The American Institute of CPAs is asking the Treasury Department and the Internal Revenue Service to increase the safe harbor for companies to avoid determining whether...

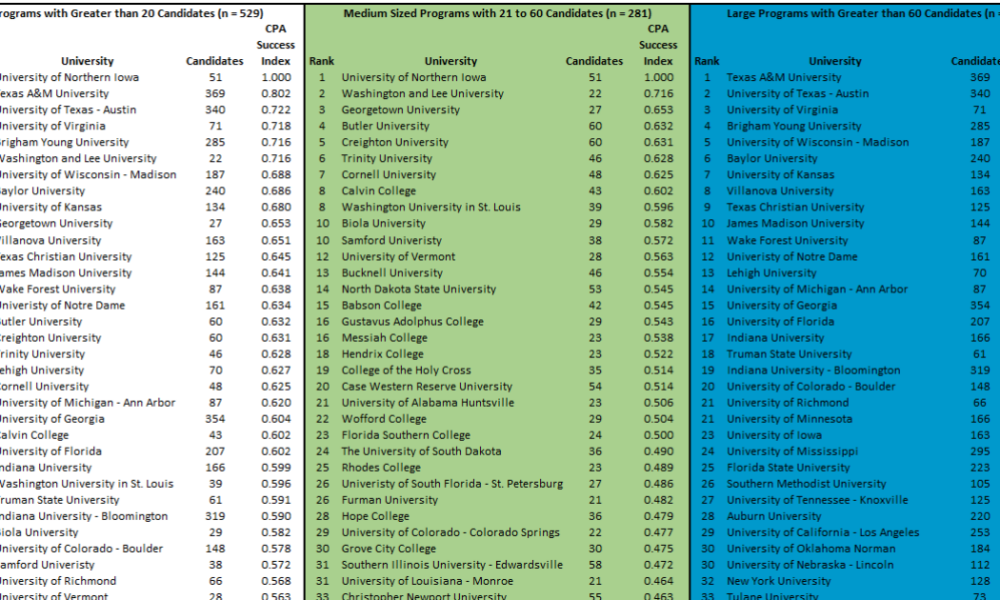

The CPA Success Index was created in 2020 as a more comprehensive metric to evaluate how well collegiate accounting programs prepare students to pass all four...

House Republicans are in talks over raising the cap for state and local tax deductions after winning pledges from President Donald Trump and congressional leaders to...

Lawmakers in the House and Senate have reintroduced bipartisan legislation backed by the American Institute of CPAs to provide faster tax filing relief to taxpayers affected...

Health savings accounts could play a crucial and tax-advantaged role for clients’ medical costs in retirement, but holding them until age 65 and beyond poses some...

The Whitehouse has cancelled the October 2023 executive order from the previous administration on AI regulation and oversight as one of many such cancellations now that...

The Financial Accounting Standards Board released a proposed accounting standards update containing a set of targeted improvements to the FASB Accounting Standards Codification. The amendments in...

Spend management solution provider Ramp announced the release of Ramp Treasury, which can act as a business or investment account for users. Specifically, Ramp Treasury lets...

Accounting and contract management solutions provider FinQuery announced a major reshuffle of its executive team, including a new CEO, COO and executive chairman. Joe Schab—the president...

More states are expected to simplify their sales tax laws and leverage artificial intelligence for doing tax audits, according to a new report from Avalara, a...