Plus, Solver Releases xFP&A Nonprofit Industry Solution Models; CPAClub launches “Club 22” professional network; and other accounting tech news.

After a court ordered the Internal Revenue Service to rehire some 7,000 probationary workers, the employees were put on administrative leave — kept on the federal...

Former U.S. tax officials urged the Justice Department not to dismantle its tax division in an agency-wide reorganization, warning that such a move would hobble enforcement. ...

Due to greater-than-expected interest, Accounting Today has moved the submission deadline for its 2024 Best Firms for Technology survey from today to END OF THE DAY...

Business groups are mobilizing to squelch a plan gathering momentum among Republicans to curtail a heavily used federal income tax break that allows corporations to deduct...

What becomes of the broken-hearted; the earth moved; Kreative accounting; and other highlights of recent tax cases. Providence, Rhode Island: Four Florida residents have been convicted...

President Trump’s imposition of steep tariffs on countries around the world is likely to drive demand for accounting experts and consultants to help companies adjust and...

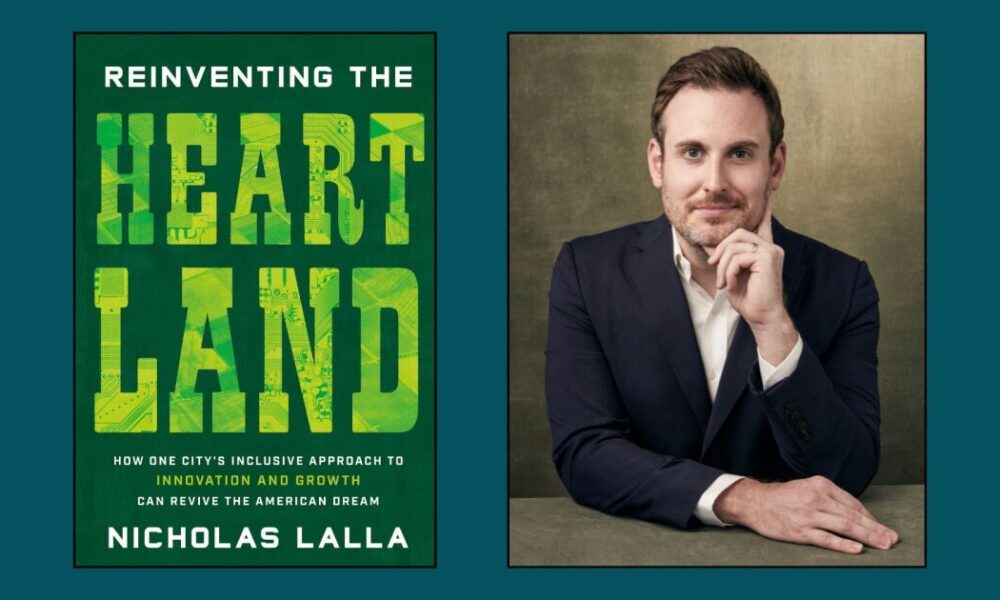

A tax credit for investments in low-income areas could spur long-term job creation in overlooked parts of the country — with the right changes to its...

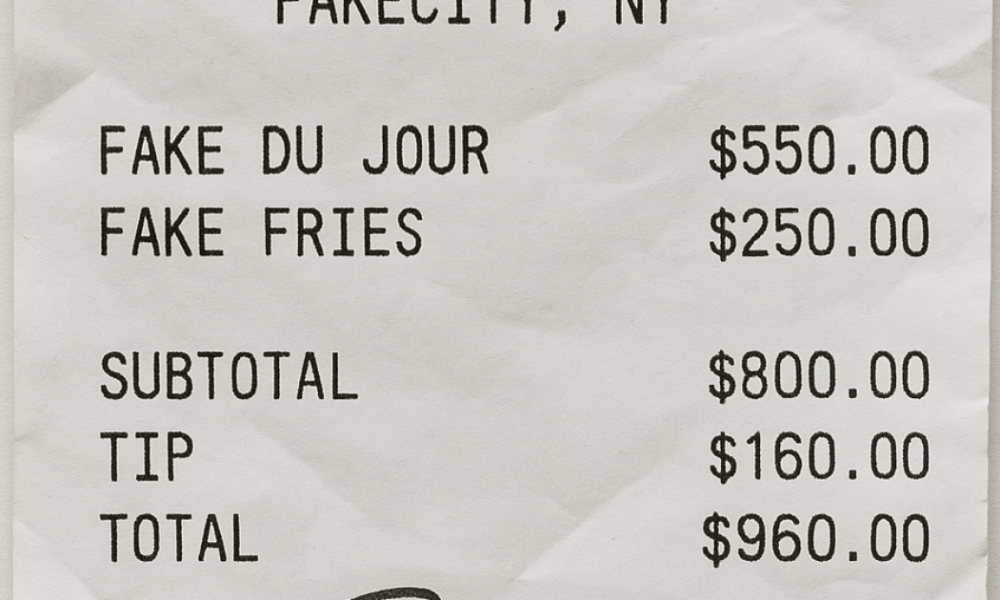

Ramp, a spend management solutions provider, released a new solution within 24 hours in direct response to recent advances in AI image generation that make it...

It’s no secret that more and more CPAs are offering financial services to their clients. In fact, financial planning questions now have a greater emphasis on...