A sign for the U.S. Social Security Administration is seen outside its headquarters in Woodlawn, Md., on Thursday, March 20, 2025.

Tom Williams | Cq-roll Call, Inc. | Getty Images

New anti-fraud protections are slated to go into effect on Monday at the Social Security Administration.

Ahead of the new policy, an agency spokesperson confirmed on Wednesday that all claim types can still be completed over the telephone, including retirement, survivor and spousal or children’s benefits. Previously, the SSA said those applicants would need to visit an agency office in person for identity proofing.

Individuals making other benefit claims — including for Social Security disability insurance, Medicare and Supplemental Security Income — can also complete their claims entirely over the telephone, which is in line with the agency’s previous guidance, according to the spokesperson.

The Social Security Administration’s update did not mention changes to direct deposit information, which it had previously said would now require in-office visits.

More from Personal Finance:

Selling out during the market’s worst days can hurt you

3 strategies to keep your money safe amid market volatility

Don’t miss these tax strategies during the tariff sell-off

The agency’s new anti-fraud efforts come as new leadership under the Trump administration’s so-called Department of Government Efficiency is broadly seeking to curb waste, fraud and abuse across federal government agencies.

The SSA is implementing the new anti-fraud procedures, including stricter identity verification, as the agency faces website outages and long wait times on its 800 number, potentially forcing more people to visit offices for assistance.

Social Security experts and advocates have raised concerns that the new policies may make accessing benefits more difficult for vulnerable populations, particularly seniors and people with disabilities.

However, the Social Security Administration’s update is a positive development, said Bill Sweeney, senior vice president of government affairs at AARP. He did add that it would be more ideal if the policy and timeline were reconsidered for better outcomes.

“This seems like a pretty good and encouraging signal that they’re listening to folks, that they’re that they’re open to pivoting and reconsidering how to roll these things out and looking at new ideas for how to implement it,” Sweeney said.

Some beneficiaries will still need to visit offices

As the Social Security Administration starts to perform anti-fraud checks over the phone, some claims will be flagged for fraud risks, according to the agency.

Those claimants who are flagged will be required to visit a Social Security Administration office in person for their claim to be processed.

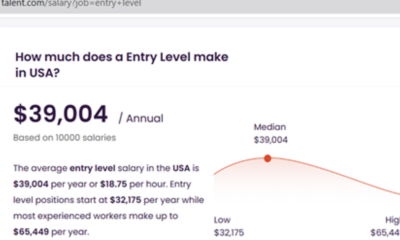

The agency estimates that about 70,000 claimants may be flagged out of 4.5 million telephone claims per year.

Benefit applicants who are not flagged will be able to complete their claims completely over the telephone.

“Telephone remains a viable option to the public,” the Social Security Administration posted on X on Tuesday.

Prior to the Social Security Administration’s update that expands the claim types that can be completed over the phone, the agency had reportedly estimated about 75,000 to 85,000 more people per week may visit its offices in-person.

Online applications may be difficult for many seniors and individuals with disabilities, who may lack access to the necessary resources or know how to navigate the processes, according to the Center on Budget and Policy Priorities, a nonpartisan research and policy institute.

More than 10% of seniors in 35 states would need to travel more than 45 miles to get to the closest Social Security office, according to a new analysis from the Center on Budget and Policy Priorities.

About 6 million seniors don’t drive, while almost 8 million older Americans have a medical condition or disability that makes it difficult for them to travel, according to the research from Center on Budget and Policy Priorities.

Many beneficiaries already face obstacles getting through to the Social Security’s phone lines to make an in-person appointment and then need to drive to a field office, said Kathleen Romig, director of Social Security and disability policy at the Center on Budget and Policy Priorities. Generally, individuals need to call for an appointment, though the agency does urge beneficiaries to first try seeking help online.

‘Fear and concern among many older Americans’

Both experts and advocates take issue with the tight timeline under which the policy changes are being implemented.

“If you’re asking seniors and other SSA customers to do something different, you need to provide enough time for them to understand what it is they need to do,” Romig said.

The AARP sent a letter on Monday to Social Security Administration acting commissioner Lee Dudek urging the agency to “halt changes to phone services,” which will “only exacerbate the ongoing customer service crisis,” wrote Nancy LeaMond, chief advocacy and engagement officer.

Instead, the new policy changes should be done more deliberately, with public input, a clear communication strategy and reasonable timeline, the AARP explained in the letter.

The changes set to go into effect on Monday come as Social Security’s website has recently repeatedly crashed, phone service hold times have increased and in some cases disconnected callers, while field offices also have long in-person waits, LeaMond said in the letter.

“This chaotic environment is fueling fear and concern among many older Americans,” LeaMond wrote.

Accounting6 days ago

Accounting6 days ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Economics6 days ago

Economics6 days ago

Finance1 week ago

Finance1 week ago

Economics4 days ago

Economics4 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago