Amanda Zeigler Amanda Zeigler was promoted to chief marketing officer at Centri Business Consulting, Philadelphia, which she joined in 2019 as a director and later became...

Plus, Insightsoftware announces Jet Reports Online; InterVal updates business customization features; and other updates from the accounting tech world.

Agentic AI holds much promise for the accounting profession. AI agents, defined as “software that is capable of at least some degree of autonomy to make...

Every year during tax season, finance professionals handle an influx of sensitive financial and personal information passed along by their clients. Although most CPAs and accountants...

Employers added 143,000 jobs in January, including 600 in accounting, tax preparation and payroll services, the U.S. Bureau of Labor Statistics reported Friday, but the unemployment...

Treasury Secretary Scott Bessent said he personally vetted the Treasury employees on Elon Musk’s government efficiency team who have read-only access to federal payment data, and...

GBQ Partners, a Top 100 Firm based in Columbus, Ohio, acquired hiring platform Talentcrowd in a move to expand its business technology offerings. Talentcrowd, also based...

The tariffs President Donald Trump threatened against Canada, Mexico and China over the weekend roiled financial markets but they fall far short of duties the U.S....

President Donald Trump outlined his tax priorities in a meeting with Republican lawmakers, including ending the carried interest tax break used by private equity fund managers...

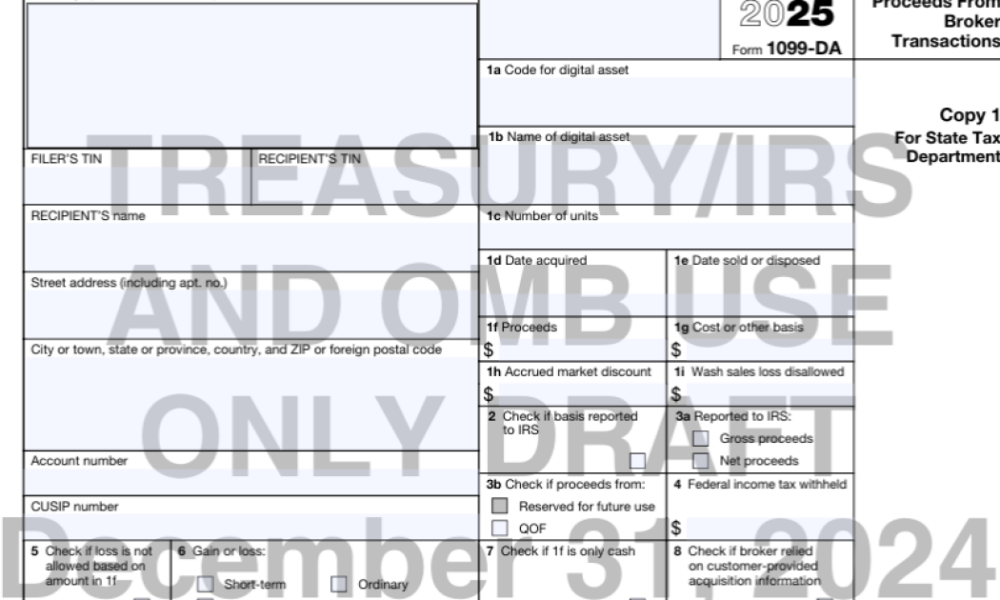

Decentralized finance companies are breathing a sigh of relief after the Treasury Department and the Internal Revenue Service gave them a two-year delay on reporting their...