Economics

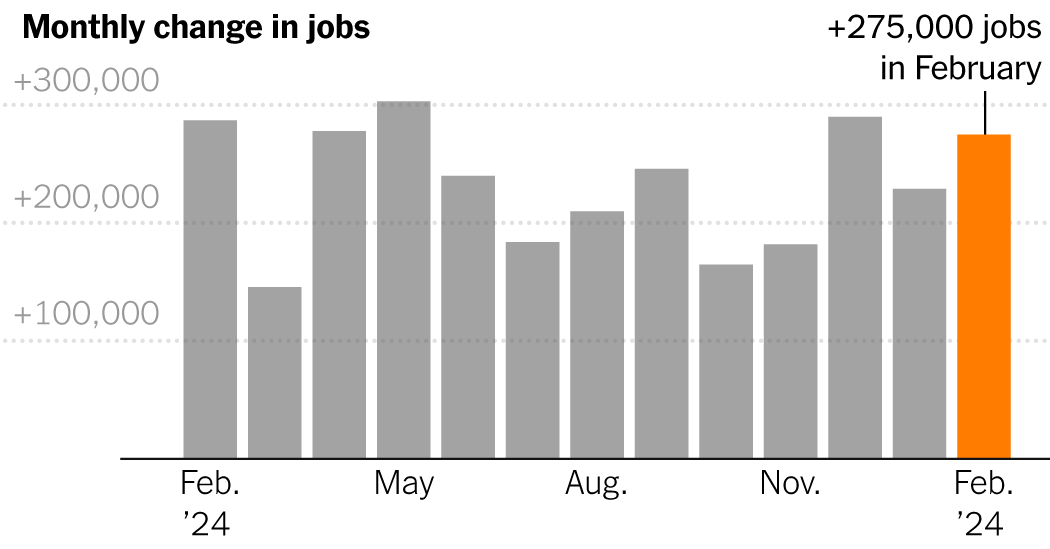

U.S. Employers Add 275,000 Jobs in Another Strong Month

-

Personal Finance1 week ago

Personal Finance1 week agoHow appealing property taxes can benefit new homeowners

-

Blog Post1 week ago

Blog Post1 week agoHow to Implement Internal Controls to Prevent Business Fraud

-

Economics6 days ago

Economics6 days agoElon Musk says Trump’s spending bill undermines the work DOGE has been doing

-

Economics1 week ago

Economics1 week agoMAGA: protecting the homeland from Canadian bookworms

-

Accounting6 days ago

Accounting6 days agoHighest paid jobs in corporate accounting

-

Personal Finance1 week ago

Personal Finance1 week agoHow to pay college tuition bills with your 529 plan

-

Economics6 days ago

Economics6 days agoHow young voters helped to put Trump in the White House

-

Personal Finance6 days ago

Personal Finance6 days agoHarvard, Trump international enrollment battle affects college applicants