a critically important caveat,” said Mark Higgins, senior vice president at Index Fund Advisors and author of “Investing in U.S. Financial History: Understanding the Past to Forecast the Future.”

With Trump Accounts, “the costs are the key,” he said: “If it keeps adding to the deficit, it is not sustainable.” (By some accounts, the program could cost more than $3 billion a year.)

“The biggest challenge for this country right now is that we have lived beyond our means,” he said. “Over the last 230 years, Congress has passed countless programs like this, which provide short-term benefits that are almost invariably dwarfed by the long-term costs.”

Universal savings accounts, which allow for more flexibility, would be a better proposal than the House provision, said Adam Michel, director of tax policy studies at the Cato Institute, a public policy think tank.

Universal savings accounts have had bipartisan support going back as far as the Clinton administration, and without the initial deposit, would come a much lower cost. They have also been successfully implemented in other countries, including Canada and the United Kingdom, according to the Tax Foundation.

Further, Trump Accounts are “overly restricted and needlessly complex,” Michel said. “A simpler system is a better way to get people to save.”

With a universal savings account, individuals could contribute up to $10,000 of after-tax income a year and withdraw the funds tax-free at any time for any purpose, according to Michel.

“It’s the flexibility that entices people,” he said. “Maybe you want to use that money to start or expand a business or buy a house or an investment property — let people choose what’s best for their lives.”

‘The 529 college savings plan is superior’

Another alternative is a tapping 529 college savings plan, which nearly every state offers.

These 529 plans have much higher contribution limits, earnings grow on a tax-advantaged basis, and when a child withdraws the money, it is tax-free if the funds are used for qualified education expenses. This year, individuals can gift up to $19,000 to a 529, or up to $38,000 if you’re married and file taxes jointly, per child without those contributions counting toward your lifetime gift tax exemption.

Although there are more limitations on what 529 funds can be applied to compared to Trump Accounts, restrictions have loosened in recent years to include continuing education classes, apprenticeship programs and student loan payments.

“For most parents, like myself with teens, the 529 college savings plan is superior if you’re focused on paying for higher education because of the federal tax-free growth,” Winnie Sun, co-founder and managing director of Sun Group Wealth Partners, based in Irvine, California, recently told CNBC.

“Also, now, the 529 is becoming more flexible with its’ ability to have unused funds rolled into a Roth IRA in the future for retirement,” said Sun, a member of CNBC’s Financial Advisor Council.

As of 2024, families can roll over unused 529 funds to the account beneficiary’s Roth individual retirement account, without triggering income taxes or penalties, so long as they meet certain requirements.

