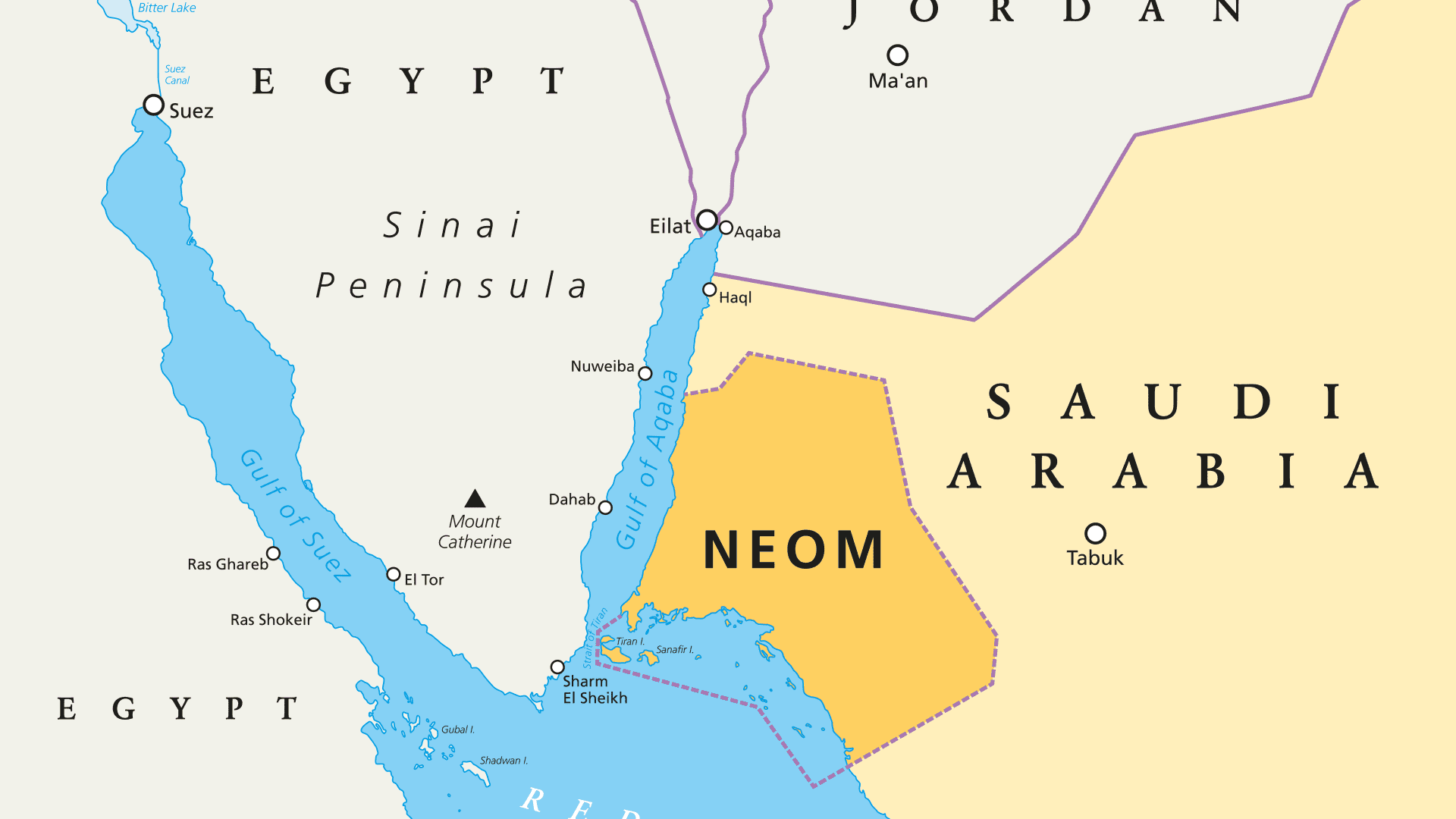

Saudi Arabia’s economy minister rejected recent reports that the kingdom’s $1.5 trillion NEOM megaproject, a futuristic desert development on the Red Sea coast, is scaling back some of its plans.

“All projects are moving full steam ahead,” Faisal Al Ibrahim told CNBC’s Dan Murphy on Monday at the World Economic Forum’s special meeting in Riyadh.

“We set out to do something unprecedented and we’re doing something unprecedented, and we will deliver something that’s unprecedented.”

In early April, reports emerged in Western media outlets that The Line project, a planned glass-walled city meant to stretch for 105 miles across the desert by 2030, would be a length of just 1.5 miles by that time — a reduction of 98.6%. Citing anonymous sources with knowledge of the matter, the initial report by Bloomberg said that the Saudi government’s original plan to have 1.5 million people living in The Line by 2030 was slashed to 300,000.

The purported scaling back of plans, at least in the medium-term, comes amid reported concerns over finances for NEOM, which is part of the kingdom’s broader Vision 2030 initiative to diversify its economy away from oil. Saudi Arabia’s sovereign wealth fund, the Public Investment Fund, has not yet approved NEOM’s budget for 2024, according to Bloomberg’s report.

Al Ibrahim stressed that the projects would be delivered according to plan, but with the qualification that decisions were being made for “optimal economic impact.”

“We see feedback from the market, we see more interest from the investors and we’ll always prioritize to where we can optimize for optimal economic impact,” he said.

“Today the economy in the kingdom is growing faster, but we don’t want to overheat it. We don’t want to deliver these projects at the cost of importing too much against our own interest. We will continue delivering these projects in a manner that meets these priorities, delivers these projects and has the optimal healthy impact for our economy and the … healthy non-oil growth within it.”

NEOM political map of the 500 billion dollar megacity project in Saudi Arabia along the Red Sea coast. Location of the smart and tourist city with autonomous judicial system. English labeling. Vector.

Peterhermesfurian | Istock | Getty Images

Still, the minister emphasized that “for NEOM, the projects, the intended scale is continuing as planned. There is no change in scale.”

“It is a long-term project that’s modular in design,” he said. “The rest of the mega projects are there to be delivered for specific impact in specific sectors.”

Asked what kind of a message the reported timeline and scale changes would send to private investors, Al Ibrahim said that decisions would be made to suit the needs and returns of the projects, and that all the developments within NEOM are seeing growing investor interest.

“Keep in mind that these sectors didn’t exist in the past. They’re being built from scratch. They require some investment and going all in from the government and the sovereign wealth fund,” he said.

“And we’re seeing increased investor interest on all of these projects. These projects will be delivered to their scale and in a manner that in terms of priorities suits the needs of the projects, the returns of these projects, and the economic impact. It’s like minimizing any leakage, minimizing any overheating risks as well.”

Personal Finance1 week ago

Personal Finance1 week ago

Blog Post1 week ago

Blog Post1 week ago

Economics5 days ago

Economics5 days ago

Economics1 week ago

Economics1 week ago

Personal Finance1 week ago

Personal Finance1 week ago

Economics6 days ago

Economics6 days ago

Accounting5 days ago

Accounting5 days ago

Personal Finance5 days ago

Personal Finance5 days ago