Federal Reserve Governor Christopher Waller said Friday he supported a half percentage point rate cut at this week’s meeting because inflation is falling even faster than he had expected.

Citing recent data on consumer and producer prices, Waller told CNBC that the data is showing core inflation, excluding food and energy, in the Fed’s preferred measure is running below 1.8% over the past four months. The Fed targets annual inflation at 2%.

“That is what put me back a bit to say, wow, inflation is softening much faster than I thought it was going to, and that is what put me over the edge to say, look, I think 50 [basis points] is the right thing to do,” Waller said during an interview with CNBC’s Steve Liesman.

Both the consumer and producer price indexes showed increases of 0.2% for the month. On a 12-month basis, the CPI ran at a 2.5% rate.

However, Waller said the more recent data has shown an even stronger trend lower, thus giving the Fed space to ease more as it shifts its focus to supporting the softening labor market.

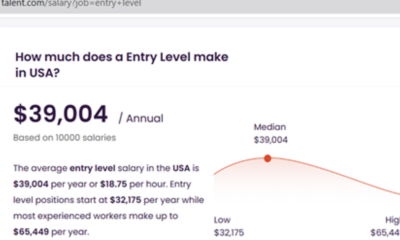

A week before the Fed meeting, markets were overwhelmingly pricing in a 25 basis point cut. A basis point equals 0.01%.

“The point is, we do have room to move, and that is what the committee is signaling,” he said.

The Fed’s action to cut by half a percentage point, or 50 basis points, brought its key borrowing rate down to a range between 4.75%-5%. Along with the decision, individual officials signaled the likelihood of another half point in cuts this year, followed by a full percentage point of reductions in 2025.

Fed Governor Michelle Bowman was the only Federal Open Market Committee member to vote against the reduction, instead preferring a smaller quarter percentage point cut. She released a statement Friday explaining her opposition, which marked the first “no” vote by a governor since 2005.

“Although it is important to recognize that there has been meaningful progress on lowering inflation, while core inflation remains around or above 2.5 percent, I see the risk that the Committee’s larger policy action could be interpreted as a premature declaration of victory on our price stability mandate,” Bowman said.

As for the future path of rates, Waller indicated there are a number of scenarios that could unfold, with each depending on how the economic data runs.

Futures market pricing shifter after Waller spoke, with traders now pricing in about a 50-50 chance of another half percentage point reduction at the Nov. 6-7 meeting, according to the CME Group’s FedWatch.

“I was a big advocate of large rate hikes when inflation was moving much, much faster than any of us expected,” he said. “I would feel the same way on the downside to protect our credibility of maintaining a 2% inflation target. If the data starts coming in soft and continues to come in soft, I would be much more willing to be aggressive on rate cuts to get inflation closer to our target.”

The Fed gets another look at inflation data next week when the Commerce Department releases the August report on the personal consumption expenditures price index, the central bank’s preferred measure. Chair Jerome Powell said Wednesday that the Fed’s economists expect the measure to show inflation running at a 2.2% annual pace. A year ago, it had been at 3.3%.

Accounting7 days ago

Accounting7 days ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Economics7 days ago

Economics7 days ago

Economics5 days ago

Economics5 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics7 days ago

Economics7 days ago