To improve firm profitability, local firm Watts, Taber and Fiske has made an innovative move to reduce full-time starting salaries for new college recruits to $38,000.

WTF managing partner Bill Billings noted, “With all the newly available IRS agents and easing of CPA licensure requirements, finding and doing the job of an entry-level professional is now super easy, so it only seems fair to align their compensation with our firm’s profitability goals.”

Market research

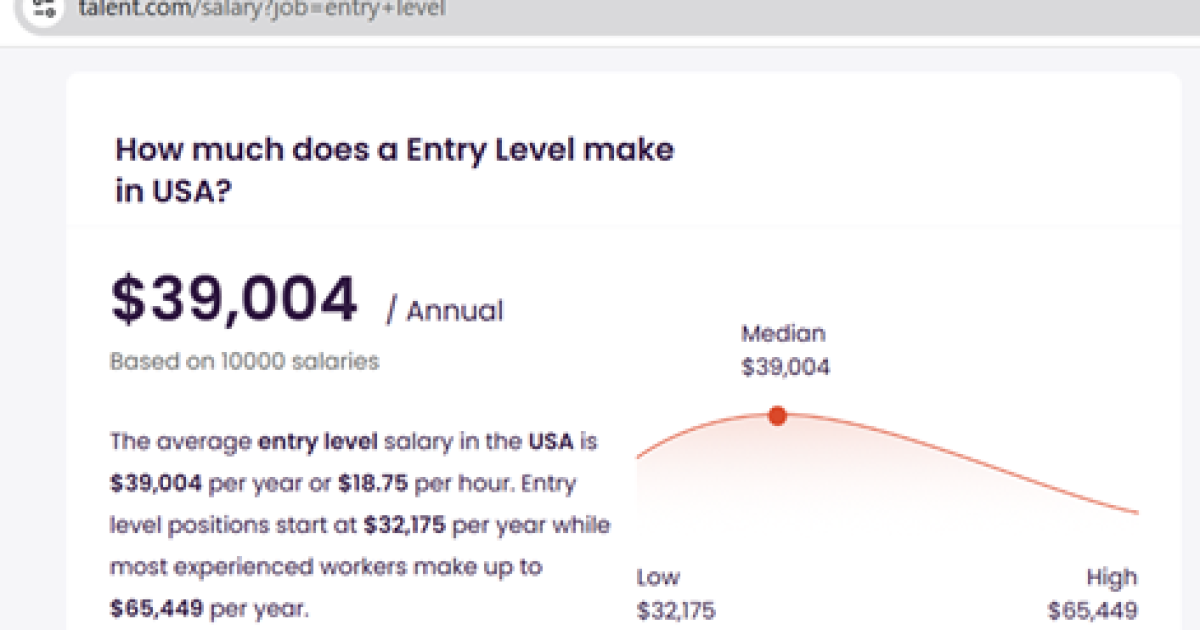

Mr. Billings performed online research and confirmed via talent.com that the average starting salary for “entry level” in the United States was $39,000. Pretty close to $38,000, and that extra $1,000 should keep those new staffers hungry to work hard to earn their next slightly-below-cost-of-living increase.

Knowing that college students have a choice of major, Billings felt that paying half the starting rate of other professionals was more aligned with the work product he was getting from new graduates. In the past, accounting was one of the more lucrative career choices, making it attractive to freshmen and sophomores choosing their career destinations. But the productivity decline of “this generation” certainly didn’t warrant that.

To determine how far to reduce entry-level salaries, WTF looked to other average professional starting salaries, then applied an approximate 50% multiple:

Software engineer: $78,000

Information science and systems: $74,000

Computer science: $75,000

Source: National Association of Colleges and Employers Winter 2024 Salary Survey

New hire sentiments

Regarding the change to a $38,000 starting salary at Watts, Taber and Fiske, we interviewed several new hires to hear their thoughts.

Audit associate Audrey felt positive, saying, “This salary easily covers both my clothes and gas for my 90-minute commute to the office. Luckily, I don’t have to pay rent because I still live with my parents. I might have to save for a few years to be able to pay for my wedding, but that’s OK.”

Tax associate Tanner felt less excited about the proposition. “I mean, this is the only offer I got, so I guess I’m glad to have it. Anyway, mostly I play the Clash of Clans video game during the day, except when someone is walking by my desk. Hopefully, no one wants me to learn the tax regulations, ʼcause that sounds difficult, and I’m not really into difficult.”

When we asked Simon, an associate at competing firm Yates, Abrams + Yang, who also had received an offer from WTF, he noted, “Making $75,000 my first year gets me excited about my future here, knowing I can save to buy an affordable starter home, if I can find one, and progress with promotions and raises to a middle-class lifestyle.”

Partner responses

Founding partner Fiske noted that his grandkids’ private school tuition and yacht club membership dues have grown significantly, and total partner comp of $850,000 wasn’t sufficient to reach his personal financial goals. If he could get another $10K from each new kid, that would ease the burden a bit. This move seemed like a no-brainer.

Retired partner Taber, who still attends partner meetings, suggested that perhaps keeping steady, or slightly increasing, staff pay might benefit the firm’s succession planning overall, as more partners are looking to retire. The current owners agreed but decided to leave that challenge to the next generation.

At press time, the firm was engaging in talks with private equity to discuss the optimal exit strategy.

Blog Post6 days ago

Blog Post6 days ago

Accounting1 week ago

Accounting1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Accounting1 week ago

Accounting1 week ago

Finance1 week ago

Finance1 week ago