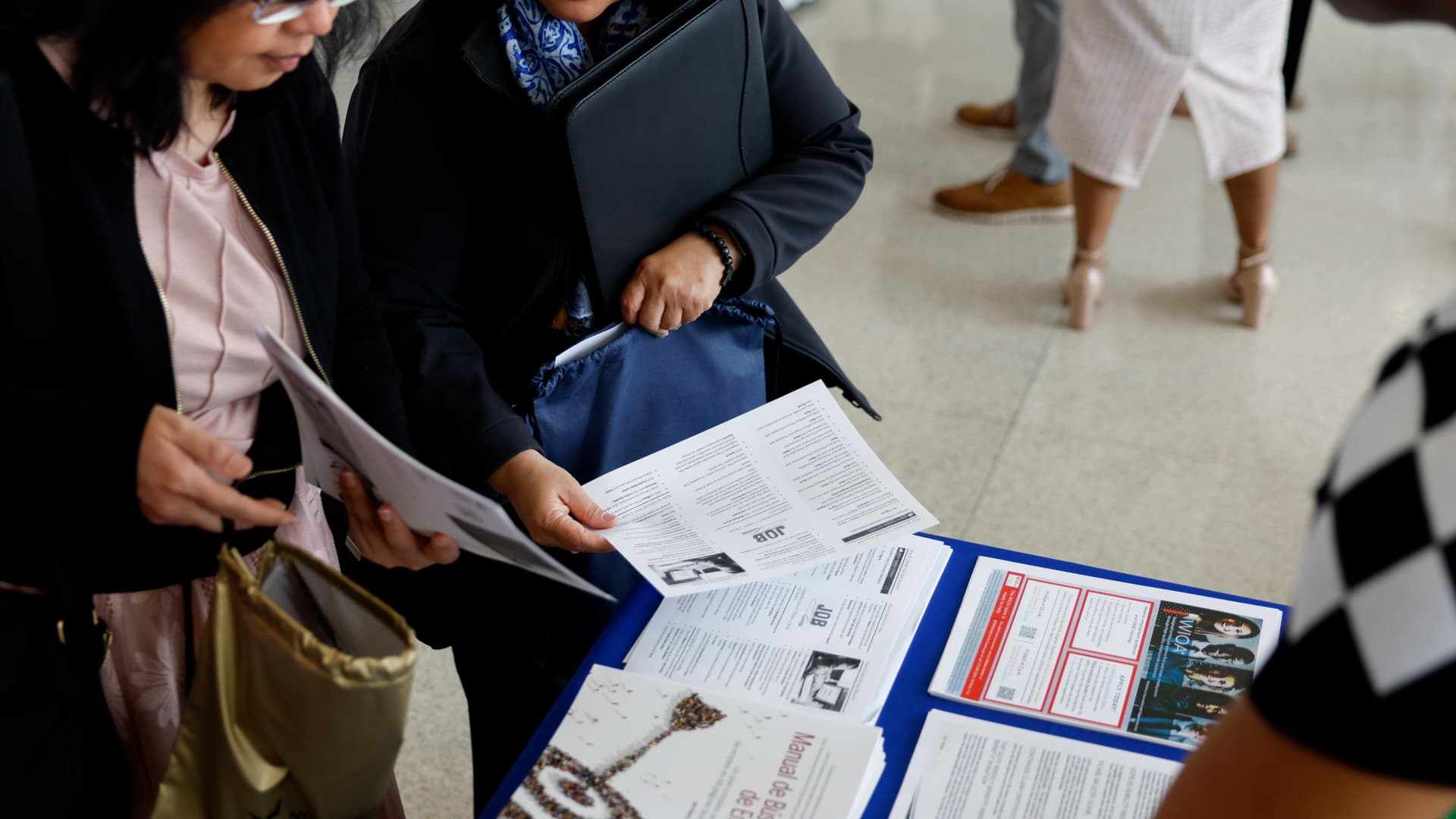

Job seekers at a job fair hosted by the Metropolitan Washington Airports Authority to support federal workers looking for new career opportunities, at Ronald Reagan Washington National Airport in Arlington, Virginia, on April 25, 2025.

Ting Shen/Bloomberg via Getty Images

While the unemployment rate in the U.S. is still fairly low, data shows it’s not uncommon to see individuals job hunting for extended periods of time.

The unemployment rate remained flat at 4.2% in May, the Bureau of Labor Statistics reported Friday.

However, over the past six months, it’s become “drastically harder to find a job,” whether you’re entering the job market for the first time or you’ve been looking for a while, according to Alí Bustamante, an economist and director at the Roosevelt Institute, a liberal think tank.

“It’s not that folks are losing their jobs,” Bustamante said. “It’s just that businesses are much more reticent to hire people, to make investments, because they just feel this very uncertain economic climate.”

More from Personal Finance:

Millions of Americans would lose health insurance under House GOP megabill

Check your home insurance ahead of an ‘above normal’ hurricane season

401(k) balances drop due to market volatility: Fidelity

Bustamante and other economists say several data points beyond the headline job market numbers — the job-finding and quits rates, the share of workers who have been unemployed for 27 weeks or more, a broader rate of unemployment and the state of so-called “white collar” jobs — showcase deeper issues within the labor market.

“Employers aren’t hiring, they’re not firing. People aren’t leaving their jobs, and there’s just fewer opportunities right now,” said Cory Stahle, an economist at Indeed, a job search site.

As career coach Mandi Woodruff-Santos put it during a recent interview with CNBC: “The job market is kind of trash right now.”

Here’s what’s happening with unemployed Americans, in five charts.

Job-finding, quits and hires are down

The job-finding rate reflects the share of unemployed workers who successfully found a job, Stahle said. Over the past few years, the job-finding rate for unemployment has been declining, he said.

