Americans are growing increasingly uneasy about the state of the U.S. economy and their own personal financial situation in the face of stubborn inflation and tariff wars.

To that point, 73% of respondents said they are “financially stressed,” with 66% of that group pointing to the tariff wars as a main source, according to a new CNBC/Survey Monkey online poll.

The survey of 4,200 U.S. adults was conducted April 3 to 7.

Americans feeling financially stressed

CNBC/Survey Monkey polls from 2023, 2024, and this year have found that, on average, more than 70% of Americans said that they are stressed about their personal finances. This year’s survey found that 38% of respondents overall said they are “very stressed,” and 29% of high-earners with incomes of $100,000 or more also shared that sentiment.

Consumers are, of course, increasingly stressed by rising prices for essentials like food, energy, and shelter. This is due to a number of factors, including rising inflation, supply chain disruptions and geopolitical events.

In the new CNBC survey, 86% of Americans cite inflation as the top reason for their financial stress, while 75% pointed to interest rates and 66% cited tariffs.

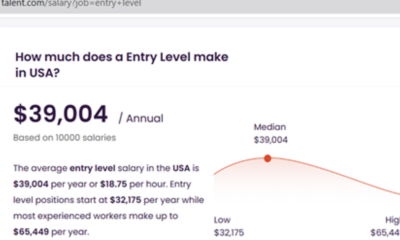

While inflation peaked at 8% in 2022, a 40-year high, it has since cooled significantly, reaching 2.4% in March. Despite this decline, the increased prices during 2022 have led to a loss of purchasing power for Americans, meaning they can buy less with the same amount of money than before.

Here’s a look at more stories on how to manage, grow and protect your money for the years ahead.

It would take nearly $114 today to buy what would have cost $100 in January of 2022, according to the Bureau of Labor Statistics.

And while Inflation has eased, experts do say the fallout from President Trump’s trade war threatens to put upward pressure on prices in the months to come.

Tariffs are generally considered to be inflationary, economists say. This is because tariffs increase the cost of imported goods, which can then be passed on to consumers in the form of higher prices. This can lead to a temporary increase in the overall inflation rate.

“We know that tariffs are inflationary,” said David McWilliams, an economist, podcaster and author. “We know that’s hitting on people’s expectations of how much money they’re going to have in their pocket in a couple of months time.”

So, when it comes to financial stress caused by tariffs, 59% of those surveyed by CNBC oppose President Trump’s tariff policy, with 72% concerned about the impact on their personal financial situation.

As a result, 32% said they have delayed or avoided making retail purchases, and 15% said they have “stocked up.”

What’s more, 34% of those surveyed said they have made changes to their investments due to recent stock market volatility from tariffs.

Handling financial stress

Many investors are concerned about their retirement savings, but financial experts say it’s important for those with a long-term perspective to understand that short-term market volatility is a distraction that’s better off ignored.

“The biggest thing is that it’s unknown, and when we don’t know things, and we can’t control things, that’s when our anxiety and our worry can spike, and it’s contagious,” said licensed therapist and executive coach George James, CNBC Global Financial Wellness Advisory Board member, a licensed therapist and executive coach.

While the market could be in for a bumpy ride over the next few months, experts say it’s best to stay the course and avoid making major portfolio changes based on the latest news.

To manage investments during the latest tariff volatility, for example, financial advisors urge investors to maintain a long-term perspective, review and potentially adjust their asset allocation, and consider diversification to mitigate risk. It’s also smart to bolster emergency funds, review your risk tolerance, and explore opportunities for tax-loss harvesting.

Financial experts also urge investors to focus on their risk appetite — and their goals.

“This is the time to evaluate short-, mid-, and long-term financial needs, concerns, and goals. Evaluation before action or inaction is essential,” said Michael Liersch, head of advice and planning at Wells Fargo, said in an e-mail to CNBC. “Getting specific on exact dollar targets, timelines around these targets, and their level of importance [priority] can create clarity around what should be done, if anything.”

SIGN UP: Money 101 is an 8-week learning course on financial freedom, delivered weekly to your inbox. Sign up here. It is also available in Spanish.

Accounting7 days ago

Accounting7 days ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Accounting1 week ago

Economics7 days ago

Economics7 days ago

Economics5 days ago

Economics5 days ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics1 week ago

Economics1 week ago