In other words, people who are looking for work are not finding jobs, Stahle said.

On the flip side, the quits rate reflects the share of employees who have left their jobs in a given month, Stahle said. That figure has also been declining, meaning people are not voluntarily leaving their jobs.

The quits rate was at 2.0% in April, little changed from 2.1% in March, both numbers seasonally adjusted, according to the latest Job Openings and Labor Turnover report by the Bureau of Labor Statistics. The number of quits was down by 220,000 over the year.

Hiring activity has also been down in recent years. The rate of hires was at 3.5% in April, little changed from 3.4% in March, both seasonally adjusted, per the JOLTs report.

As people stay put in their jobs and employers are reluctant to hire, such factors create a “low hiring, low firing” environment, Stahle said.

Many workers are job hunting for at least 27 weeks

The number of long-term unemployed workers dropped in the bureau’s latest report. However, not only is the rate still high, the recent drop could also be a red flag, Bustamente said.

The share of unemployed workers facing long-term unemployment — those who have been jobless for at least 27 weeks — was a seasonally adjusted 20.4% in May, according to the bureau’s latest data. That’s down from a seasonally adjusted 23.5% in April.

But the recent decline may not be an improvement. It could be signaling that a large number of long-term unemployed workers left the labor force altogether, he said.

Considering that 139,000 jobs were added in May and about 218,000 workers are no longer in the unemployment cohort, there’s a significant gap of workers who were unemployed but did not secure new roles, Bustamante said.

What’s more, the number of people not in the labor force jumped by 622,000 in May.

“All the data point to long-term unemployment declining because people left the labor force,” Bustamante said.

A broader unemployment rate is high

While the headline unemployment rate — also known as the U-3 rate — has remained steady, another measure shows a clearer picture of what’s happening with unemployed workers still looking for jobs, experts say.

The U-6 rate includes the total number of unemployed workers, plus all marginally attached workers, and the total employed part time for economic reasons.

Marginally attached workers are those who are neither working nor looking for a job — but indicate that they want and are available for work, and looked for a new role recently. There’s a subset of this group called discouraged workers, or those who are not currently looking for a job due to labor-market reasons.

People employed part time for economic reasons are those who want and are available for full-time work but settled for a part-time schedule.

As of the latest BLS data, the U-6 rate remained unchanged from April at 7.8%.

This data tells us that more and more Americans have either stopped looking for work out of labor-market frustrations, or are picking up part-time gigs to get by financially, experts say.

‘White collar’ industries contract; other sectors grow

When looking at professional and business services — the industry that represents “white collar,” and middle and upper-class, educated workers — there hasn’t been much hiring, experts say.

Fields such as marketing, software development, data analytics and data science have far fewer opportunities now than they did before the pandemic, Stahle said.

On the other hand, industries such as health care, construction and manufacturing have seen consistent job growth. Nearly half of the job growth came from health care, which added 62,000 jobs in May, the bureau found.

“There’s been a divergence in opportunity,” Stahle said. “Your experience with the labor market is going to depend largely on the type of work it is you’re doing.”

Trade tensions not stopping Chinese companies from pushing into U.S.

SEC plans ahead for PCAOB takeover

Optimism declines among accountants | Accounting Today

New 2023 K-1 instructions stir the CAMT pot for partnerships and corporations

The Essential Practice of Bank and Credit Card Statement Reconciliation

Are American progressives making themselves sad?

Trending

-

Personal Finance1 week ago

Personal Finance1 week agoWhat the national debt, deficit mean for your money

-

Economics1 week ago

Economics1 week agoPeople cooking at home at highest level since Covid, Campbell’s says

-

Economics6 days ago

Economics6 days agoJobs report May 2025:

-

Economics1 week ago

Economics1 week agoElon Musk’s failure in government

-

Economics6 days ago

Economics6 days agoDonald Trump has many ways to hurt Elon Musk

-

Economics6 days ago

Economics6 days agoDonald Trump has many ways to hurt Elon Musk

-

Economics4 days ago

Economics4 days agoSending the National Guard to LA is not about stopping rioting

-

Finance6 days ago

Finance6 days agoStocks making the biggest moves midday: WOOF, TSLA, CRCL, LULU